State of Wyoming decreased its holdings in Scilex Holding Company (NASDAQ:SCLX - Free Report) by 8.1% during the 1st quarter, according to its most recent disclosure with the SEC. The firm owned 131,139 shares of the company's stock after selling 11,485 shares during the period. State of Wyoming owned approximately 1.89% of Scilex worth $33,000 at the end of the most recent reporting period.

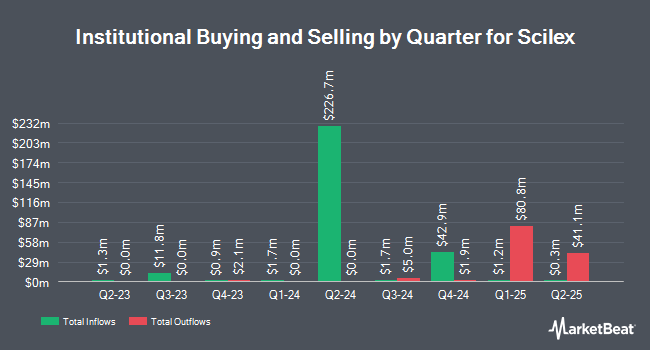

Several other hedge funds have also recently bought and sold shares of the business. Northern Trust Corp raised its holdings in Scilex by 64.0% in the fourth quarter. Northern Trust Corp now owns 1,273,968 shares of the company's stock valued at $543,000 after buying an additional 497,182 shares during the period. Janus Henderson Group PLC raised its holdings in Scilex by 28.7% in the fourth quarter. Janus Henderson Group PLC now owns 687,547 shares of the company's stock valued at $293,000 after buying an additional 153,245 shares during the period. Finally, Jane Street Group LLC raised its holdings in Scilex by 965.8% in the fourth quarter. Jane Street Group LLC now owns 321,480 shares of the company's stock valued at $137,000 after buying an additional 291,316 shares during the period. Hedge funds and other institutional investors own 69.67% of the company's stock.

Scilex Price Performance

NASDAQ SCLX traded down $3.14 during mid-day trading on Tuesday, hitting $22.56. The company's stock had a trading volume of 260,484 shares, compared to its average volume of 194,509. Scilex Holding Company has a 52-week low of $3.60 and a 52-week high of $39.90. The stock's fifty day simple moving average is $15.96 and its two-hundred day simple moving average is $9.94. The firm has a market capitalization of $157.02 million, a P/E ratio of -0.78 and a beta of 1.34.

Scilex (NASDAQ:SCLX - Get Free Report) last issued its quarterly earnings data on Wednesday, August 13th. The company reported ($7.42) earnings per share (EPS) for the quarter, missing the consensus estimate of ($4.55) by ($2.87). The business had revenue of $9.90 million for the quarter, compared to the consensus estimate of $26.25 million. On average, equities analysts forecast that Scilex Holding Company will post -0.57 earnings per share for the current fiscal year.

About Scilex

(

Free Report)

Scilex Holding Company focuses on acquiring, developing, and commercializing non-opioid pain management products for the treatment of acute and chronic pain. Its commercial products include ZTlido (lidocaine topical system) 1.8% (ZTlido), a prescription lidocaine topical product for the relief of neuropathic pain associated with postherpetic neuralgia (PHN), which is a form of post-shingles nerve pain; ELYXYB, a ready-to-use oral solution for the acute treatment of migraine with or without aura in adults; and GLOPERBA, a liquid oral version of the anti-gout medicine colchicine indicated for the prophylaxis of painful gout flares in adults.

See Also

Before you consider Scilex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Scilex wasn't on the list.

While Scilex currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.