State of Wyoming purchased a new stake in Red Violet, Inc. (NASDAQ:RDVT - Free Report) in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund purchased 6,322 shares of the company's stock, valued at approximately $238,000.

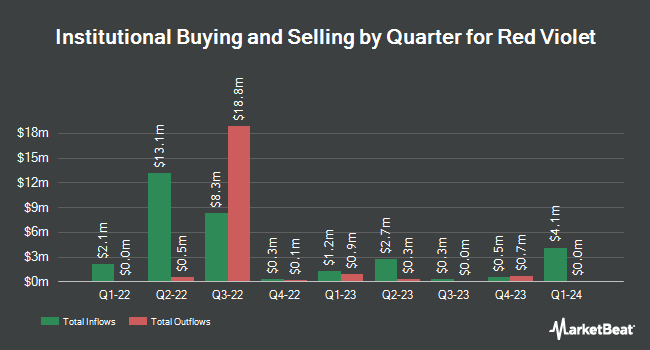

Several other hedge funds have also bought and sold shares of the business. AlphaQuest LLC acquired a new stake in Red Violet in the 1st quarter valued at $129,000. Martingale Asset Management L P grew its position in Red Violet by 95.6% in the 1st quarter. Martingale Asset Management L P now owns 17,232 shares of the company's stock valued at $648,000 after purchasing an additional 8,420 shares during the period. Quantbot Technologies LP grew its position in Red Violet by 66.4% in the 1st quarter. Quantbot Technologies LP now owns 4,046 shares of the company's stock valued at $152,000 after purchasing an additional 1,615 shares during the period. American Century Companies Inc. grew its position in Red Violet by 63.9% in the 1st quarter. American Century Companies Inc. now owns 17,380 shares of the company's stock valued at $653,000 after purchasing an additional 6,776 shares during the period. Finally, Russell Investments Group Ltd. grew its position in Red Violet by 52.0% in the 1st quarter. Russell Investments Group Ltd. now owns 152,374 shares of the company's stock valued at $5,728,000 after purchasing an additional 52,130 shares during the period. Institutional investors and hedge funds own 63.56% of the company's stock.

Red Violet Stock Performance

RDVT traded down $0.65 during mid-day trading on Tuesday, reaching $50.48. 23,396 shares of the stock were exchanged, compared to its average volume of 102,369. The stock has a market capitalization of $705.70 million, a PE ratio of 83.97 and a beta of 1.72. The company has a 50 day moving average price of $46.43 and a two-hundred day moving average price of $43.54. Red Violet, Inc. has a 1 year low of $25.37 and a 1 year high of $54.19.

Analysts Set New Price Targets

Several research firms recently issued reports on RDVT. Lake Street Capital began coverage on shares of Red Violet in a research report on Monday, August 4th. They issued a "buy" rating and a $60.00 price target for the company. Wall Street Zen raised shares of Red Violet from a "hold" rating to a "buy" rating in a research report on Saturday, August 30th. One investment analyst has rated the stock with a Buy rating, Based on data from MarketBeat.com, the stock currently has a consensus rating of "Buy" and a consensus price target of $60.00.

Check Out Our Latest Stock Analysis on Red Violet

Red Violet Profile

(

Free Report)

Red Violet, Inc, a software and services company, specializes in proprietary technologies and applying analytical capabilities to deliver identity intelligence in the United States. It offers idiCORE, an investigative solution used to address various organizational challenges, which include due diligence, risk mitigation, identity authentication, fraud detection and prevention, customer acquisition, and regulatory compliance; and FOREWARN, an app-based solution that provides instant knowledge before face-to-face engagement with a consumer, as well as helps professionals to identify and mitigate risk.

Read More

Before you consider Red Violet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Red Violet wasn't on the list.

While Red Violet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.