Trexquant Investment LP reduced its stake in Stellus Capital Investment Corporation (NYSE:SCM - Free Report) by 49.4% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 31,878 shares of the investment management company's stock after selling 31,158 shares during the period. Trexquant Investment LP owned 0.11% of Stellus Capital Investment worth $446,000 as of its most recent filing with the Securities and Exchange Commission.

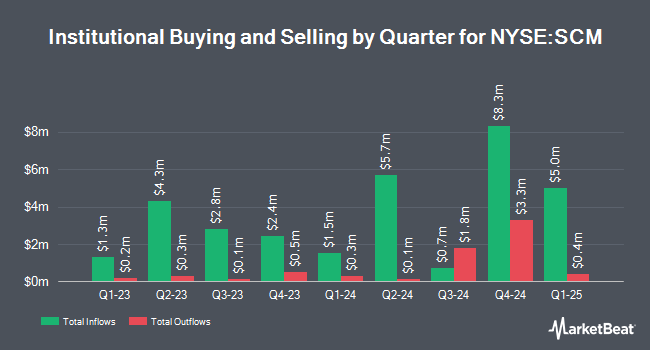

A number of other institutional investors also recently made changes to their positions in SCM. Chilton Capital Management LLC lifted its stake in shares of Stellus Capital Investment by 10.6% in the 1st quarter. Chilton Capital Management LLC now owns 8,409 shares of the investment management company's stock worth $118,000 after acquiring an additional 809 shares during the period. XTX Topco Ltd acquired a new stake in shares of Stellus Capital Investment in the 1st quarter worth approximately $150,000. Quantbot Technologies LP acquired a new stake in shares of Stellus Capital Investment in the 1st quarter worth approximately $155,000. Oppenheimer & Co. Inc. lifted its stake in shares of Stellus Capital Investment by 27.7% in the 1st quarter. Oppenheimer & Co. Inc. now owns 15,440 shares of the investment management company's stock worth $216,000 after acquiring an additional 3,352 shares during the period. Finally, Northern Trust Corp lifted its stake in shares of Stellus Capital Investment by 30.1% in the 4th quarter. Northern Trust Corp now owns 22,973 shares of the investment management company's stock worth $316,000 after acquiring an additional 5,314 shares during the period. 13.22% of the stock is owned by institutional investors and hedge funds.

Stellus Capital Investment Price Performance

SCM stock traded down $0.06 on Friday, hitting $14.15. 200,132 shares of the company's stock traded hands, compared to its average volume of 148,998. Stellus Capital Investment Corporation has a 1-year low of $11.19 and a 1-year high of $15.56. The stock has a market cap of $402.09 million, a price-to-earnings ratio of 9.76 and a beta of 0.87. The stock has a fifty day moving average of $14.60 and a 200-day moving average of $13.89. The company has a current ratio of 0.28, a quick ratio of 0.28 and a debt-to-equity ratio of 1.27.

Stellus Capital Investment (NYSE:SCM - Get Free Report) last released its quarterly earnings results on Wednesday, August 6th. The investment management company reported $0.35 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.35. Stellus Capital Investment had a net margin of 38.24% and a return on equity of 11.06%. The business had revenue of $25.70 million for the quarter, compared to analyst estimates of $26.15 million. On average, analysts forecast that Stellus Capital Investment Corporation will post 1.74 EPS for the current fiscal year.

Stellus Capital Investment Dividend Announcement

The company also recently declared a monthly dividend, which will be paid on Monday, September 15th. Stockholders of record on Friday, August 29th will be issued a dividend of $0.1333 per share. The ex-dividend date is Friday, August 29th. This represents a c) dividend on an annualized basis and a dividend yield of 11.3%. Stellus Capital Investment's payout ratio is currently 110.34%.

Analysts Set New Price Targets

Separately, Wall Street Zen raised shares of Stellus Capital Investment from a "sell" rating to a "hold" rating in a research note on Saturday, August 9th. One research analyst has rated the stock with a Hold rating, According to MarketBeat, Stellus Capital Investment presently has an average rating of "Hold" and a consensus price target of $13.00.

Read Our Latest Report on Stellus Capital Investment

About Stellus Capital Investment

(

Free Report)

Stellus Capital Investment Corporation is a business development company specializing in investments in private middle-market companies. It invests through first lien, second lien, unitranche, and mezzanine debt financing, often with a corresponding equity investment. The fund prefers to invest in US and Canada.

Recommended Stories

Before you consider Stellus Capital Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stellus Capital Investment wasn't on the list.

While Stellus Capital Investment currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.