Strive Asset Management LLC purchased a new position in Adobe Inc. (NASDAQ:ADBE - Free Report) in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund purchased 2,616 shares of the software company's stock, valued at approximately $1,163,000. Adobe makes up about 0.9% of Strive Asset Management LLC's portfolio, making the stock its 27th biggest holding.

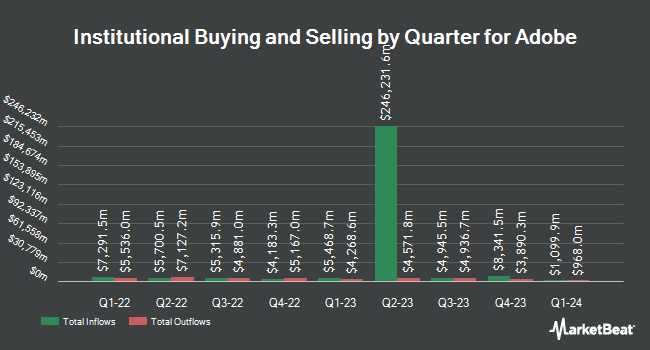

Several other institutional investors and hedge funds also recently added to or reduced their stakes in ADBE. Siemens Fonds Invest GmbH boosted its stake in Adobe by 252.9% during the 4th quarter. Siemens Fonds Invest GmbH now owns 55,658 shares of the software company's stock worth $25,000 after purchasing an additional 39,888 shares during the last quarter. Decker Retirement Planning Inc. acquired a new stake in Adobe during the 4th quarter worth $31,000. Summit Securities Group LLC acquired a new stake in Adobe during the 4th quarter worth $31,000. Caitlin John LLC boosted its stake in Adobe by 171.4% during the 4th quarter. Caitlin John LLC now owns 76 shares of the software company's stock worth $34,000 after purchasing an additional 48 shares during the last quarter. Finally, Avion Wealth boosted its stake in Adobe by 112.2% during the 4th quarter. Avion Wealth now owns 87 shares of the software company's stock worth $38,000 after purchasing an additional 46 shares during the last quarter. Hedge funds and other institutional investors own 81.79% of the company's stock.

Adobe Trading Down 0.9%

NASDAQ ADBE traded down $3.58 during trading hours on Wednesday, reaching $414.03. The company had a trading volume of 2,493,615 shares, compared to its average volume of 3,449,021. The company has a current ratio of 1.07, a quick ratio of 1.07 and a debt-to-equity ratio of 0.29. The stock has a market capitalization of $176.46 billion, a P/E ratio of 33.39, a price-to-earnings-growth ratio of 2.15 and a beta of 1.55. The stock has a 50-day moving average of $376.12 and a 200 day moving average of $433.08. Adobe Inc. has a 1-year low of $332.01 and a 1-year high of $587.75.

Adobe (NASDAQ:ADBE - Get Free Report) last released its earnings results on Wednesday, March 12th. The software company reported $5.08 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $4.97 by $0.11. Adobe had a return on equity of 45.87% and a net margin of 25.85%. The firm had revenue of $5.71 billion during the quarter, compared to analyst estimates of $5.66 billion. During the same period last year, the business posted $4.48 earnings per share. As a group, research analysts anticipate that Adobe Inc. will post 16.65 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, CFO Daniel Durn acquired 1,300 shares of the business's stock in a transaction on Thursday, March 20th. The shares were bought at an average price of $390.58 per share, with a total value of $507,754.00. Following the completion of the acquisition, the chief financial officer now owns 29,876 shares in the company, valued at $11,668,968.08. This trade represents a 4.55% increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the SEC, which can be accessed through this link. Insiders own 0.16% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts have issued reports on ADBE shares. Royal Bank of Canada lowered their target price on shares of Adobe from $530.00 to $480.00 and set an "outperform" rating on the stock in a research note on Monday, April 14th. Stifel Nicolaus lowered their target price on shares of Adobe from $600.00 to $525.00 and set a "buy" rating on the stock in a research note on Thursday, March 13th. Evercore ISI lowered their target price on shares of Adobe from $650.00 to $550.00 and set an "outperform" rating on the stock in a research note on Thursday, March 13th. Jefferies Financial Group lowered their price target on shares of Adobe from $650.00 to $590.00 and set a "buy" rating on the stock in a research report on Monday, March 31st. Finally, Oppenheimer lowered their price target on shares of Adobe from $560.00 to $530.00 and set an "outperform" rating on the stock in a research report on Thursday, March 13th. Eleven equities research analysts have rated the stock with a hold rating, seventeen have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $502.88.

Get Our Latest Analysis on Adobe

About Adobe

(

Free Report)

Adobe Inc, together with its subsidiaries, operates as a diversified software company worldwide. It operates through three segments: Digital Media, Digital Experience, and Publishing and Advertising. The Digital Media segment offers products, services, and solutions that enable individuals, teams, and enterprises to create, publish, and promote content; and Document Cloud, a unified cloud-based document services platform.

Featured Stories

Before you consider Adobe, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adobe wasn't on the list.

While Adobe currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.