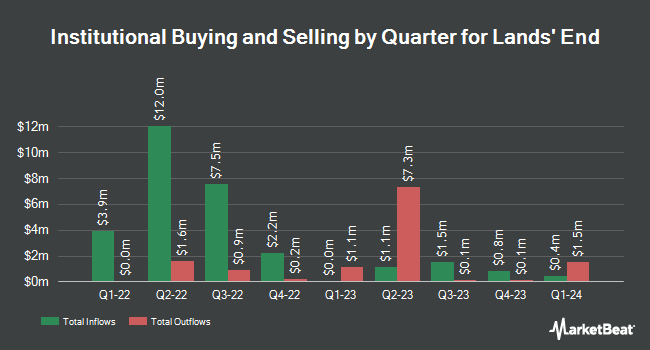

Strs Ohio bought a new position in Lands' End, Inc. (NASDAQ:LE - Free Report) during the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 39,600 shares of the company's stock, valued at approximately $403,000. Strs Ohio owned about 0.13% of Lands' End as of its most recent SEC filing.

A number of other hedge funds have also recently modified their holdings of LE. Towerview LLC boosted its stake in shares of Lands' End by 28.2% in the first quarter. Towerview LLC now owns 420,000 shares of the company's stock worth $4,276,000 after buying an additional 92,500 shares during the last quarter. Squarepoint Ops LLC boosted its stake in shares of Lands' End by 150.1% in the fourth quarter. Squarepoint Ops LLC now owns 103,305 shares of the company's stock worth $1,357,000 after buying an additional 61,993 shares during the last quarter. Nuveen LLC purchased a new stake in shares of Lands' End in the first quarter worth about $623,000. SG Americas Securities LLC purchased a new stake in shares of Lands' End in the first quarter worth about $582,000. Finally, Bank of America Corp DE boosted its stake in shares of Lands' End by 320.8% in the fourth quarter. Bank of America Corp DE now owns 51,811 shares of the company's stock worth $681,000 after buying an additional 39,499 shares during the last quarter. Hedge funds and other institutional investors own 37.46% of the company's stock.

Analysts Set New Price Targets

Separately, Wall Street Zen upgraded Lands' End from a "hold" rating to a "buy" rating in a research report on Saturday, September 13th.

Check Out Our Latest Stock Analysis on Lands' End

Lands' End Stock Performance

Shares of LE stock opened at $15.53 on Tuesday. The company has a market capitalization of $473.98 million, a P/E ratio of 86.28 and a beta of 2.34. The business's 50 day moving average is $13.52 and its two-hundred day moving average is $10.97. The company has a current ratio of 1.62, a quick ratio of 0.41 and a debt-to-equity ratio of 1.13. Lands' End, Inc. has a 12-month low of $7.65 and a 12-month high of $19.88.

Lands' End (NASDAQ:LE - Get Free Report) last issued its quarterly earnings results on Tuesday, September 9th. The company reported ($0.06) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.03) by ($0.03). The business had revenue of $294.08 million for the quarter, compared to analysts' expectations of $323.96 million. Lands' End had a return on equity of 5.32% and a net margin of 0.46%.During the same quarter in the prior year, the company posted ($0.02) EPS. Lands' End has set its Q3 2025 guidance at 0.100-0.220 EPS. FY 2025 guidance at 0.620-0.88 EPS. Analysts expect that Lands' End, Inc. will post 0.41 EPS for the current fiscal year.

Lands' End Profile

(

Free Report)

Lands' End, Inc operates as a digital retailer of apparel, swimwear, outerwear, accessories, footwear, home products, and uniform in the United States, Europe, Asia, and internationally. It operates through U.S. eCommerce, International, Outfitters, Third Party, and Retail segments. The company also sells uniform and logo apparel.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lands' End, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lands' End wasn't on the list.

While Lands' End currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.