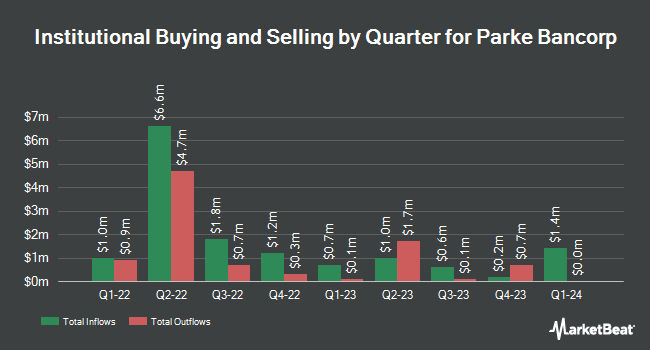

Strs Ohio bought a new position in shares of Parke Bancorp, Inc. (NASDAQ:PKBK - Free Report) during the first quarter, according to the company in its most recent disclosure with the SEC. The firm bought 26,200 shares of the bank's stock, valued at approximately $494,000. Strs Ohio owned about 0.22% of Parke Bancorp as of its most recent SEC filing.

Other large investors also recently bought and sold shares of the company. Trexquant Investment LP bought a new position in Parke Bancorp during the 1st quarter worth approximately $207,000. Jane Street Group LLC bought a new position in Parke Bancorp during the 1st quarter worth approximately $229,000. Millennium Management LLC bought a new position in Parke Bancorp during the 4th quarter worth approximately $413,000. Empirical Finance LLC bought a new position in Parke Bancorp during the 1st quarter worth approximately $421,000. Finally, Citadel Advisors LLC bought a new position in Parke Bancorp during the 4th quarter worth approximately $617,000. Institutional investors own 49.69% of the company's stock.

Wall Street Analyst Weigh In

Separately, Wall Street Zen downgraded Parke Bancorp from a "buy" rating to a "hold" rating in a report on Saturday, June 7th.

Read Our Latest Analysis on Parke Bancorp

Parke Bancorp Stock Performance

PKBK traded up $0.05 during trading hours on Monday, hitting $22.11. The company's stock had a trading volume of 28,847 shares, compared to its average volume of 38,121. Parke Bancorp, Inc. has a fifty-two week low of $16.94 and a fifty-two week high of $24.29. The company has a current ratio of 1.23, a quick ratio of 1.23 and a debt-to-equity ratio of 0.46. The firm has a market capitalization of $262.00 million, a PE ratio of 8.60 and a beta of 0.64. The company has a 50-day simple moving average of $21.79 and a 200 day simple moving average of $20.14.

Parke Bancorp (NASDAQ:PKBK - Get Free Report) last posted its earnings results on Wednesday, July 16th. The bank reported $0.69 EPS for the quarter. Parke Bancorp had a return on equity of 10.21% and a net margin of 22.44%.The firm had revenue of $18.69 million for the quarter.

Parke Bancorp Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, October 17th. Shareholders of record on Friday, October 3rd will be paid a dividend of $0.18 per share. This represents a $0.72 dividend on an annualized basis and a yield of 3.3%. The ex-dividend date of this dividend is Friday, October 3rd. Parke Bancorp's dividend payout ratio (DPR) is presently 28.02%.

Insider Buying and Selling at Parke Bancorp

In other news, COO Ralph Martin Gallo sold 1,946 shares of the firm's stock in a transaction on Tuesday, August 12th. The stock was sold at an average price of $21.89, for a total transaction of $42,597.94. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CFO Jonathan D. Hill sold 2,000 shares of the firm's stock in a transaction on Friday, August 22nd. The stock was sold at an average price of $22.09, for a total value of $44,180.00. Following the sale, the chief financial officer directly owned 8,000 shares of the company's stock, valued at approximately $176,720. This represents a 20.00% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 8,909 shares of company stock valued at $195,499. 12.89% of the stock is owned by corporate insiders.

Parke Bancorp Company Profile

(

Free Report)

Parke Bancorp, Inc operates as the bank holding company for Parke Bank that provides personal and business financial services to individuals and small to mid-sized businesses. The company offers various deposit products, including checking, savings, time, money market, and individual retirement accounts, as well as certificates of deposit.

Featured Articles

Before you consider Parke Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Parke Bancorp wasn't on the list.

While Parke Bancorp currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.