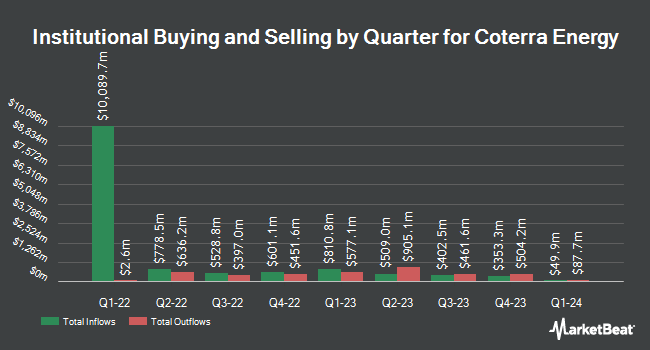

Sumitomo Mitsui DS Asset Management Company Ltd decreased its holdings in shares of Coterra Energy Inc. (NYSE:CTRA - Free Report) by 33.1% in the 2nd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 93,651 shares of the company's stock after selling 46,324 shares during the quarter. Sumitomo Mitsui DS Asset Management Company Ltd's holdings in Coterra Energy were worth $2,377,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors have also bought and sold shares of CTRA. Cornerstone Planning Group LLC boosted its stake in Coterra Energy by 175.6% during the 1st quarter. Cornerstone Planning Group LLC now owns 871 shares of the company's stock worth $25,000 after acquiring an additional 555 shares during the last quarter. Raleigh Capital Management Inc. boosted its stake in Coterra Energy by 463.5% during the 1st quarter. Raleigh Capital Management Inc. now owns 896 shares of the company's stock worth $26,000 after acquiring an additional 737 shares during the last quarter. Banque Cantonale Vaudoise bought a new position in Coterra Energy during the 1st quarter worth approximately $29,000. Wayfinding Financial LLC bought a new position in Coterra Energy during the 1st quarter worth approximately $34,000. Finally, Investors Research Corp boosted its stake in Coterra Energy by 45.2% during the 1st quarter. Investors Research Corp now owns 1,311 shares of the company's stock worth $38,000 after acquiring an additional 408 shares during the last quarter. Institutional investors own 87.92% of the company's stock.

Coterra Energy Price Performance

NYSE CTRA opened at $23.28 on Monday. The company has a quick ratio of 1.08, a current ratio of 1.13 and a debt-to-equity ratio of 0.29. Coterra Energy Inc. has a 12-month low of $22.46 and a 12-month high of $29.95. The company has a market capitalization of $17.77 billion, a PE ratio of 11.14, a price-to-earnings-growth ratio of 0.33 and a beta of 0.34. The firm's 50 day moving average is $24.03 and its 200-day moving average is $25.22.

Coterra Energy (NYSE:CTRA - Get Free Report) last posted its quarterly earnings data on Monday, August 4th. The company reported $0.48 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.50 by ($0.02). Coterra Energy had a net margin of 23.80% and a return on equity of 10.99%. The business had revenue of $1.97 billion during the quarter, compared to analyst estimates of $1.78 billion. During the same quarter last year, the business earned $0.37 earnings per share. Coterra Energy's revenue for the quarter was up 54.6% on a year-over-year basis. Equities research analysts anticipate that Coterra Energy Inc. will post 1.54 earnings per share for the current fiscal year.

Coterra Energy Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, August 28th. Stockholders of record on Thursday, August 14th were issued a $0.22 dividend. The ex-dividend date was Thursday, August 14th. This represents a $0.88 dividend on an annualized basis and a dividend yield of 3.8%. Coterra Energy's dividend payout ratio (DPR) is 42.11%.

Analyst Upgrades and Downgrades

Several research firms recently weighed in on CTRA. Wells Fargo & Company lifted their price objective on shares of Coterra Energy from $32.00 to $33.00 and gave the stock an "overweight" rating in a research note on Thursday, August 14th. Barclays lifted their price objective on shares of Coterra Energy from $35.00 to $37.00 and gave the stock an "overweight" rating in a research note on Monday, July 7th. The Goldman Sachs Group reaffirmed a "neutral" rating and issued a $31.00 price target on shares of Coterra Energy in a research note on Tuesday, July 1st. Raymond James Financial reaffirmed an "outperform" rating and issued a $34.00 price target (down previously from $38.00) on shares of Coterra Energy in a research note on Thursday, September 11th. Finally, Mizuho cut their price target on shares of Coterra Energy from $36.00 to $33.00 and set an "outperform" rating on the stock in a research note on Monday, September 15th. Fourteen investment analysts have rated the stock with a Buy rating and four have issued a Hold rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $33.22.

Read Our Latest Research Report on CTRA

About Coterra Energy

(

Free Report)

Coterra Energy Inc, an independent oil and gas company, engages in the development, exploration, and production of oil, natural gas, and natural gas liquids in the United States. The company's properties include the Marcellus Shale with approximately 186,000 net acres in the dry gas window of the play located in Susquehanna County, Pennsylvania; Permian Basin properties with approximately 296,000 net acres located in west Texas and southeast New Mexico; and Anadarko Basin properties with approximately 182,000 net acres located in Oklahoma.

Featured Stories

Want to see what other hedge funds are holding CTRA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Coterra Energy Inc. (NYSE:CTRA - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Coterra Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coterra Energy wasn't on the list.

While Coterra Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.