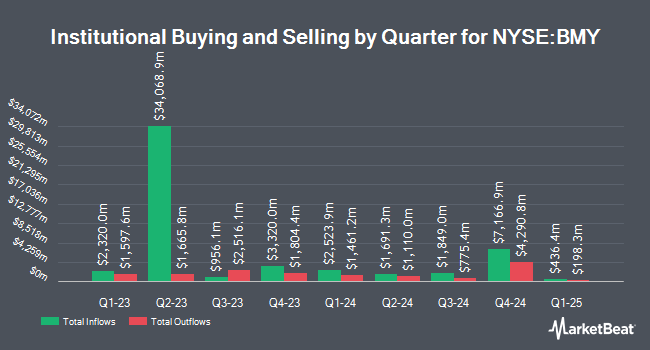

Summit Securities Group LLC reduced its holdings in shares of Bristol Myers Squibb Company (NYSE:BMY - Free Report) by 81.2% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 9,700 shares of the biopharmaceutical company's stock after selling 42,000 shares during the period. Summit Securities Group LLC's holdings in Bristol Myers Squibb were worth $592,000 at the end of the most recent quarter.

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Pinney & Scofield Inc. bought a new position in shares of Bristol Myers Squibb in the fourth quarter worth approximately $25,000. Park Square Financial Group LLC bought a new position in shares of Bristol Myers Squibb in the fourth quarter worth approximately $26,000. Global Wealth Strategies & Associates boosted its position in shares of Bristol Myers Squibb by 137.5% in the first quarter. Global Wealth Strategies & Associates now owns 475 shares of the biopharmaceutical company's stock worth $29,000 after purchasing an additional 275 shares during the period. Transce3nd LLC bought a new position in shares of Bristol Myers Squibb in the fourth quarter worth approximately $28,000. Finally, Harel Insurance Investments & Financial Services Ltd. bought a new position in shares of Bristol Myers Squibb in the first quarter worth approximately $31,000. 76.41% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of research firms have weighed in on BMY. Cantor Fitzgerald reiterated a "neutral" rating and issued a $55.00 price target on shares of Bristol Myers Squibb in a research report on Tuesday, April 22nd. Daiwa America lowered shares of Bristol Myers Squibb from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, August 5th. Jefferies Financial Group dropped their price target on shares of Bristol Myers Squibb from $70.00 to $68.00 and set a "buy" rating for the company in a research report on Wednesday, April 23rd. Argus upgraded shares of Bristol Myers Squibb to a "hold" rating in a research report on Friday, April 25th. Finally, Morgan Stanley restated a "hold" rating on shares of Bristol Myers Squibb in a research report on Thursday, July 31st. One analyst has rated the stock with a sell rating, fifteen have assigned a hold rating, five have given a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average price target of $56.38.

Check Out Our Latest Stock Report on Bristol Myers Squibb

Bristol Myers Squibb Price Performance

BMY stock opened at $48.45 on Friday. Bristol Myers Squibb Company has a 52 week low of $42.96 and a 52 week high of $63.33. The company has a quick ratio of 1.11, a current ratio of 1.21 and a debt-to-equity ratio of 2.54. The company has a fifty day simple moving average of $47.23 and a two-hundred day simple moving average of $51.45. The firm has a market capitalization of $98.62 billion, a P/E ratio of 19.54, a price-to-earnings-growth ratio of 2.48 and a beta of 0.36.

Bristol Myers Squibb (NYSE:BMY - Get Free Report) last announced its earnings results on Thursday, July 31st. The biopharmaceutical company reported $1.46 earnings per share for the quarter, beating the consensus estimate of $1.07 by $0.39. Bristol Myers Squibb had a net margin of 10.58% and a return on equity of 80.04%. The business had revenue of $12.27 billion for the quarter, compared to the consensus estimate of $11.32 billion. During the same quarter in the prior year, the firm posted $2.07 earnings per share. The business's revenue for the quarter was up .6% on a year-over-year basis. Analysts anticipate that Bristol Myers Squibb Company will post 6.74 earnings per share for the current fiscal year.

Bristol Myers Squibb Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, August 1st. Investors of record on Thursday, July 3rd were paid a $0.62 dividend. This represents a $2.48 annualized dividend and a yield of 5.1%. The ex-dividend date of this dividend was Thursday, July 3rd. Bristol Myers Squibb's dividend payout ratio (DPR) is currently 100.00%.

Bristol Myers Squibb Company Profile

(

Free Report)

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide. It offers products for hematology, oncology, cardiovascular, immunology, fibrotic, and neuroscience diseases. The company's products include Eliquis for reduction in risk of stroke/systemic embolism in non-valvular atrial fibrillation, and for the treatment of DVT/PE; Opdivo for various anti-cancer indications, including bladder, blood, CRC, head and neck, RCC, HCC, lung, melanoma, MPM, stomach and esophageal cancer; Pomalyst/Imnovid for multiple myeloma; Orencia for active rheumatoid arthritis and psoriatic arthritis; and Sprycel for the treatment of Philadelphia chromosome-positive chronic myeloid leukemia.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bristol Myers Squibb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bristol Myers Squibb wasn't on the list.

While Bristol Myers Squibb currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.