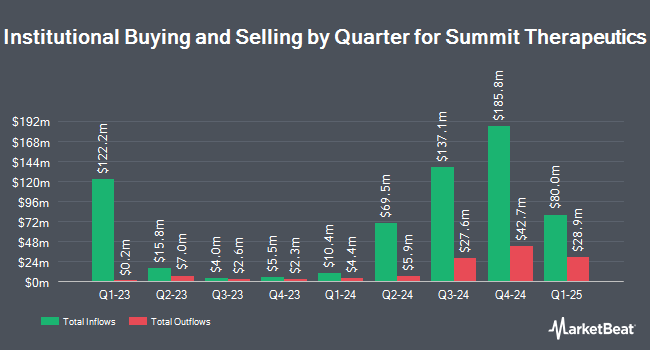

Russell Investments Group Ltd. raised its stake in Summit Therapeutics PLC (NASDAQ:SMMT - Free Report) by 204.3% during the first quarter, according to its most recent disclosure with the SEC. The fund owned 211,004 shares of the company's stock after buying an additional 141,664 shares during the quarter. Russell Investments Group Ltd.'s holdings in Summit Therapeutics were worth $4,070,000 as of its most recent SEC filing.

Other hedge funds have also recently bought and sold shares of the company. Golden State Wealth Management LLC raised its holdings in shares of Summit Therapeutics by 100.0% during the first quarter. Golden State Wealth Management LLC now owns 1,502 shares of the company's stock valued at $29,000 after buying an additional 751 shares during the last quarter. CWM LLC raised its holdings in shares of Summit Therapeutics by 3,455.3% during the first quarter. CWM LLC now owns 1,671 shares of the company's stock valued at $32,000 after buying an additional 1,624 shares during the last quarter. Fifth Third Bancorp raised its holdings in shares of Summit Therapeutics by 1,400.0% during the first quarter. Fifth Third Bancorp now owns 3,000 shares of the company's stock valued at $58,000 after buying an additional 2,800 shares during the last quarter. Exchange Traded Concepts LLC raised its holdings in shares of Summit Therapeutics by 11.4% during the first quarter. Exchange Traded Concepts LLC now owns 6,328 shares of the company's stock valued at $122,000 after buying an additional 647 shares during the last quarter. Finally, Hsbc Holdings PLC bought a new stake in Summit Therapeutics during the 4th quarter valued at $188,000. 4.61% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

SMMT has been the topic of several recent analyst reports. Zacks Research downgraded Summit Therapeutics from a "hold" rating to a "strong sell" rating in a research note on Thursday, August 14th. HC Wainwright lifted their price objective on shares of Summit Therapeutics from $44.00 to $50.00 and gave the company a "buy" rating in a research note on Wednesday. JMP Securities restated a "market outperform" rating and set a $40.00 price objective on shares of Summit Therapeutics in a research note on Tuesday, August 19th. Wall Street Zen downgraded shares of Summit Therapeutics from a "hold" rating to a "sell" rating in a research report on Saturday, August 16th. Finally, Piper Sandler started coverage on shares of Summit Therapeutics in a research report on Monday, August 18th. They set a "neutral" rating and a $21.00 price target on the stock. One analyst has rated the stock with a Strong Buy rating, eleven have issued a Buy rating, one has assigned a Hold rating and three have assigned a Sell rating to the stock. Based on data from MarketBeat.com, Summit Therapeutics has a consensus rating of "Moderate Buy" and an average price target of $33.31.

View Our Latest Research Report on Summit Therapeutics

Summit Therapeutics Stock Down 7.9%

Summit Therapeutics stock traded down $2.14 during midday trading on Wednesday, hitting $24.85. The company's stock had a trading volume of 3,500,416 shares, compared to its average volume of 3,615,099. The stock's 50-day moving average price is $25.29 and its 200-day moving average price is $23.02. Summit Therapeutics PLC has a 12 month low of $11.76 and a 12 month high of $36.91. The company has a market capitalization of $18.46 billion, a PE ratio of -24.68 and a beta of -1.06.

Summit Therapeutics (NASDAQ:SMMT - Get Free Report) last issued its quarterly earnings results on Monday, August 11th. The company reported ($0.76) EPS for the quarter, missing the consensus estimate of ($0.10) by ($0.66). As a group, equities analysts anticipate that Summit Therapeutics PLC will post -0.3 EPS for the current year.

About Summit Therapeutics

(

Free Report)

Summit Therapeutics Inc, a biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies in the United States, and the United Kingdom. The company's lead development candidate is Ivonescimab, a bispecific antibody for immunotherapy through blockade of PD-1 with the anti-angiogenesis; and anti-infectives portfolio includes SMT-738, a novel class of precision antibiotics for the treatment of multidrug resistant infections, which primarily includes carbapenem-resistant Enterobacteriaceae infections.

Read More

Before you consider Summit Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Summit Therapeutics wasn't on the list.

While Summit Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.