Lincluden Management Ltd. decreased its stake in shares of Suncor Energy Inc. (NYSE:SU - Free Report) TSE: SU by 1.4% during the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 618,260 shares of the oil and gas producer's stock after selling 9,074 shares during the quarter. Suncor Energy comprises 3.0% of Lincluden Management Ltd.'s holdings, making the stock its 12th largest position. Lincluden Management Ltd. owned 0.05% of Suncor Energy worth $23,940,000 as of its most recent filing with the SEC.

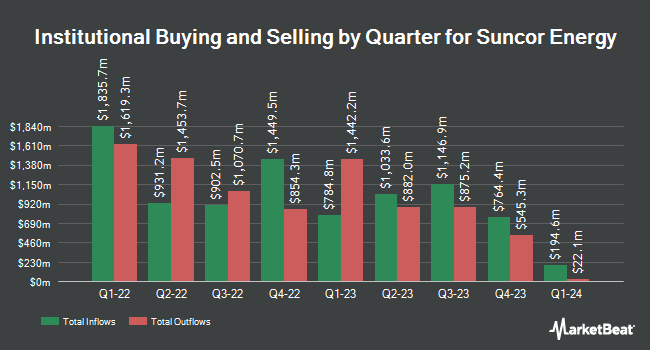

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in SU. Vanguard Group Inc. boosted its position in shares of Suncor Energy by 0.6% in the 4th quarter. Vanguard Group Inc. now owns 53,019,357 shares of the oil and gas producer's stock valued at $1,892,526,000 after purchasing an additional 323,714 shares during the period. Artisan Partners Limited Partnership raised its stake in shares of Suncor Energy by 0.7% during the 4th quarter. Artisan Partners Limited Partnership now owns 24,289,019 shares of the oil and gas producer's stock worth $865,885,000 after buying an additional 169,700 shares in the last quarter. Massachusetts Financial Services Co. MA raised its stake in shares of Suncor Energy by 0.9% during the 4th quarter. Massachusetts Financial Services Co. MA now owns 23,308,055 shares of the oil and gas producer's stock worth $831,631,000 after buying an additional 209,447 shares in the last quarter. Toronto Dominion Bank increased its stake in Suncor Energy by 3.0% in the 4th quarter. Toronto Dominion Bank now owns 19,098,225 shares of the oil and gas producer's stock valued at $680,847,000 after purchasing an additional 552,018 shares in the last quarter. Finally, Principal Financial Group Inc. increased its stake in Suncor Energy by 65.0% in the 1st quarter. Principal Financial Group Inc. now owns 16,018,129 shares of the oil and gas producer's stock valued at $620,136,000 after purchasing an additional 6,311,513 shares in the last quarter. Hedge funds and other institutional investors own 67.37% of the company's stock.

Suncor Energy Stock Down 1.0%

Suncor Energy stock traded down $0.39 during midday trading on Friday, hitting $39.31. The stock had a trading volume of 2,698,794 shares, compared to its average volume of 3,448,143. The stock has a market cap of $48.07 billion, a P/E ratio of 11.33, a P/E/G ratio of 3.50 and a beta of 0.80. The business has a fifty day moving average price of $38.06 and a 200 day moving average price of $37.36. Suncor Energy Inc. has a 12 month low of $30.79 and a 12 month high of $41.94. The company has a current ratio of 1.39, a quick ratio of 0.84 and a debt-to-equity ratio of 0.21.

Suncor Energy (NYSE:SU - Get Free Report) TSE: SU last issued its quarterly earnings results on Tuesday, May 6th. The oil and gas producer reported $0.91 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.86 by $0.05. Suncor Energy had a return on equity of 14.90% and a net margin of 11.95%. The firm had revenue of $9.10 billion during the quarter, compared to analyst estimates of $13.39 billion. During the same period last year, the company posted $1.41 EPS. Research analysts predict that Suncor Energy Inc. will post 3.42 EPS for the current year.

Suncor Energy Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Wednesday, June 25th. Stockholders of record on Wednesday, June 4th were issued a $0.4133 dividend. The ex-dividend date of this dividend was Wednesday, June 4th. This represents a $1.65 dividend on an annualized basis and a dividend yield of 4.20%. This is a positive change from Suncor Energy's previous quarterly dividend of $0.40. Suncor Energy's dividend payout ratio is presently 47.84%.

Wall Street Analyst Weigh In

Separately, Wall Street Zen lowered Suncor Energy from a "buy" rating to a "hold" rating in a research note on Thursday, April 17th. Four research analysts have rated the stock with a hold rating, five have assigned a buy rating and two have issued a strong buy rating to the company. According to MarketBeat.com, Suncor Energy currently has an average rating of "Moderate Buy" and an average price target of $66.00.

Read Our Latest Research Report on Suncor Energy

Suncor Energy Profile

(

Free Report)

Suncor Energy Inc operates as an integrated energy company in Canada, the United States, and internationally. It operates through Oil Sands; Exploration and Production; and Refining and Marketing segments. The Oil Sands segment explores, develops, and produces bitumen, synthetic crude oil, and related products.

Read More

Before you consider Suncor Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Suncor Energy wasn't on the list.

While Suncor Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.