GSA Capital Partners LLP raised its stake in shares of Supernus Pharmaceuticals, Inc. (NASDAQ:SUPN - Free Report) by 375.0% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 90,538 shares of the specialty pharmaceutical company's stock after purchasing an additional 71,478 shares during the quarter. Supernus Pharmaceuticals comprises 0.3% of GSA Capital Partners LLP's holdings, making the stock its 14th biggest position. GSA Capital Partners LLP owned approximately 0.16% of Supernus Pharmaceuticals worth $2,965,000 as of its most recent filing with the Securities and Exchange Commission.

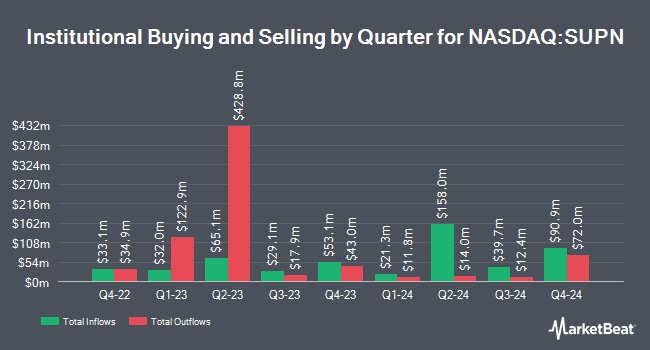

A number of other hedge funds have also bought and sold shares of SUPN. Raiffeisen Bank International AG acquired a new position in Supernus Pharmaceuticals during the 4th quarter valued at approximately $25,000. Financial Management Professionals Inc. acquired a new position in Supernus Pharmaceuticals during the 1st quarter valued at approximately $30,000. Versant Capital Management Inc increased its stake in Supernus Pharmaceuticals by 6,931.3% during the 1st quarter. Versant Capital Management Inc now owns 1,125 shares of the specialty pharmaceutical company's stock valued at $37,000 after purchasing an additional 1,109 shares in the last quarter. GF Fund Management CO. LTD. acquired a new position in Supernus Pharmaceuticals during the 4th quarter valued at approximately $42,000. Finally, Headlands Technologies LLC increased its stake in Supernus Pharmaceuticals by 203.0% during the 4th quarter. Headlands Technologies LLC now owns 1,515 shares of the specialty pharmaceutical company's stock valued at $55,000 after purchasing an additional 1,015 shares in the last quarter.

Wall Street Analysts Forecast Growth

Several analysts have recently commented on SUPN shares. Cantor Fitzgerald raised shares of Supernus Pharmaceuticals from a "neutral" rating to an "overweight" rating and set a $42.00 price objective on the stock in a report on Wednesday. Wall Street Zen downgraded shares of Supernus Pharmaceuticals from a "buy" rating to a "hold" rating in a report on Sunday, July 20th.

Read Our Latest Stock Analysis on Supernus Pharmaceuticals

Supernus Pharmaceuticals Stock Performance

NASDAQ SUPN traded up $0.41 during mid-day trading on Friday, reaching $35.51. 555,171 shares of the stock were exchanged, compared to its average volume of 588,053. The business's 50 day moving average is $32.57 and its 200-day moving average is $33.42. Supernus Pharmaceuticals, Inc. has a 1 year low of $27.05 and a 1 year high of $40.28. The company has a market capitalization of $1.99 billion, a P/E ratio of 31.92 and a beta of 0.70.

Supernus Pharmaceuticals Company Profile

(

Free Report)

Supernus Pharmaceuticals, Inc, a biopharmaceutical company, focuses on the development and commercialization of products for the treatment of central nervous system (CNS) diseases in the United States. The company's commercial products are Trokendi XR, an extended release topiramate product indicated for the treatment of epilepsy, as well as for the prophylaxis of migraine headache; and Oxtellar XR, an extended release oxcarbazepine for the monotherapy treatment of partial onset seizures in adults and children between 6 to 17 years of age.

Featured Articles

Before you consider Supernus Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Supernus Pharmaceuticals wasn't on the list.

While Supernus Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.