Swedbank AB purchased a new position in shares of Futu Holdings Limited Sponsored ADR (NASDAQ:FUTU - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the SEC. The fund purchased 6,100 shares of the company's stock, valued at approximately $624,000.

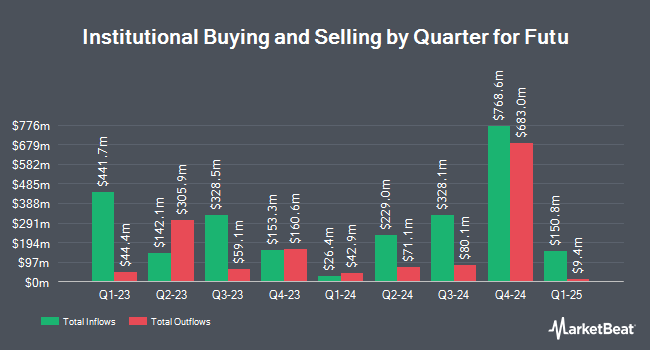

A number of other hedge funds and other institutional investors have also bought and sold shares of FUTU. Hhlr Advisors LTD. grew its position in shares of Futu by 285.2% in the 1st quarter. Hhlr Advisors LTD. now owns 4,307,492 shares of the company's stock valued at $440,872,000 after buying an additional 3,189,189 shares during the last quarter. Greenwoods Asset Management Hong Kong Ltd. boosted its position in shares of Futu by 48.2% during the 1st quarter. Greenwoods Asset Management Hong Kong Ltd. now owns 1,901,635 shares of the company's stock valued at $194,632,000 after purchasing an additional 618,701 shares in the last quarter. Price T Rowe Associates Inc. MD boosted its holdings in Futu by 30.5% in the first quarter. Price T Rowe Associates Inc. MD now owns 1,786,247 shares of the company's stock worth $182,824,000 after acquiring an additional 417,620 shares in the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC boosted its holdings in Futu by 883.4% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 989,367 shares of the company's stock worth $101,262,000 after acquiring an additional 888,760 shares in the last quarter. Finally, Trivest Advisors Ltd bought a new position in Futu in the first quarter worth approximately $98,651,000.

Wall Street Analyst Weigh In

Several analysts have recently commented on FUTU shares. Citigroup increased their price objective on Futu from $176.00 to $190.00 and gave the stock a "neutral" rating in a research note on Thursday, August 21st. JPMorgan Chase & Co. increased their price target on Futu from $200.00 to $270.00 and gave the company an "overweight" rating in a research report on Thursday, August 28th. Barclays raised their target price on Futu from $176.00 to $232.00 and gave the stock an "overweight" rating in a research report on Friday, August 22nd. Daiwa America upgraded Futu to a "strong-buy" rating in a research report on Tuesday, August 12th. Finally, Daiwa Capital Markets began coverage on Futu in a research note on Monday, August 11th. They set a "buy" rating and a $190.00 price objective for the company. One equities research analyst has rated the stock with a Strong Buy rating, seven have given a Buy rating and one has assigned a Hold rating to the company. According to data from MarketBeat, the company presently has an average rating of "Buy" and an average price target of $190.43.

View Our Latest Stock Analysis on Futu

Futu Stock Down 2.8%

Shares of FUTU stock opened at $175.67 on Wednesday. The business has a 50-day moving average price of $169.20 and a two-hundred day moving average price of $127.25. Futu Holdings Limited Sponsored ADR has a 12-month low of $58.56 and a 12-month high of $199.86. The firm has a market cap of $24.44 billion, a P/E ratio of 24.36, a price-to-earnings-growth ratio of 0.80 and a beta of 0.57.

About Futu

(

Free Report)

Futu Holdings Limited provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally. It offers online financial services, including securities and derivative trades brokerage, margin financing and fund distribution services through its Futubull and Moomoo digital platforms.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Futu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Futu wasn't on the list.

While Futu currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.