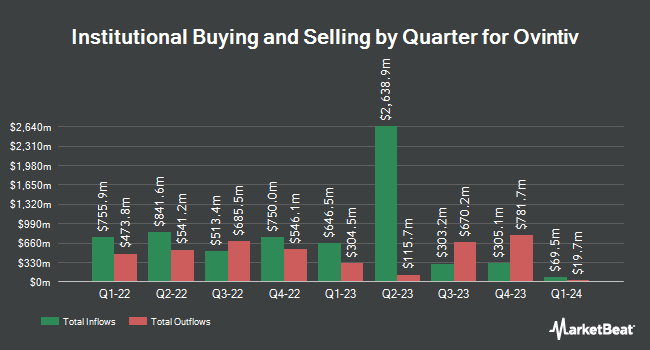

Systematic Financial Management LP raised its position in shares of Ovintiv Inc. (NYSE:OVV - Free Report) by 1.5% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 668,456 shares of the company's stock after acquiring an additional 9,566 shares during the quarter. Systematic Financial Management LP owned about 0.26% of Ovintiv worth $28,610,000 as of its most recent SEC filing.

Other institutional investors and hedge funds also recently made changes to their positions in the company. Colonial Trust Co SC bought a new position in shares of Ovintiv during the 4th quarter worth about $28,000. Harbour Investments Inc. lifted its position in Ovintiv by 143.8% in the 1st quarter. Harbour Investments Inc. now owns 919 shares of the company's stock valued at $39,000 after acquiring an additional 542 shares in the last quarter. Optiver Holding B.V. bought a new position in Ovintiv in the 4th quarter valued at about $40,000. Gen Wealth Partners Inc lifted its position in Ovintiv by 91.8% in the 1st quarter. Gen Wealth Partners Inc now owns 1,011 shares of the company's stock valued at $43,000 after acquiring an additional 484 shares in the last quarter. Finally, SVB Wealth LLC bought a new position in Ovintiv in the 1st quarter valued at about $48,000. Institutional investors own 83.81% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages recently weighed in on OVV. Scotiabank raised their price target on shares of Ovintiv from $48.00 to $51.00 and gave the company a "sector outperform" rating in a research report on Friday, July 11th. TD Cowen raised shares of Ovintiv to a "strong-buy" rating in a research report on Monday, July 7th. Barclays increased their price objective on shares of Ovintiv from $55.00 to $57.00 and gave the company an "overweight" rating in a research note on Friday, July 25th. Mizuho decreased their price target on shares of Ovintiv from $60.00 to $58.00 and set an "outperform" rating for the company in a research note on Tuesday, May 13th. Finally, Wells Fargo & Company decreased their price target on shares of Ovintiv from $46.00 to $41.00 and set an "equal weight" rating for the company in a research note on Monday, June 16th. Two research analysts have rated the stock with a Strong Buy rating, twelve have assigned a Buy rating and two have given a Hold rating to the stock. According to data from MarketBeat, Ovintiv presently has a consensus rating of "Buy" and a consensus price target of $53.07.

Check Out Our Latest Stock Analysis on OVV

Ovintiv Trading Up 1.4%

Shares of OVV stock traded up $0.59 during mid-day trading on Wednesday, reaching $41.50. The stock had a trading volume of 2,260,023 shares, compared to its average volume of 3,531,844. The stock's 50-day moving average price is $40.03 and its two-hundred day moving average price is $38.98. Ovintiv Inc. has a 52-week low of $29.80 and a 52-week high of $47.18. The firm has a market capitalization of $10.67 billion, a PE ratio of 18.36, a price-to-earnings-growth ratio of 5.14 and a beta of 1.10. The company has a current ratio of 0.43, a quick ratio of 0.43 and a debt-to-equity ratio of 0.42.

Ovintiv (NYSE:OVV - Get Free Report) last announced its quarterly earnings results on Thursday, July 24th. The company reported $1.02 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.04 by ($0.02). Ovintiv had a net margin of 6.46% and a return on equity of 14.24%. The company had revenue of $1.79 billion for the quarter, compared to analysts' expectations of $1.92 billion. Equities analysts expect that Ovintiv Inc. will post 5.59 earnings per share for the current fiscal year.

Ovintiv Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, September 29th. Shareholders of record on Monday, September 15th will be issued a $0.30 dividend. This represents a $1.20 dividend on an annualized basis and a yield of 2.9%. The ex-dividend date is Monday, September 15th. Ovintiv's dividend payout ratio is 53.10%.

Ovintiv Profile

(

Free Report)

Ovintiv Inc, together with its subsidiaries, explores, develops, produces, and markets natural gas, oil, and natural gas liquids in the United States and Canada. The company operates through USA Operations, Canadian Operations, and Market Optimization segments. Its principal assets include Permian in west Texas and Anadarko in west-central Oklahoma; and Montney in northeast British Columbia and northwest Alberta.

Read More

Before you consider Ovintiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ovintiv wasn't on the list.

While Ovintiv currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.