SVB Wealth LLC increased its stake in shares of T. Rowe Price Group, Inc. (NASDAQ:TROW - Free Report) by 178.6% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 12,163 shares of the asset manager's stock after acquiring an additional 7,798 shares during the quarter. SVB Wealth LLC's holdings in T. Rowe Price Group were worth $1,117,000 at the end of the most recent quarter.

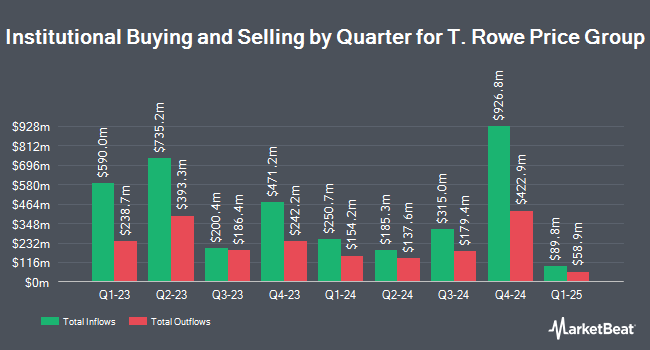

Several other institutional investors and hedge funds have also bought and sold shares of the stock. RBO & Co. LLC boosted its stake in T. Rowe Price Group by 7.8% during the first quarter. RBO & Co. LLC now owns 89,098 shares of the asset manager's stock worth $8,185,000 after acquiring an additional 6,480 shares in the last quarter. Northwestern Mutual Wealth Management Co. boosted its stake in T. Rowe Price Group by 15.7% during the first quarter. Northwestern Mutual Wealth Management Co. now owns 34,040 shares of the asset manager's stock worth $3,127,000 after acquiring an additional 4,608 shares in the last quarter. Phoenix Wealth Advisors boosted its stake in T. Rowe Price Group by 6.0% during the first quarter. Phoenix Wealth Advisors now owns 2,199 shares of the asset manager's stock worth $202,000 after acquiring an additional 125 shares in the last quarter. AlphaQuest LLC lifted its stake in shares of T. Rowe Price Group by 535.2% in the first quarter. AlphaQuest LLC now owns 4,580 shares of the asset manager's stock valued at $421,000 after buying an additional 3,859 shares in the last quarter. Finally, Allstate Corp lifted its stake in shares of T. Rowe Price Group by 177.3% in the first quarter. Allstate Corp now owns 18,345 shares of the asset manager's stock valued at $1,685,000 after buying an additional 11,730 shares in the last quarter. 73.39% of the stock is owned by institutional investors.

Insider Transactions at T. Rowe Price Group

In related news, VP Dorothy C. Sawyer sold 2,000 shares of the firm's stock in a transaction dated Wednesday, June 11th. The shares were sold at an average price of $95.43, for a total transaction of $190,860.00. Following the completion of the sale, the vice president owned 44,789 shares in the company, valued at approximately $4,274,214.27. This trade represents a 4.27% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Company insiders own 1.60% of the company's stock.

T. Rowe Price Group Trading Up 0.7%

Shares of TROW stock traded up $0.81 during trading on Wednesday, hitting $109.37. The company's stock had a trading volume of 933,594 shares, compared to its average volume of 1,777,064. The company has a market cap of $24.03 billion, a PE ratio of 12.22, a P/E/G ratio of 2.82 and a beta of 1.47. The business has a fifty day moving average of $102.75 and a 200-day moving average of $97.48. T. Rowe Price Group, Inc. has a 52 week low of $77.85 and a 52 week high of $125.81.

T. Rowe Price Group (NASDAQ:TROW - Get Free Report) last released its earnings results on Friday, August 1st. The asset manager reported $2.24 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.15 by $0.09. T. Rowe Price Group had a return on equity of 19.77% and a net margin of 28.72%.The company had revenue of $1.72 billion during the quarter, compared to analyst estimates of $1.72 billion. During the same period in the prior year, the company posted $2.26 earnings per share. T. Rowe Price Group's quarterly revenue was down .6% on a year-over-year basis. As a group, research analysts predict that T. Rowe Price Group, Inc. will post 9.29 EPS for the current year.

T. Rowe Price Group Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, September 29th. Investors of record on Monday, September 15th will be issued a dividend of $1.27 per share. This represents a $5.08 dividend on an annualized basis and a yield of 4.6%. The ex-dividend date is Monday, September 15th. T. Rowe Price Group's dividend payout ratio (DPR) is 56.76%.

Wall Street Analyst Weigh In

TROW has been the topic of a number of recent research reports. JPMorgan Chase & Co. raised their price objective on shares of T. Rowe Price Group from $98.00 to $102.00 and gave the company an "underweight" rating in a research note on Monday, August 4th. Keefe, Bruyette & Woods raised their price objective on shares of T. Rowe Price Group from $110.00 to $112.00 and gave the company a "market perform" rating in a research note on Monday, August 4th. Wells Fargo & Company raised their price objective on shares of T. Rowe Price Group from $98.00 to $108.00 and gave the company an "equal weight" rating in a research note on Friday, July 11th. Morgan Stanley raised their price objective on shares of T. Rowe Price Group from $112.00 to $116.00 and gave the company an "equal weight" rating in a research note on Monday, August 4th. Finally, Evercore ISI raised their price objective on shares of T. Rowe Price Group from $106.00 to $110.00 and gave the company an "in-line" rating in a research note on Monday, August 4th. Eight equities research analysts have rated the stock with a Hold rating and four have issued a Sell rating to the company. Based on data from MarketBeat, T. Rowe Price Group has a consensus rating of "Reduce" and a consensus price target of $101.09.

Check Out Our Latest Stock Report on TROW

T. Rowe Price Group Company Profile

(

Free Report)

T. Rowe Price Group, Inc is a publicly owned investment manager. The firm provides its services to individuals, institutional investors, retirement plans, financial intermediaries, and institutions. It launches and manages equity and fixed income mutual funds. The firm invests in the public equity and fixed income markets across the globe.

Featured Articles

Before you consider T. Rowe Price Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and T. Rowe Price Group wasn't on the list.

While T. Rowe Price Group currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.