Taikang Asset Management Hong Kong Co Ltd purchased a new stake in Tencent Music Entertainment Group Sponsored ADR (NYSE:TME - Free Report) during the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm purchased 14,366 shares of the company's stock, valued at approximately $207,000.

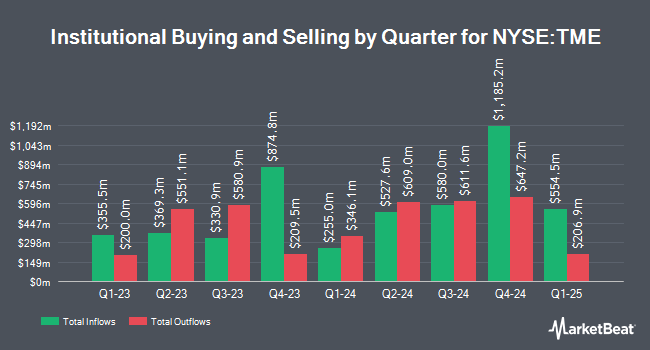

Several other hedge funds have also added to or reduced their stakes in TME. Wells Fargo & Company MN boosted its holdings in Tencent Music Entertainment Group by 86.9% during the fourth quarter. Wells Fargo & Company MN now owns 136,423 shares of the company's stock worth $1,548,000 after buying an additional 63,413 shares during the last quarter. Raymond James Financial Inc. bought a new position in Tencent Music Entertainment Group during the fourth quarter worth about $731,000. Mariner LLC boosted its holdings in Tencent Music Entertainment Group by 9.8% during the fourth quarter. Mariner LLC now owns 47,685 shares of the company's stock worth $541,000 after buying an additional 4,273 shares during the last quarter. First Trust Advisors LP boosted its holdings in Tencent Music Entertainment Group by 77.2% during the fourth quarter. First Trust Advisors LP now owns 58,851 shares of the company's stock worth $668,000 after buying an additional 25,633 shares during the last quarter. Finally, Dimensional Fund Advisors LP boosted its holdings in Tencent Music Entertainment Group by 12.1% during the fourth quarter. Dimensional Fund Advisors LP now owns 3,253,409 shares of the company's stock worth $36,925,000 after buying an additional 352,082 shares during the last quarter. Institutional investors own 24.32% of the company's stock.

Analyst Ratings Changes

A number of equities analysts have issued reports on the company. Citigroup restated a "buy" rating and set a $29.00 target price (up previously from $23.00) on shares of Tencent Music Entertainment Group in a report on Tuesday, August 12th. Macquarie set a $29.80 price objective on Tencent Music Entertainment Group and gave the company an "outperform" rating in a report on Tuesday, August 12th. Sanford C. Bernstein set a $27.50 price objective on Tencent Music Entertainment Group and gave the company an "outperform" rating in a report on Wednesday, August 13th. Zacks Research upgraded Tencent Music Entertainment Group from a "hold" rating to a "strong-buy" rating in a report on Tuesday. Finally, Wall Street Zen upgraded Tencent Music Entertainment Group from a "hold" rating to a "buy" rating in a report on Friday, August 22nd. Two investment analysts have rated the stock with a Strong Buy rating and nine have issued a Buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Buy" and an average target price of $24.47.

View Our Latest Research Report on Tencent Music Entertainment Group

Tencent Music Entertainment Group Stock Down 1.5%

Tencent Music Entertainment Group stock traded down $0.36 during midday trading on Friday, reaching $24.54. The stock had a trading volume of 7,157,765 shares, compared to its average volume of 7,278,725. The firm's fifty day simple moving average is $21.96 and its 200-day simple moving average is $17.19. Tencent Music Entertainment Group Sponsored ADR has a 1-year low of $9.41 and a 1-year high of $26.54. The stock has a market capitalization of $42.11 billion, a P/E ratio of 26.96 and a beta of 0.50. The company has a debt-to-equity ratio of 0.04, a quick ratio of 1.87 and a current ratio of 1.87.

Tencent Music Entertainment Group Profile

(

Free Report)

Tencent Music Entertainment Group operates online music entertainment platforms to provide music streaming, online karaoke, and live streaming services in the People's Republic of China. It offers QQ Music, Kugou Music, and Kuwo Music that enable users to discover music in personalized ways; long-form audio content, including audiobooks, podcasts and talk shows, as well as music-oriented video content comprising music videos, live performances, and short videos; and WeSing, which enables users to sing along from its library of karaoke songs and share their performances in audio or video formats with friends.

Further Reading

Before you consider Tencent Music Entertainment Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tencent Music Entertainment Group wasn't on the list.

While Tencent Music Entertainment Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.