Bank of New York Mellon Corp boosted its position in Takeda Pharmaceutical Co. (NYSE:TAK - Free Report) by 23.4% in the 1st quarter, according to its most recent filing with the SEC. The firm owned 129,479 shares of the company's stock after acquiring an additional 24,587 shares during the period. Bank of New York Mellon Corp's holdings in Takeda Pharmaceutical were worth $1,925,000 at the end of the most recent reporting period.

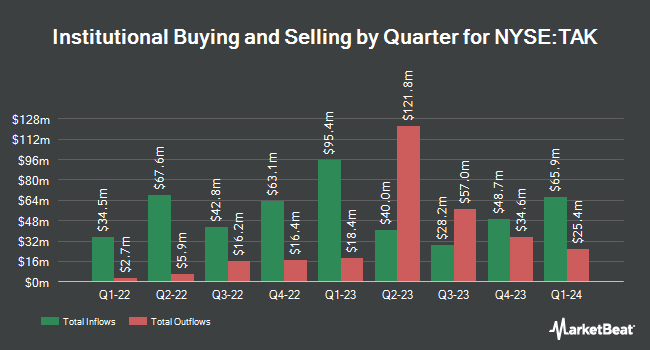

Several other institutional investors also recently made changes to their positions in TAK. GAMMA Investing LLC boosted its position in Takeda Pharmaceutical by 22.6% during the 1st quarter. GAMMA Investing LLC now owns 7,042 shares of the company's stock worth $105,000 after purchasing an additional 1,296 shares during the period. Allspring Global Investments Holdings LLC lifted its holdings in Takeda Pharmaceutical by 5.4% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 21,373 shares of the company's stock worth $319,000 after buying an additional 1,098 shares in the last quarter. Russell Investments Group Ltd. lifted its holdings in Takeda Pharmaceutical by 48.6% in the 4th quarter. Russell Investments Group Ltd. now owns 45,324 shares of the company's stock worth $600,000 after buying an additional 14,831 shares in the last quarter. Farther Finance Advisors LLC lifted its holdings in Takeda Pharmaceutical by 29.2% in the 1st quarter. Farther Finance Advisors LLC now owns 4,620 shares of the company's stock worth $69,000 after buying an additional 1,045 shares in the last quarter. Finally, Vontobel Holding Ltd. acquired a new position in Takeda Pharmaceutical in the 1st quarter worth $262,000. 9.17% of the stock is owned by hedge funds and other institutional investors.

Takeda Pharmaceutical Stock Up 3.3%

TAK stock traded up $0.45 during trading on Friday, reaching $14.17. The stock had a trading volume of 6,215,654 shares, compared to its average volume of 4,714,807. Takeda Pharmaceutical Co. has a 1-year low of $12.80 and a 1-year high of $15.53. The company has a current ratio of 1.16, a quick ratio of 0.52 and a debt-to-equity ratio of 0.60. The company has a market capitalization of $45.09 billion, a P/E ratio of 47.23 and a beta of 0.22. The firm has a fifty day moving average price of $14.86 and a 200 day moving average price of $14.51.

Takeda Pharmaceutical (NYSE:TAK - Get Free Report) last issued its earnings results on Thursday, May 8th. The company reported $0.16 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.24 by ($0.08). The company had revenue of $7.34 billion during the quarter, compared to analyst estimates of $8.02 billion. Takeda Pharmaceutical had a net margin of 3.20% and a return on equity of 10.50%. On average, equities analysts anticipate that Takeda Pharmaceutical Co. will post 1.64 earnings per share for the current year.

About Takeda Pharmaceutical

(

Free Report)

Takeda Pharmaceutical Company Limited engages in the research, development, manufacture, marketing, and out-licensing of pharmaceutical products in Japan and internationally. It offers pharmaceutical products in the areas of gastroenterology, rare diseases, plasma derived therapies, immunology, oncology, and neuroscience.

Read More

Before you consider Takeda Pharmaceutical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Takeda Pharmaceutical wasn't on the list.

While Takeda Pharmaceutical currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.