Charles Schwab Investment Management Inc. increased its position in shares of Takeda Pharmaceutical Co. (NYSE:TAK - Free Report) by 22.7% in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 311,216 shares of the company's stock after purchasing an additional 57,665 shares during the period. Charles Schwab Investment Management Inc.'s holdings in Takeda Pharmaceutical were worth $4,628,000 as of its most recent SEC filing.

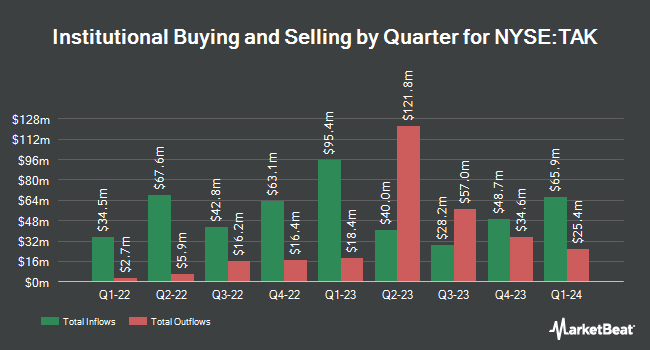

Several other large investors have also recently added to or reduced their stakes in TAK. Raymond James Financial Inc. purchased a new position in Takeda Pharmaceutical in the fourth quarter valued at about $1,447,000. Marshall Wace LLP purchased a new position in Takeda Pharmaceutical in the fourth quarter valued at about $1,010,000. Dimensional Fund Advisors LP increased its holdings in Takeda Pharmaceutical by 60.0% in the fourth quarter. Dimensional Fund Advisors LP now owns 181,929 shares of the company's stock valued at $2,409,000 after buying an additional 68,200 shares in the last quarter. Tower Research Capital LLC TRC increased its holdings in Takeda Pharmaceutical by 413.2% in the fourth quarter. Tower Research Capital LLC TRC now owns 20,898 shares of the company's stock valued at $277,000 after buying an additional 16,826 shares in the last quarter. Finally, Northern Trust Corp increased its holdings in Takeda Pharmaceutical by 14.6% in the fourth quarter. Northern Trust Corp now owns 1,873,588 shares of the company's stock valued at $24,806,000 after buying an additional 238,161 shares in the last quarter. 9.17% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Separately, Zacks Research cut shares of Takeda Pharmaceutical from a "hold" rating to a "strong sell" rating in a report on Thursday, August 21st. One analyst has rated the stock with a Buy rating and one has assigned a Sell rating to the company's stock. According to data from MarketBeat.com, Takeda Pharmaceutical currently has a consensus rating of "Hold".

Read Our Latest Analysis on TAK

Takeda Pharmaceutical Price Performance

Shares of TAK stock traded down $0.02 during trading hours on Wednesday, hitting $15.15. The company's stock had a trading volume of 3,693,809 shares, compared to its average volume of 3,028,552. The business has a fifty day moving average of $14.82 and a 200-day moving average of $14.76. The stock has a market cap of $48.19 billion, a price-to-earnings ratio of 50.48 and a beta of 0.22. Takeda Pharmaceutical Co. has a twelve month low of $12.80 and a twelve month high of $15.56. The company has a current ratio of 1.16, a quick ratio of 0.59 and a debt-to-equity ratio of 0.60.

Takeda Pharmaceutical (NYSE:TAK - Get Free Report) last released its quarterly earnings results on Wednesday, July 30th. The company reported $0.52 EPS for the quarter, beating the consensus estimate of $0.47 by $0.05. The business had revenue of $7.45 billion for the quarter, compared to analyst estimates of $7.96 billion. Takeda Pharmaceutical had a net margin of 3.20% and a return on equity of 10.50%. Takeda Pharmaceutical has set its FY 2025 guidance at 3.360-3.360 EPS. As a group, equities research analysts anticipate that Takeda Pharmaceutical Co. will post 1.64 EPS for the current year.

About Takeda Pharmaceutical

(

Free Report)

Takeda Pharmaceutical Company Limited engages in the research, development, manufacture, marketing, and out-licensing of pharmaceutical products in Japan and internationally. It offers pharmaceutical products in the areas of gastroenterology, rare diseases, plasma derived therapies, immunology, oncology, and neuroscience.

Further Reading

Before you consider Takeda Pharmaceutical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Takeda Pharmaceutical wasn't on the list.

While Takeda Pharmaceutical currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.