AlphaQuest LLC increased its holdings in Targa Resources, Inc. (NYSE:TRGP - Free Report) by 95.8% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 10,819 shares of the pipeline company's stock after acquiring an additional 5,293 shares during the quarter. AlphaQuest LLC's holdings in Targa Resources were worth $2,169,000 as of its most recent filing with the Securities & Exchange Commission.

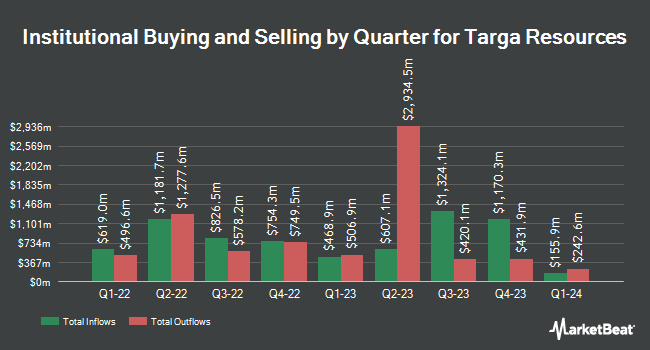

A number of other institutional investors have also added to or reduced their stakes in the company. Allstate Corp raised its holdings in Targa Resources by 72.3% in the first quarter. Allstate Corp now owns 10,450 shares of the pipeline company's stock worth $2,095,000 after purchasing an additional 4,386 shares in the last quarter. Compound Planning Inc. raised its holdings in Targa Resources by 42.2% in the first quarter. Compound Planning Inc. now owns 2,160 shares of the pipeline company's stock worth $433,000 after purchasing an additional 641 shares in the last quarter. Ameriprise Financial Inc. raised its holdings in Targa Resources by 8.3% in the first quarter. Ameriprise Financial Inc. now owns 497,791 shares of the pipeline company's stock worth $99,794,000 after purchasing an additional 38,097 shares in the last quarter. Norinchukin Bank The raised its holdings in Targa Resources by 9.8% in the first quarter. Norinchukin Bank The now owns 8,470 shares of the pipeline company's stock worth $1,698,000 after purchasing an additional 757 shares in the last quarter. Finally, Summit Financial LLC raised its holdings in Targa Resources by 96.6% in the first quarter. Summit Financial LLC now owns 9,080 shares of the pipeline company's stock worth $1,820,000 after purchasing an additional 4,462 shares in the last quarter. Institutional investors own 92.13% of the company's stock.

Targa Resources Stock Performance

NYSE TRGP traded down $1.9590 during trading hours on Monday, hitting $161.3010. The company's stock had a trading volume of 921,451 shares, compared to its average volume of 1,858,846. Targa Resources, Inc. has a 12 month low of $142.11 and a 12 month high of $218.51. The company's 50 day simple moving average is $167.72 and its two-hundred day simple moving average is $174.96. The company has a market cap of $34.71 billion, a P/E ratio of 22.81, a price-to-earnings-growth ratio of 1.00 and a beta of 1.12. The company has a debt-to-equity ratio of 5.93, a current ratio of 0.69 and a quick ratio of 0.56.

Targa Resources (NYSE:TRGP - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The pipeline company reported $2.87 EPS for the quarter, topping the consensus estimate of $1.95 by $0.92. The company had revenue of $4.26 billion during the quarter, compared to the consensus estimate of $4.82 billion. Targa Resources had a return on equity of 43.35% and a net margin of 8.99%. As a group, sell-side analysts expect that Targa Resources, Inc. will post 8.15 EPS for the current fiscal year.

Targa Resources Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, August 15th. Shareholders of record on Thursday, July 31st were given a $1.00 dividend. The ex-dividend date of this dividend was Thursday, July 31st. This is a positive change from Targa Resources's previous quarterly dividend of $0.12. This represents a $4.00 annualized dividend and a yield of 2.5%. Targa Resources's payout ratio is 56.58%.

Wall Street Analysts Forecast Growth

A number of equities analysts have issued reports on TRGP shares. Wall Street Zen upgraded Targa Resources from a "hold" rating to a "buy" rating in a report on Saturday. TD Securities initiated coverage on Targa Resources in a report on Monday, July 7th. They set a "hold" rating for the company. JPMorgan Chase & Co. raised their price target on Targa Resources from $189.00 to $209.00 and gave the company an "overweight" rating in a report on Thursday, July 10th. Mizuho set a $212.00 price target on Targa Resources and gave the company an "outperform" rating in a report on Tuesday, May 20th. Finally, Cfra Research upgraded Targa Resources to a "hold" rating in a report on Friday, August 8th. Two research analysts have rated the stock with a Strong Buy rating, thirteen have assigned a Buy rating and three have given a Hold rating to the company's stock. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $209.21.

View Our Latest Analysis on Targa Resources

About Targa Resources

(

Free Report)

Targa Resources Corp., together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary domestic midstream infrastructure assets in North America. It operates in two segments, Gathering and Processing, and Logistics and Transportation. The company is involved in gathering, compressing, treating, processing, transporting, and selling natural gas; storing, fractionating, treating, transporting, and selling natural gas liquids (NGL) and NGL products, including services to liquefied petroleum gas exporters; and gathering, storing, terminaling, purchasing, and selling crude oil.

Featured Stories

Before you consider Targa Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Targa Resources wasn't on the list.

While Targa Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.