Aberdeen Group plc lifted its holdings in Tarsus Pharmaceuticals, Inc. (NASDAQ:TARS - Free Report) by 18.8% in the 2nd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 61,597 shares of the company's stock after purchasing an additional 9,728 shares during the period. Aberdeen Group plc owned about 0.15% of Tarsus Pharmaceuticals worth $2,495,000 as of its most recent filing with the Securities & Exchange Commission.

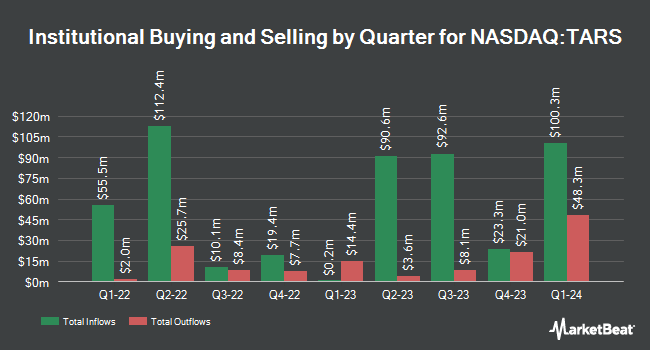

A number of other hedge funds also recently bought and sold shares of the business. Valmark Advisers Inc. acquired a new stake in Tarsus Pharmaceuticals in the first quarter valued at approximately $283,000. Amalgamated Bank grew its stake in Tarsus Pharmaceuticals by 30.1% in the 1st quarter. Amalgamated Bank now owns 1,274 shares of the company's stock valued at $65,000 after acquiring an additional 295 shares during the period. Arizona State Retirement System grew its stake in Tarsus Pharmaceuticals by 6.1% in the 1st quarter. Arizona State Retirement System now owns 8,182 shares of the company's stock valued at $420,000 after acquiring an additional 470 shares during the period. Victory Capital Management Inc. increased its holdings in Tarsus Pharmaceuticals by 999.5% in the 1st quarter. Victory Capital Management Inc. now owns 44,320 shares of the company's stock worth $2,277,000 after acquiring an additional 40,289 shares in the last quarter. Finally, Universal Beteiligungs und Servicegesellschaft mbH acquired a new position in Tarsus Pharmaceuticals during the first quarter worth $1,818,000. Hedge funds and other institutional investors own 90.01% of the company's stock.

Tarsus Pharmaceuticals Stock Performance

NASDAQ:TARS opened at $72.93 on Friday. The company has a market cap of $3.08 billion, a P/E ratio of -31.30 and a beta of 0.81. Tarsus Pharmaceuticals, Inc. has a twelve month low of $35.84 and a twelve month high of $76.81. The company's 50-day moving average price is $58.73 and its 200-day moving average price is $49.01. The company has a current ratio of 5.26, a quick ratio of 5.21 and a debt-to-equity ratio of 0.22.

Tarsus Pharmaceuticals (NASDAQ:TARS - Get Free Report) last released its quarterly earnings data on Wednesday, August 6th. The company reported ($0.48) EPS for the quarter, missing analysts' consensus estimates of ($0.33) by ($0.15). Tarsus Pharmaceuticals had a negative net margin of 31.13% and a negative return on equity of 32.36%. The business had revenue of $102.66 million during the quarter, compared to analyst estimates of $95.81 million. On average, sell-side analysts forecast that Tarsus Pharmaceuticals, Inc. will post -3.17 earnings per share for the current fiscal year.

Insider Activity at Tarsus Pharmaceuticals

In related news, CEO Bobak R. Azamian sold 6,000 shares of Tarsus Pharmaceuticals stock in a transaction that occurred on Wednesday, September 24th. The stock was sold at an average price of $55.37, for a total transaction of $332,220.00. Following the transaction, the chief executive officer owned 812,106 shares in the company, valued at approximately $44,966,309.22. This trade represents a 0.73% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, Director William J. Phd Link sold 27,116 shares of the company's stock in a transaction on Monday, September 8th. The shares were sold at an average price of $57.00, for a total value of $1,545,612.00. Following the completion of the sale, the director owned 143,332 shares of the company's stock, valued at approximately $8,169,924. The trade was a 15.91% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 39,116 shares of company stock valued at $2,177,832. Insiders own 8.97% of the company's stock.

Analysts Set New Price Targets

Several analysts have recently issued reports on the stock. Weiss Ratings reiterated a "sell (d-)" rating on shares of Tarsus Pharmaceuticals in a research report on Wednesday, October 8th. Zacks Research raised shares of Tarsus Pharmaceuticals from a "strong sell" rating to a "hold" rating in a research note on Friday, September 5th. Five investment analysts have rated the stock with a Buy rating, two have given a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat, Tarsus Pharmaceuticals has an average rating of "Moderate Buy" and a consensus target price of $66.67.

Check Out Our Latest Research Report on TARS

Tarsus Pharmaceuticals Profile

(

Free Report)

Tarsus Pharmaceuticals, Inc, a commercial stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutic candidates for eye care in the United States. The company's lead product candidate is XDEMVY, a novel therapeutic for the treatment of blepharitis caused by the infestation of Demodex mites, as well as to treat meibomian gland disease.

Featured Stories

Want to see what other hedge funds are holding TARS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Tarsus Pharmaceuticals, Inc. (NASDAQ:TARS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tarsus Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tarsus Pharmaceuticals wasn't on the list.

While Tarsus Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.