TB Alternative Assets Ltd. purchased a new position in Cleveland-Cliffs Inc. (NYSE:CLF - Free Report) during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund purchased 333,887 shares of the mining company's stock, valued at approximately $2,538,000. Cleveland-Cliffs accounts for about 0.5% of TB Alternative Assets Ltd.'s investment portfolio, making the stock its 26th largest position. TB Alternative Assets Ltd. owned about 0.07% of Cleveland-Cliffs at the end of the most recent reporting period.

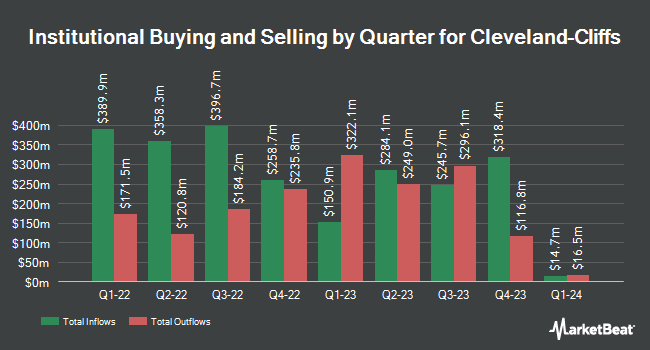

A number of other institutional investors have also recently made changes to their positions in the stock. ProShare Advisors LLC increased its stake in shares of Cleveland-Cliffs by 11.1% in the fourth quarter. ProShare Advisors LLC now owns 22,660 shares of the mining company's stock worth $213,000 after buying an additional 2,257 shares during the period. Tidal Investments LLC increased its position in shares of Cleveland-Cliffs by 53.7% in the fourth quarter. Tidal Investments LLC now owns 54,872 shares of the mining company's stock valued at $516,000 after acquiring an additional 19,167 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its stake in shares of Cleveland-Cliffs by 22.9% during the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,298,868 shares of the mining company's stock valued at $12,209,000 after acquiring an additional 242,386 shares during the last quarter. Toronto Dominion Bank raised its stake in shares of Cleveland-Cliffs by 9,170.9% during the fourth quarter. Toronto Dominion Bank now owns 69,995 shares of the mining company's stock valued at $658,000 after acquiring an additional 69,240 shares during the last quarter. Finally, Jefferies Financial Group Inc. boosted its holdings in shares of Cleveland-Cliffs by 1,151.4% during the fourth quarter. Jefferies Financial Group Inc. now owns 150,037 shares of the mining company's stock worth $1,410,000 after purchasing an additional 138,047 shares during the period. Hedge funds and other institutional investors own 67.68% of the company's stock.

Cleveland-Cliffs Trading Up 2.0%

NYSE:CLF opened at $11.73 on Thursday. Cleveland-Cliffs Inc. has a one year low of $5.63 and a one year high of $14.34. The company's 50-day simple moving average is $10.70 and its 200 day simple moving average is $8.90. The firm has a market capitalization of $5.80 billion, a P/E ratio of -3.44 and a beta of 1.93. The company has a debt-to-equity ratio of 1.28, a current ratio of 2.04 and a quick ratio of 0.61.

Cleveland-Cliffs (NYSE:CLF - Get Free Report) last released its earnings results on Monday, July 21st. The mining company reported ($0.50) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.68) by $0.18. The firm had revenue of $4.93 billion during the quarter, compared to analyst estimates of $4.90 billion. Cleveland-Cliffs had a negative net margin of 9.03% and a negative return on equity of 17.97%. The business's revenue was up 7.5% on a year-over-year basis. During the same period last year, the business earned $0.11 earnings per share. As a group, analysts forecast that Cleveland-Cliffs Inc. will post -0.79 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

CLF has been the topic of a number of research analyst reports. JPMorgan Chase & Co. boosted their price target on Cleveland-Cliffs from $7.50 to $10.00 and gave the company a "neutral" rating in a report on Thursday, July 24th. Wells Fargo & Company boosted their target price on Cleveland-Cliffs from $10.00 to $11.00 and gave the company an "equal weight" rating in a research note on Monday, September 15th. Citigroup upped their target price on Cleveland-Cliffs from $7.50 to $11.00 and gave the company a "neutral" rating in a report on Monday, July 21st. Morgan Stanley lifted their price target on shares of Cleveland-Cliffs from $8.00 to $10.50 and gave the company an "equal weight" rating in a report on Tuesday, July 22nd. Finally, KeyCorp raised shares of Cleveland-Cliffs from a "sector weight" rating to an "overweight" rating and set a $14.00 price objective on the stock in a research report on Tuesday, July 22nd. Three investment analysts have rated the stock with a Buy rating, five have assigned a Hold rating and one has assigned a Sell rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average target price of $11.24.

View Our Latest Stock Analysis on Cleveland-Cliffs

About Cleveland-Cliffs

(

Free Report)

Cleveland-Cliffs is the largest flat-rolled steel company and the largest iron ore pellet producer in North America. The company is vertically integrated from mining through iron making, steelmaking, rolling, finishing and downstream with hot and cold stamping of steel parts and components. The company was formerly known as Cliffs Natural Resources Inc and changed its name to Cleveland-Cliffs Inc in August 2017.

Recommended Stories

Want to see what other hedge funds are holding CLF? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Cleveland-Cliffs Inc. (NYSE:CLF - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cleveland-Cliffs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cleveland-Cliffs wasn't on the list.

While Cleveland-Cliffs currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.