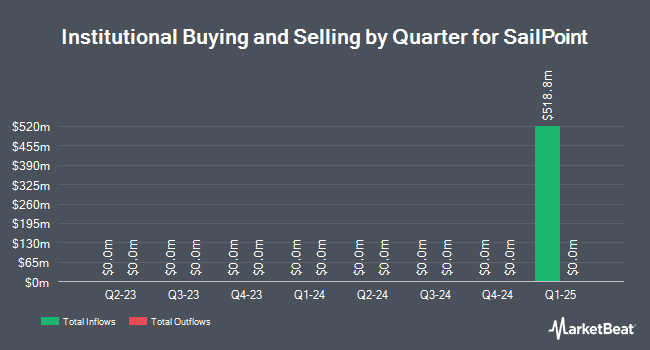

TD Asset Management Inc acquired a new stake in SailPoint, Inc. (NASDAQ:SAIL - Free Report) during the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor acquired 194,840 shares of the company's stock, valued at approximately $3,653,000.

Several other institutional investors and hedge funds have also bought and sold shares of SAIL. Assetmark Inc. purchased a new position in shares of SailPoint during the 1st quarter valued at $32,000. Universal Beteiligungs und Servicegesellschaft mbH bought a new position in shares of SailPoint in the first quarter worth approximately $1,683,000. GW&K Investment Management LLC purchased a new position in SailPoint in the first quarter worth $2,173,000. Allianz Asset Management GmbH bought a new position in SailPoint in the first quarter valued at $3,496,000. Finally, Phoenix Financial Ltd. purchased a new stake in SailPoint during the first quarter valued at about $4,321,000.

SailPoint Stock Performance

Shares of SAIL traded up $0.55 during mid-day trading on Wednesday, hitting $20.05. 682,139 shares of the company's stock traded hands, compared to its average volume of 2,054,597. The business has a 50-day simple moving average of $21.06. SailPoint, Inc. has a 1 year low of $15.05 and a 1 year high of $26.35.

SailPoint (NASDAQ:SAIL - Get Free Report) last issued its quarterly earnings data on Wednesday, June 11th. The company reported $0.01 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.01) by $0.02. The company had revenue of $230.47 million for the quarter, compared to analysts' expectations of $225.18 million. SailPoint's quarterly revenue was up 22.8% on a year-over-year basis.

Analysts Set New Price Targets

Several equities analysts have recently commented on SAIL shares. The Goldman Sachs Group reiterated a "neutral" rating on shares of SailPoint in a research report on Wednesday, June 11th. Wells Fargo & Company lifted their price target on shares of SailPoint from $16.00 to $20.00 and gave the stock an "equal weight" rating in a research note on Thursday, June 12th. Barclays boosted their price objective on shares of SailPoint from $23.00 to $25.00 and gave the stock an "overweight" rating in a report on Thursday, June 12th. Royal Bank Of Canada reaffirmed an "outperform" rating and set a $29.00 target price (up previously from $27.00) on shares of SailPoint in a report on Thursday, June 12th. Finally, Morgan Stanley lowered their price target on shares of SailPoint from $26.00 to $25.00 and set an "equal weight" rating for the company in a research note on Wednesday, April 16th. Two equities research analysts have rated the stock with a sell rating, five have issued a hold rating and eleven have issued a buy rating to the company. According to data from MarketBeat.com, SailPoint currently has an average rating of "Moderate Buy" and a consensus price target of $25.47.

Check Out Our Latest Stock Analysis on SAIL

SailPoint Profile

(

Free Report)

SailPoint, Inc delivers solutions to enable comprehensive identity security for the enterprise. Its solutions enable organizations to establish, control, and automate policies that help them define and maintain a robust security posture and achieve regulatory compliance. The company was founded by Mark David McClain in 2005 and is headquartered in Austin, TX.

Featured Stories

Before you consider SailPoint, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SailPoint wasn't on the list.

While SailPoint currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.