TD Asset Management Inc reduced its holdings in Novanta Inc. (NASDAQ:NOVT - Free Report) by 36.3% in the second quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 14,836 shares of the technology company's stock after selling 8,464 shares during the period. TD Asset Management Inc's holdings in Novanta were worth $1,913,000 as of its most recent filing with the Securities & Exchange Commission.

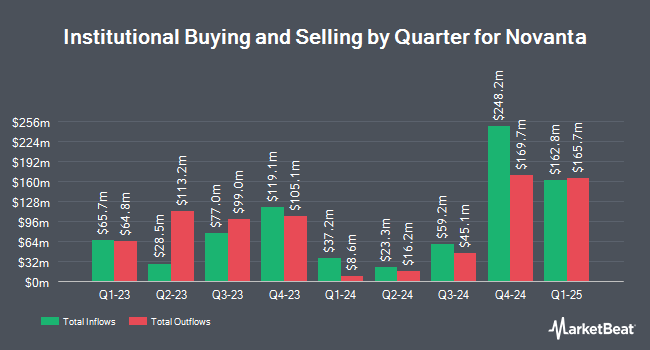

Other institutional investors and hedge funds have also made changes to their positions in the company. SVB Wealth LLC purchased a new position in shares of Novanta in the 1st quarter worth $48,000. GAMMA Investing LLC grew its stake in shares of Novanta by 146.0% in the 1st quarter. GAMMA Investing LLC now owns 401 shares of the technology company's stock worth $51,000 after buying an additional 238 shares in the last quarter. CWM LLC grew its stake in shares of Novanta by 329.8% in the 1st quarter. CWM LLC now owns 404 shares of the technology company's stock worth $52,000 after buying an additional 310 shares in the last quarter. Signaturefd LLC grew its stake in shares of Novanta by 80.0% in the 1st quarter. Signaturefd LLC now owns 414 shares of the technology company's stock worth $53,000 after buying an additional 184 shares in the last quarter. Finally, Summit Securities Group LLC purchased a new position in shares of Novanta in the 1st quarter worth $62,000. 98.35% of the stock is owned by hedge funds and other institutional investors.

Novanta Stock Up 4.2%

Shares of NOVT opened at $113.00 on Wednesday. The firm has a market capitalization of $4.07 billion, a P/E ratio of 66.47 and a beta of 1.49. Novanta Inc. has a 12-month low of $98.76 and a 12-month high of $184.11. The company has a current ratio of 2.54, a quick ratio of 1.62 and a debt-to-equity ratio of 0.57. The firm has a fifty day moving average price of $111.34 and a 200-day moving average price of $118.65.

Novanta (NASDAQ:NOVT - Get Free Report) last issued its earnings results on Tuesday, August 5th. The technology company reported $0.76 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.74 by $0.02. The firm had revenue of $241.05 million during the quarter, compared to analyst estimates of $237.97 million. Novanta had a net margin of 6.41% and a return on equity of 14.70%. The business's revenue was up 2.2% on a year-over-year basis. During the same period in the previous year, the firm earned $0.73 earnings per share. Novanta has set its FY 2025 guidance at 3.220-3.360 EPS. Q3 2025 guidance at 0.780-0.850 EPS. Equities research analysts expect that Novanta Inc. will post 3.03 earnings per share for the current year.

Novanta announced that its Board of Directors has initiated a share buyback plan on Thursday, September 18th that authorizes the company to buyback $200.00 million in shares. This buyback authorization authorizes the technology company to purchase up to 4.9% of its shares through open market purchases. Shares buyback plans are typically a sign that the company's management believes its shares are undervalued.

Wall Street Analyst Weigh In

A number of equities analysts have commented on NOVT shares. Robert W. Baird dropped their price objective on shares of Novanta from $139.00 to $133.00 and set a "neutral" rating for the company in a research note on Monday, August 11th. Zacks Research raised shares of Novanta from a "strong sell" rating to a "hold" rating in a research note on Monday, October 6th. Weiss Ratings reaffirmed a "hold (c-)" rating on shares of Novanta in a research note on Wednesday, October 8th. Finally, Wall Street Zen lowered shares of Novanta from a "buy" rating to a "hold" rating in a research note on Monday, August 11th. Three investment analysts have rated the stock with a Hold rating, Based on data from MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $133.00.

Read Our Latest Analysis on NOVT

Novanta Company Profile

(

Free Report)

Novanta, Inc engages in the provision of core technology solutions to healthcare and advanced industrial original equipment manufacturers. It operates through the following segments: Photonics, Vision, and Precision Motion. The Photonics segment designs, manufactures, and markets photonics-based solutions, including laser scanning and laser beam delivery, CO2 laser, continuous wave and ultrafast laser, and optical light engine products.

Featured Stories

Want to see what other hedge funds are holding NOVT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Novanta Inc. (NASDAQ:NOVT - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Novanta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novanta wasn't on the list.

While Novanta currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.