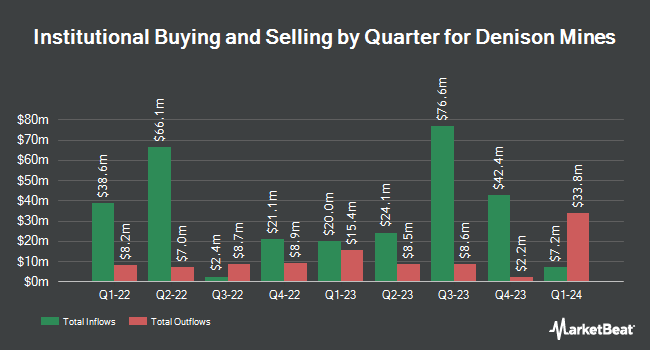

TD Asset Management Inc increased its holdings in shares of Denison Mine Corp (NYSEAMERICAN:DNN - Free Report) TSE: DML by 4.1% in the second quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 8,987,804 shares of the basic materials company's stock after buying an additional 352,195 shares during the period. TD Asset Management Inc owned 1.00% of Denison Mine worth $16,401,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also recently bought and sold shares of the business. Sowell Financial Services LLC bought a new stake in shares of Denison Mine during the 1st quarter valued at $26,000. Providence Capital Advisors LLC acquired a new stake in shares of Denison Mine during the first quarter worth $30,000. HFG Wealth Management LLC bought a new stake in Denison Mine in the second quarter valued at about $45,000. Compound Planning Inc. acquired a new position in Denison Mine in the first quarter valued at about $53,000. Finally, Crown Wealth Group LLC bought a new position in Denison Mine during the second quarter worth about $78,000. 36.74% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several research firms have recently issued reports on DNN. TD Securities restated a "buy" rating on shares of Denison Mine in a research report on Monday, August 11th. National Bankshares reaffirmed an "outperform" rating on shares of Denison Mine in a research note on Monday, August 18th. Scotiabank reissued an "outperform" rating on shares of Denison Mine in a research report on Thursday, August 7th. Desjardins upgraded shares of Denison Mine to a "moderate buy" rating in a research report on Monday, August 18th. Finally, Raymond James Financial reaffirmed an "outperform" rating on shares of Denison Mine in a research note on Friday, October 10th. Five investment analysts have rated the stock with a Buy rating, According to data from MarketBeat, the company presently has a consensus rating of "Buy" and a consensus target price of $2.75.

Get Our Latest Stock Report on Denison Mine

Denison Mine Stock Performance

Shares of DNN opened at $2.92 on Friday. The firm has a market cap of $2.62 billion, a P/E ratio of -48.67 and a beta of 1.32. Denison Mine Corp has a twelve month low of $1.08 and a twelve month high of $3.42. The firm's 50 day moving average price is $2.51 and its two-hundred day moving average price is $1.96.

Denison Mine Company Profile

(

Free Report)

Denison Mines Corp. engages in the acquisition, exploration, and development of uranium bearing properties in Canada. Its flagship project is the Wheeler River uranium project covering an area of approximately 300,000 hectares located in the Athabasca Basin region in northern Saskatchewan. The company was formerly known as International Uranium Corporation and changed its name to Denison Mines Corp.

See Also

Want to see what other hedge funds are holding DNN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Denison Mine Corp (NYSEAMERICAN:DNN - Free Report) TSE: DML.

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Denison Mine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Denison Mine wasn't on the list.

While Denison Mine currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.