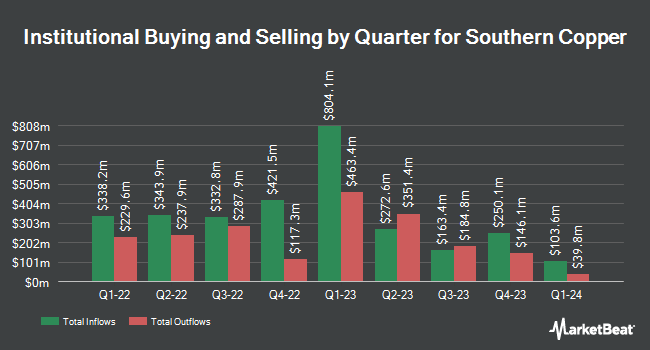

TD Asset Management Inc purchased a new position in shares of Southern Copper Corporation (NYSE:SCCO - Free Report) during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor purchased 7,690 shares of the basic materials company's stock, valued at approximately $778,000.

Other institutional investors and hedge funds have also made changes to their positions in the company. Teacher Retirement System of Texas acquired a new position in shares of Southern Copper during the 1st quarter worth $2,637,000. Golden State Wealth Management LLC acquired a new stake in Southern Copper in the 1st quarter valued at about $29,000. Oppenheimer & Co. Inc. acquired a new stake in Southern Copper in the 1st quarter valued at about $337,000. GAMMA Investing LLC grew its stake in Southern Copper by 35.2% in the 1st quarter. GAMMA Investing LLC now owns 906 shares of the basic materials company's stock valued at $85,000 after acquiring an additional 236 shares during the last quarter. Finally, Novem Group grew its stake in Southern Copper by 34.4% in the 1st quarter. Novem Group now owns 10,758 shares of the basic materials company's stock valued at $1,005,000 after acquiring an additional 2,754 shares during the last quarter. 7.94% of the stock is owned by institutional investors and hedge funds.

Southern Copper Stock Performance

Shares of NYSE SCCO opened at $126.64 on Thursday. The company has a current ratio of 5.27, a quick ratio of 4.51 and a debt-to-equity ratio of 0.67. The business has a fifty day simple moving average of $111.99 and a 200 day simple moving average of $100.13. Southern Copper Corporation has a one year low of $74.84 and a one year high of $136.49. The firm has a market capitalization of $101.83 billion, a price-to-earnings ratio of 27.71, a PEG ratio of 1.23 and a beta of 1.02.

Wall Street Analysts Forecast Growth

A number of research analysts have issued reports on SCCO shares. UBS Group restated a "buy" rating on shares of Southern Copper in a report on Friday, September 19th. Jefferies Financial Group set a $155.00 price target on shares of Southern Copper and gave the stock a "buy" rating in a research report on Monday, October 6th. Morgan Stanley set a $132.00 price objective on shares of Southern Copper and gave the stock an "equal weight" rating in a report on Wednesday, October 8th. Weiss Ratings reiterated a "buy (b-)" rating on shares of Southern Copper in a research note on Wednesday, October 8th. Finally, Citigroup restated a "sell" rating and set a $108.00 price objective (up from $89.10) on shares of Southern Copper in a research note on Wednesday, October 8th. Two equities research analysts have rated the stock with a Buy rating, seven have issued a Hold rating and three have given a Sell rating to the company. Based on data from MarketBeat.com, the company has a consensus rating of "Reduce" and an average target price of $110.78.

Get Our Latest Analysis on SCCO

Insider Transactions at Southern Copper

In other Southern Copper news, Director Bonilla Luis Miguel Palomino sold 414 shares of the stock in a transaction on Friday, August 8th. The stock was sold at an average price of $100.00, for a total transaction of $41,400.00. Following the completion of the transaction, the director directly owned 2,327 shares in the company, valued at $232,700. This represents a 15.10% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Insiders sold 1,228 shares of company stock worth $123,102 in the last three months. Corporate insiders own 0.07% of the company's stock.

Southern Copper Profile

(

Free Report)

Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile. The company is involved in the mining, milling, and flotation of copper ore to produce copper and molybdenum concentrates; smelting of copper concentrates to produce blister and anode copper; refining of anode copper to produce copper cathodes; production of molybdenum concentrate and sulfuric acid; production of refined silver, gold, and other materials; and mining and processing of zinc, copper, molybdenum, silver, gold, and lead.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Southern Copper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southern Copper wasn't on the list.

While Southern Copper currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.