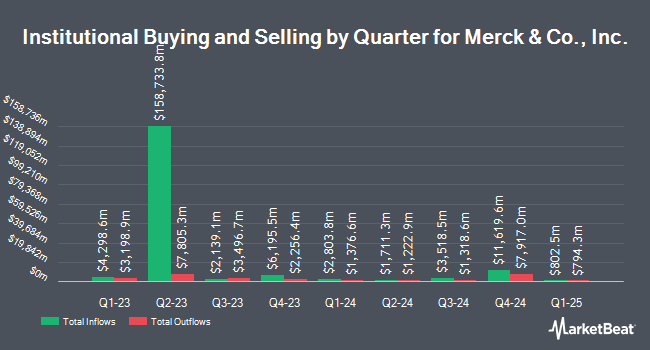

Tema Etfs LLC grew its holdings in Merck & Co., Inc. (NYSE:MRK - Free Report) by 245.5% in the first quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 39,190 shares of the company's stock after buying an additional 27,848 shares during the period. Merck & Co., Inc. makes up 1.1% of Tema Etfs LLC's portfolio, making the stock its 24th largest holding. Tema Etfs LLC's holdings in Merck & Co., Inc. were worth $3,518,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also made changes to their positions in the business. Trexquant Investment LP grew its stake in shares of Merck & Co., Inc. by 1,314.5% in the 1st quarter. Trexquant Investment LP now owns 415,961 shares of the company's stock worth $37,337,000 after buying an additional 386,555 shares in the last quarter. Gerber Kawasaki Wealth & Investment Management grew its stake in shares of Merck & Co., Inc. by 7.1% in the 1st quarter. Gerber Kawasaki Wealth & Investment Management now owns 7,060 shares of the company's stock worth $634,000 after buying an additional 467 shares in the last quarter. Huber Capital Management LLC grew its stake in shares of Merck & Co., Inc. by 123.2% in the 1st quarter. Huber Capital Management LLC now owns 45,293 shares of the company's stock worth $4,066,000 after buying an additional 25,000 shares in the last quarter. Landscape Capital Management L.L.C. purchased a new position in shares of Merck & Co., Inc. in the 1st quarter worth $1,565,000. Finally, OMERS ADMINISTRATION Corp grew its stake in shares of Merck & Co., Inc. by 11.7% in the 1st quarter. OMERS ADMINISTRATION Corp now owns 257,081 shares of the company's stock worth $23,076,000 after buying an additional 26,900 shares in the last quarter. 76.07% of the stock is owned by hedge funds and other institutional investors.

Merck & Co., Inc. Trading Up 1.1%

MRK traded up $0.92 on Monday, reaching $84.13. 10,870,371 shares of the company traded hands, compared to its average volume of 10,934,819. Merck & Co., Inc. has a one year low of $73.31 and a one year high of $120.30. The firm has a fifty day simple moving average of $82.14 and a two-hundred day simple moving average of $82.97. The company has a market cap of $210.14 billion, a P/E ratio of 12.96, a price-to-earnings-growth ratio of 0.89 and a beta of 0.37. The company has a quick ratio of 1.17, a current ratio of 1.42 and a debt-to-equity ratio of 0.69.

Merck & Co., Inc. (NYSE:MRK - Get Free Report) last announced its quarterly earnings data on Tuesday, July 29th. The company reported $2.13 earnings per share for the quarter, beating analysts' consensus estimates of $2.03 by $0.10. Merck & Co., Inc. had a net margin of 25.79% and a return on equity of 41.05%. The company had revenue of $15.81 billion during the quarter, compared to analyst estimates of $15.92 billion. Merck & Co., Inc. has set its FY 2025 guidance at 8.870-8.970 EPS. As a group, equities research analysts expect that Merck & Co., Inc. will post 9.01 earnings per share for the current year.

Merck & Co., Inc. Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, October 7th. Investors of record on Monday, September 15th will be issued a dividend of $0.81 per share. The ex-dividend date is Monday, September 15th. This represents a $3.24 dividend on an annualized basis and a yield of 3.9%. Merck & Co., Inc.'s dividend payout ratio (DPR) is presently 49.92%.

Analyst Upgrades and Downgrades

A number of equities analysts have commented on MRK shares. Citigroup reissued a "neutral" rating and issued a $84.00 price objective (down from $115.00) on shares of Merck & Co., Inc. in a research note on Wednesday, May 14th. Cantor Fitzgerald cut shares of Merck & Co., Inc. from an "overweight" rating to a "cautious" rating in a research note on Tuesday, May 20th. Wells Fargo & Company dropped their price objective on shares of Merck & Co., Inc. from $97.00 to $90.00 and set an "equal weight" rating for the company in a research note on Wednesday, July 30th. Finally, Morgan Stanley dropped their price target on shares of Merck & Co., Inc. from $99.00 to $98.00 and set an "equal weight" rating for the company in a research note on Thursday, July 10th. One investment analyst has rated the stock with a Strong Buy rating, six have assigned a Buy rating, twelve have given a Hold rating and one has assigned a Sell rating to the stock. According to MarketBeat.com, the stock has an average rating of "Hold" and an average price target of $107.44.

View Our Latest Report on Merck & Co., Inc.

Merck & Co., Inc. Company Profile

(

Free Report)

Merck & Co, Inc is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products.

See Also

Before you consider Merck & Co., Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merck & Co., Inc. wasn't on the list.

While Merck & Co., Inc. currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.