Tema Etfs LLC cut its stake in Schrodinger, Inc. (NASDAQ:SDGR - Free Report) by 52.7% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 16,457 shares of the company's stock after selling 18,331 shares during the period. Tema Etfs LLC's holdings in Schrodinger were worth $325,000 at the end of the most recent reporting period.

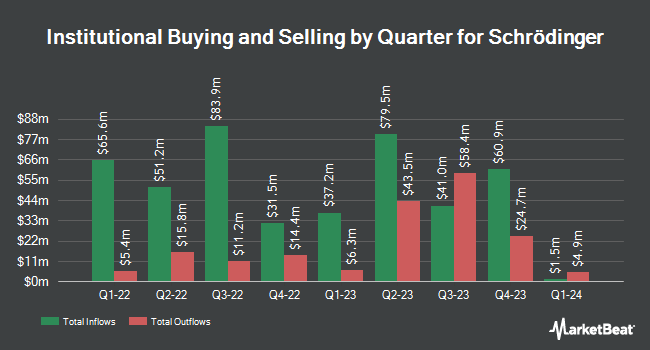

Several other hedge funds have also recently bought and sold shares of the stock. Raymond James Financial Inc. acquired a new stake in shares of Schrodinger during the fourth quarter worth approximately $325,000. MetLife Investment Management LLC increased its holdings in shares of Schrodinger by 5.6% in the fourth quarter. MetLife Investment Management LLC now owns 34,554 shares of the company's stock valued at $667,000 after purchasing an additional 1,825 shares in the last quarter. Price T Rowe Associates Inc. MD increased its holdings in shares of Schrodinger by 8.7% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 42,009 shares of the company's stock valued at $811,000 after purchasing an additional 3,376 shares in the last quarter. Susquehanna Fundamental Investments LLC acquired a new stake in shares of Schrodinger in the fourth quarter valued at approximately $965,000. Finally, Northern Trust Corp increased its stake in shares of Schrodinger by 11.3% in the 4th quarter. Northern Trust Corp now owns 602,618 shares of the company's stock valued at $11,625,000 after buying an additional 60,987 shares during the period. 79.05% of the stock is currently owned by institutional investors and hedge funds.

Schrodinger Price Performance

Shares of SDGR traded down $0.02 during trading hours on Wednesday, hitting $19.09. The stock had a trading volume of 141,317 shares, compared to its average volume of 1,149,106. The firm has a 50 day simple moving average of $20.49 and a 200-day simple moving average of $21.87. Schrodinger, Inc. has a 1-year low of $16.60 and a 1-year high of $28.47. The firm has a market capitalization of $1.41 billion, a P/E ratio of -7.70 and a beta of 1.79.

Schrodinger (NASDAQ:SDGR - Get Free Report) last released its quarterly earnings results on Wednesday, August 6th. The company reported ($0.59) earnings per share for the quarter, topping the consensus estimate of ($0.83) by $0.24. Schrodinger had a negative net margin of 76.22% and a negative return on equity of 45.70%. The business had revenue of $54.76 million for the quarter, compared to analysts' expectations of $52.03 million. During the same period in the previous year, the company earned ($0.66) earnings per share. The firm's revenue for the quarter was up 15.7% compared to the same quarter last year. Equities analysts predict that Schrodinger, Inc. will post -2.37 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of analysts have commented on the stock. Citigroup lowered shares of Schrodinger from a "buy" rating to a "neutral" rating and lowered their target price for the stock from $35.00 to $20.00 in a report on Friday, August 15th. Wall Street Zen downgraded Schrodinger from a "hold" rating to a "sell" rating in a research report on Saturday. Morgan Stanley cut their price objective on Schrodinger from $28.00 to $19.00 and set an "equal weight" rating for the company in a report on Monday, August 18th. Barclays started coverage on Schrodinger in a report on Thursday, August 14th. They set an "overweight" rating and a $25.00 price target for the company. Finally, KeyCorp dropped their price target on Schrodinger from $32.00 to $30.00 and set an "overweight" rating for the company in a report on Monday, July 14th. Four analysts have rated the stock with a Buy rating and two have assigned a Hold rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $27.83.

Read Our Latest Analysis on SDGR

Schrodinger Company Profile

(

Free Report)

Schrödinger, Inc, together with its subsidiaries, develops physics-based computational platform that enables discovery of novel molecules for drug development and materials applications. The company operates in two segments, Software and Drug Discovery. The Software segment is focused on licensing its software to transform molecular discovery for life sciences and materials science industries.

See Also

Before you consider Schrodinger, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Schrodinger wasn't on the list.

While Schrodinger currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.