Tempus Wealth Planning LLC acquired a new stake in ODDITY Tech Ltd. (NASDAQ:ODD - Free Report) in the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor acquired 8,533 shares of the company's stock, valued at approximately $369,000.

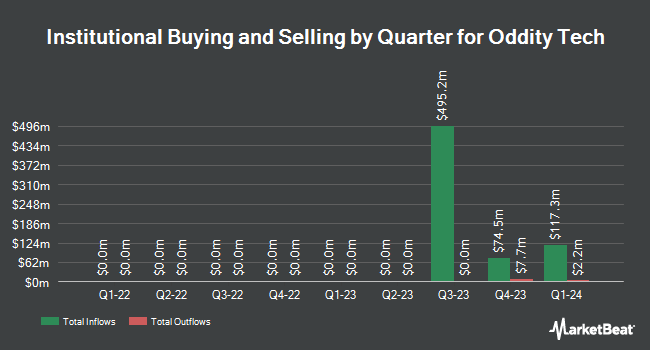

A number of other hedge funds have also recently modified their holdings of the company. Granahan Investment Management LLC increased its stake in shares of ODDITY Tech by 15.9% in the fourth quarter. Granahan Investment Management LLC now owns 1,538,198 shares of the company's stock worth $64,635,000 after purchasing an additional 211,485 shares in the last quarter. Bamco Inc. NY increased its stake in ODDITY Tech by 14.7% in the 4th quarter. Bamco Inc. NY now owns 1,429,198 shares of the company's stock worth $60,055,000 after buying an additional 183,152 shares during the period. Capital International Investors increased its stake in ODDITY Tech by 29.5% in the 4th quarter. Capital International Investors now owns 1,365,744 shares of the company's stock worth $57,389,000 after buying an additional 311,401 shares during the period. Massachusetts Financial Services Co. MA increased its position in ODDITY Tech by 0.5% during the 1st quarter. Massachusetts Financial Services Co. MA now owns 1,289,493 shares of the company's stock valued at $55,783,000 after purchasing an additional 6,419 shares during the period. Finally, Janus Henderson Group PLC increased its position in ODDITY Tech by 71.9% during the 4th quarter. Janus Henderson Group PLC now owns 846,281 shares of the company's stock valued at $35,539,000 after purchasing an additional 354,083 shares during the period. Hedge funds and other institutional investors own 35.88% of the company's stock.

Analyst Ratings Changes

Several analysts have commented on ODD shares. Barclays lifted their price objective on shares of ODDITY Tech from $60.00 to $73.00 and gave the company an "equal weight" rating in a research note on Tuesday, July 15th. JMP Securities reissued a "market outperform" rating and issued a $66.00 price objective on shares of ODDITY Tech in a research note on Tuesday, April 22nd. JPMorgan Chase & Co. raised their price objective on shares of ODDITY Tech from $63.00 to $85.00 and gave the stock an "overweight" rating in a report on Tuesday, June 3rd. KeyCorp boosted their target price on shares of ODDITY Tech from $65.00 to $90.00 and gave the stock an "overweight" rating in a research report on Monday, July 14th. Finally, Bank of America lifted their price target on ODDITY Tech from $68.00 to $80.00 and gave the company a "buy" rating in a report on Friday, June 27th. Three research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $70.13.

View Our Latest Analysis on ODDITY Tech

ODDITY Tech Price Performance

NASDAQ:ODD traded up $0.15 during trading hours on Tuesday, reaching $68.58. 163,146 shares of the company were exchanged, compared to its average volume of 822,471. ODDITY Tech Ltd. has a 1-year low of $32.71 and a 1-year high of $79.18. The company has a market capitalization of $3.83 billion, a P/E ratio of 39.39, a P/E/G ratio of 3.17 and a beta of 3.30. The business has a 50 day moving average of $72.18 and a 200 day moving average of $55.80.

ODDITY Tech (NASDAQ:ODD - Get Free Report) last released its earnings results on Tuesday, April 29th. The company reported $0.69 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.63 by $0.06. ODDITY Tech had a return on equity of 30.67% and a net margin of 15.12%. The company had revenue of $268.08 million during the quarter, compared to analyst estimates of $260.71 million. During the same period in the prior year, the company posted $0.61 earnings per share. ODDITY Tech's quarterly revenue was up 26.7% on a year-over-year basis. As a group, equities research analysts anticipate that ODDITY Tech Ltd. will post 1.62 earnings per share for the current fiscal year.

ODDITY Tech Company Profile

(

Free Report)

Oddity Tech Ltd. operates as a consumer tech company that builds digital-first brands for the beauty and wellness industries in the United States and internationally. It serves consumers worldwide through its AI-driven online platform, which uses data science, machine learning, and computer vision capabilities to identify consumer needs, and develop solutions in the form of beauty and wellness products.

See Also

Before you consider ODDITY Tech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ODDITY Tech wasn't on the list.

While ODDITY Tech currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.