Teton Advisors Inc. lowered its holdings in Graham Corporation (NYSE:GHM - Free Report) by 35.3% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 44,000 shares of the industrial products company's stock after selling 24,000 shares during the period. Teton Advisors Inc. owned approximately 0.40% of Graham worth $1,268,000 as of its most recent SEC filing.

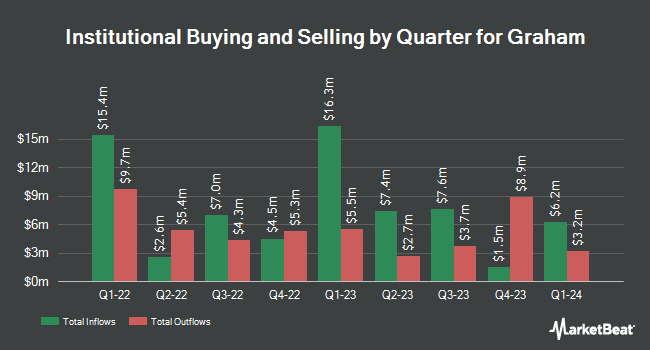

Several other institutional investors and hedge funds have also made changes to their positions in the company. Gamco Investors INC. ET AL boosted its stake in shares of Graham by 1.8% in the first quarter. Gamco Investors INC. ET AL now owns 281,285 shares of the industrial products company's stock valued at $8,107,000 after purchasing an additional 4,850 shares during the period. Wellington Management Group LLP boosted its stake in shares of Graham by 47.5% in the first quarter. Wellington Management Group LLP now owns 54,960 shares of the industrial products company's stock valued at $1,584,000 after purchasing an additional 17,693 shares during the period. Algert Global LLC boosted its stake in shares of Graham by 7.4% in the first quarter. Algert Global LLC now owns 8,498 shares of the industrial products company's stock valued at $245,000 after purchasing an additional 588 shares during the period. Philadelphia Trust Co. purchased a new position in shares of Graham in the first quarter valued at $1,723,000. Finally, American Century Companies Inc. boosted its stake in shares of Graham by 61.4% in the first quarter. American Century Companies Inc. now owns 222,187 shares of the industrial products company's stock valued at $6,403,000 after purchasing an additional 84,529 shares during the period. 69.46% of the stock is currently owned by hedge funds and other institutional investors.

Graham Stock Down 0.1%

NYSE:GHM traded down $0.03 during trading hours on Friday, reaching $49.15. 89,817 shares of the stock were exchanged, compared to its average volume of 119,918. The firm has a 50 day simple moving average of $51.25 and a 200-day simple moving average of $40.35. Graham Corporation has a 52 week low of $24.78 and a 52 week high of $58.00. The stock has a market capitalization of $539.61 million, a P/E ratio of 39.00 and a beta of 0.92.

Graham (NYSE:GHM - Get Free Report) last released its earnings results on Tuesday, August 5th. The industrial products company reported $0.45 earnings per share for the quarter, beating the consensus estimate of $0.25 by $0.20. Graham had a net margin of 6.43% and a return on equity of 12.83%. The firm had revenue of $55.49 million during the quarter, compared to analyst estimates of $55.53 million. Graham has set its FY 2026 guidance at EPS. As a group, analysts expect that Graham Corporation will post 1.07 earnings per share for the current year.

Analyst Upgrades and Downgrades

Several brokerages have recently weighed in on GHM. Northland Capmk upgraded shares of Graham to a "strong-buy" rating in a research note on Monday, June 23rd. Maxim Group upgraded shares of Graham to a "buy" rating and set a $65.00 target price for the company in a research note on Wednesday, July 2nd. Finally, Northland Securities assumed coverage on shares of Graham in a research note on Monday, June 23rd. They issued an "outperform" rating and a $55.00 target price for the company. One equities research analyst has rated the stock with a Strong Buy rating and two have assigned a Buy rating to the company's stock. According to MarketBeat.com, the company has a consensus rating of "Buy" and a consensus target price of $60.00.

Get Our Latest Analysis on Graham

Graham Profile

(

Free Report)

Graham Corporation, together with its subsidiaries, designs and manufactures fluid, power, heat transfer, and vacuum equipment for chemical and petrochemical processing, defense, space, petroleum refining, cryogenic, energy, and other industries. It offers power plant systems, including ejectors and surface condensers; torpedo ejection, propulsion, and power systems, such as turbines, alternators, regulators, pumps, and blowers; and thermal management systems comprising pumps, blowers, and drive electronics for defense sector.

Read More

Before you consider Graham, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Graham wasn't on the list.

While Graham currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.