Texas Yale Capital Corp. raised its stake in shares of Prologis, Inc. (NYSE:PLD - Free Report) by 7.0% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 49,289 shares of the real estate investment trust's stock after purchasing an additional 3,220 shares during the quarter. Texas Yale Capital Corp.'s holdings in Prologis were worth $5,510,000 as of its most recent filing with the Securities and Exchange Commission.

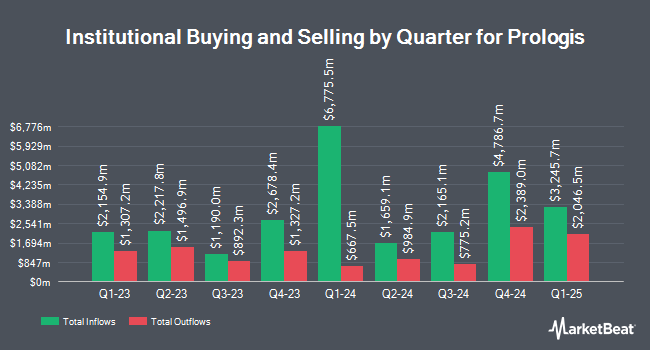

Other institutional investors also recently added to or reduced their stakes in the company. REAP Financial Group LLC boosted its stake in Prologis by 40.0% in the 4th quarter. REAP Financial Group LLC now owns 294 shares of the real estate investment trust's stock worth $31,000 after purchasing an additional 84 shares during the period. Phoenix Financial Ltd. boosted its position in Prologis by 1.0% in the fourth quarter. Phoenix Financial Ltd. now owns 9,032 shares of the real estate investment trust's stock valued at $955,000 after buying an additional 86 shares in the last quarter. CreativeOne Wealth LLC grew its stake in shares of Prologis by 1.7% in the fourth quarter. CreativeOne Wealth LLC now owns 6,073 shares of the real estate investment trust's stock worth $642,000 after purchasing an additional 100 shares during the last quarter. Focus Financial Network Inc. boosted its holdings in Prologis by 5.2% during the first quarter. Focus Financial Network Inc. now owns 2,093 shares of the real estate investment trust's stock worth $234,000 after purchasing an additional 104 shares during the last quarter. Finally, Loomis Sayles & Co. L P grew its stake in Prologis by 9.2% in the 4th quarter. Loomis Sayles & Co. L P now owns 1,346 shares of the real estate investment trust's stock valued at $142,000 after purchasing an additional 113 shares during the period. 93.50% of the stock is owned by institutional investors and hedge funds.

Prologis Trading Down 2.8%

PLD stock traded down $3.12 during mid-day trading on Monday, reaching $107.17. 2,850,581 shares of the stock traded hands, compared to its average volume of 4,602,891. The company has a debt-to-equity ratio of 0.60, a quick ratio of 0.41 and a current ratio of 0.19. Prologis, Inc. has a one year low of $85.35 and a one year high of $132.57. The stock has a market capitalization of $99.45 billion, a PE ratio of 29.04, a PEG ratio of 2.77 and a beta of 1.23. The business has a 50-day moving average price of $107.48 and a two-hundred day moving average price of $109.80.

Prologis (NYSE:PLD - Get Free Report) last announced its quarterly earnings data on Wednesday, July 16th. The real estate investment trust reported $1.46 EPS for the quarter, beating the consensus estimate of $1.41 by $0.05. The company had revenue of $2.03 billion for the quarter, compared to the consensus estimate of $2.03 billion. Prologis had a return on equity of 5.96% and a net margin of 40.29%. Prologis's quarterly revenue was up 8.8% on a year-over-year basis. During the same quarter in the prior year, the company posted $1.34 EPS. Equities research analysts expect that Prologis, Inc. will post 5.73 EPS for the current year.

Prologis Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Monday, June 30th. Investors of record on Tuesday, June 17th were issued a $1.01 dividend. The ex-dividend date was Tuesday, June 17th. This represents a $4.04 annualized dividend and a yield of 3.77%. Prologis's dividend payout ratio (DPR) is presently 109.49%.

Analyst Ratings Changes

A number of research analysts have weighed in on PLD shares. UBS Group boosted their target price on shares of Prologis from $106.00 to $120.00 and gave the company a "buy" rating in a research note on Tuesday, July 8th. Barclays lowered their price target on shares of Prologis from $132.00 to $119.00 and set an "overweight" rating on the stock in a research report on Wednesday, April 30th. Citigroup lowered their price target on shares of Prologis from $150.00 to $140.00 and set a "buy" rating on the stock in a research report on Wednesday, July 23rd. Wall Street Zen lowered shares of Prologis from a "hold" rating to a "sell" rating in a research report on Saturday, June 14th. Finally, Royal Bank Of Canada lowered their price target on shares of Prologis from $128.00 to $117.00 and set a "sector perform" rating on the stock in a research report on Tuesday, April 29th. Two investment analysts have rated the stock with a sell rating, seven have issued a hold rating, ten have given a buy rating and two have given a strong buy rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $120.74.

Get Our Latest Stock Analysis on Prologis

About Prologis

(

Free Report)

Prologis, Inc is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. At March 31, 2024, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.2 billion square feet (115 million square meters) in 19 countries.

See Also

Before you consider Prologis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prologis wasn't on the list.

While Prologis currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.