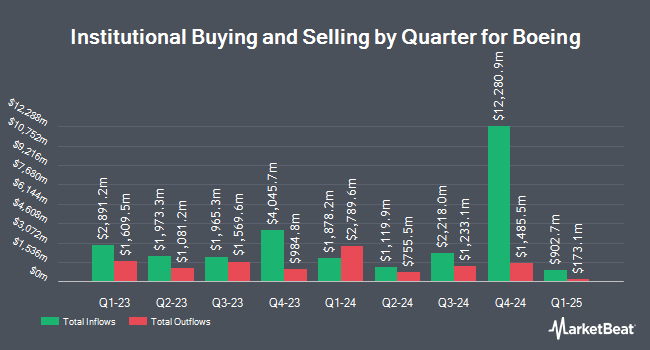

Texas Yale Capital Corp. reduced its holdings in shares of The Boeing Company (NYSE:BA - Free Report) by 11.7% during the 1st quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 26,304 shares of the aircraft producer's stock after selling 3,490 shares during the period. Texas Yale Capital Corp.'s holdings in Boeing were worth $4,486,000 at the end of the most recent reporting period.

Other institutional investors have also made changes to their positions in the company. American National Bank & Trust lifted its position in shares of Boeing by 474.1% during the first quarter. American National Bank & Trust now owns 155 shares of the aircraft producer's stock worth $26,000 after purchasing an additional 128 shares in the last quarter. REAP Financial Group LLC raised its position in shares of Boeing by 60.2% during the 4th quarter. REAP Financial Group LLC now owns 173 shares of the aircraft producer's stock valued at $31,000 after acquiring an additional 65 shares during the last quarter. Dogwood Wealth Management LLC raised its position in shares of Boeing by 167.2% during the 4th quarter. Dogwood Wealth Management LLC now owns 179 shares of the aircraft producer's stock valued at $32,000 after acquiring an additional 112 shares during the last quarter. Solstein Capital LLC bought a new stake in shares of Boeing during the 4th quarter valued at $33,000. Finally, Heck Capital Advisors LLC bought a new stake in shares of Boeing during the 4th quarter valued at $33,000. 64.82% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several equities research analysts have commented on the stock. Sanford C. Bernstein reaffirmed an "outperform" rating on shares of Boeing in a research note on Monday, July 14th. JPMorgan Chase & Co. increased their price objective on shares of Boeing from $200.00 to $230.00 and gave the stock an "overweight" rating in a research report on Wednesday, July 16th. Rothschild & Co Redburn raised shares of Boeing from a "neutral" rating to a "buy" rating and set a $275.00 target price for the company in a research note on Friday, June 27th. Redburn Atlantic raised shares of Boeing from a "hold" rating to a "strong-buy" rating and raised their target price for the company from $180.00 to $275.00 in a research report on Friday, June 27th. Finally, UBS Group raised their target price on shares of Boeing from $207.00 to $226.00 and gave the company a "buy" rating in a research report on Friday, May 9th. Four research analysts have rated the stock with a sell rating, three have assigned a hold rating, seventeen have issued a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus target price of $221.55.

Read Our Latest Stock Analysis on Boeing

Insider Activity at Boeing

In related news, EVP Jeffrey S. Shockey sold 3,205 shares of the business's stock in a transaction on Tuesday, May 13th. The shares were sold at an average price of $202.87, for a total value of $650,198.35. Following the transaction, the executive vice president owned 20,513 shares in the company, valued at $4,161,472.31. The trade was a 13.51% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, EVP David Christopher Raymond sold 3,899 shares of the business's stock in a transaction on Friday, May 2nd. The shares were sold at an average price of $187.01, for a total transaction of $729,151.99. Following the completion of the transaction, the executive vice president owned 42,513 shares in the company, valued at approximately $7,950,356.13. The trade was a 8.40% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 7,744 shares of company stock worth $1,511,370 over the last quarter. Company insiders own 0.09% of the company's stock.

Boeing Stock Performance

Boeing stock traded up $3.34 during mid-day trading on Monday, reaching $236.40. The company had a trading volume of 7,886,003 shares, compared to its average volume of 6,673,094. The business has a fifty day simple moving average of $213.01 and a 200 day simple moving average of $186.96. The Boeing Company has a fifty-two week low of $128.88 and a fifty-two week high of $236.63.

Boeing Company Profile

(

Free Report)

The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide. The company operates through Commercial Airplanes; Defense, Space & Security; and Global Services segments.

Further Reading

Before you consider Boeing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boeing wasn't on the list.

While Boeing currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.