Entropy Technologies LP lifted its holdings in shares of TG Therapeutics, Inc. (NASDAQ:TGTX - Free Report) by 251.5% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 30,859 shares of the biopharmaceutical company's stock after purchasing an additional 22,079 shares during the quarter. Entropy Technologies LP's holdings in TG Therapeutics were worth $1,217,000 at the end of the most recent quarter.

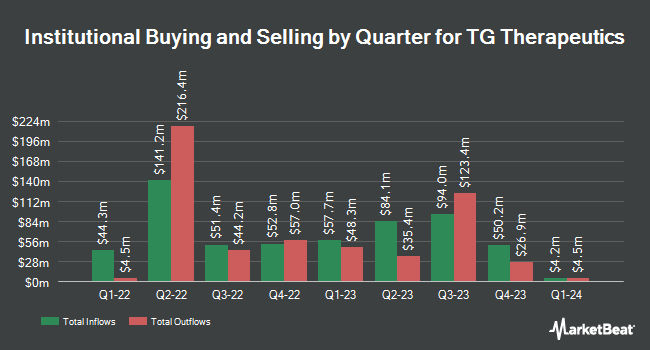

Other hedge funds and other institutional investors also recently modified their holdings of the company. Invesco Ltd. lifted its position in TG Therapeutics by 30.2% in the 1st quarter. Invesco Ltd. now owns 1,210,842 shares of the biopharmaceutical company's stock worth $47,744,000 after buying an additional 281,099 shares during the last quarter. Pandora Wealth Inc. bought a new stake in TG Therapeutics in the 1st quarter worth approximately $3,300,000. Citigroup Inc. lifted its position in TG Therapeutics by 0.6% in the 1st quarter. Citigroup Inc. now owns 349,104 shares of the biopharmaceutical company's stock worth $13,765,000 after buying an additional 1,927 shares during the last quarter. Deutsche Bank AG lifted its position in TG Therapeutics by 1.1% in the 1st quarter. Deutsche Bank AG now owns 148,705 shares of the biopharmaceutical company's stock worth $5,863,000 after buying an additional 1,685 shares during the last quarter. Finally, WealthShield Partners LLC bought a new stake in TG Therapeutics in the 1st quarter worth approximately $239,000. Hedge funds and other institutional investors own 58.58% of the company's stock.

TG Therapeutics Trading Up 1.1%

TGTX stock traded up $0.31 during midday trading on Friday, hitting $28.08. The company had a trading volume of 1,811,717 shares, compared to its average volume of 2,818,288. The company has a current ratio of 3.86, a quick ratio of 3.04 and a debt-to-equity ratio of 0.89. TG Therapeutics, Inc. has a 52 week low of $20.81 and a 52 week high of $46.48. The stock's 50 day moving average price is $35.07 and its 200 day moving average price is $35.83. The stock has a market cap of $4.46 billion, a price-to-earnings ratio of 75.89 and a beta of 1.95.

TG Therapeutics (NASDAQ:TGTX - Get Free Report) last announced its quarterly earnings data on Monday, August 4th. The biopharmaceutical company reported $0.17 earnings per share for the quarter, missing the consensus estimate of $0.32 by ($0.15). TG Therapeutics had a net margin of 13.31% and a return on equity of 26.05%. The company had revenue of $141.15 million during the quarter, compared to the consensus estimate of $147.76 million. During the same quarter in the previous year, the firm posted $0.04 EPS. The business's revenue for the quarter was up 92.1% compared to the same quarter last year. As a group, equities research analysts expect that TG Therapeutics, Inc. will post 0.08 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

Separately, The Goldman Sachs Group upgraded TG Therapeutics to a "hold" rating and set a $37.00 target price for the company in a research report on Thursday, July 10th. Two research analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to MarketBeat.com, TG Therapeutics presently has a consensus rating of "Moderate Buy" and a consensus price target of $46.25.

Read Our Latest Research Report on TG Therapeutics

Insiders Place Their Bets

In related news, Director Yann Echelard sold 10,000 shares of the company's stock in a transaction that occurred on Friday, June 13th. The stock was sold at an average price of $36.94, for a total transaction of $369,400.00. Following the completion of the transaction, the director owned 228,816 shares in the company, valued at $8,452,463.04. This represents a 4.19% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Insiders own 10.64% of the company's stock.

About TG Therapeutics

(

Free Report)

TG Therapeutics, Inc, a commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally. It provides BRIUMVI, an anti-CD20 monoclonal antibody for the treatment of adult patients with relapsing forms of multiple sclerosis (RMS), including clinically isolated syndrome, relapsing-remitting disease, and active secondary progressive disease in adults.

Featured Articles

Before you consider TG Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TG Therapeutics wasn't on the list.

While TG Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.