Banque Transatlantique SA boosted its holdings in shares of The Boeing Company (NYSE:BA - Free Report) by 1,134.4% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 3,086 shares of the aircraft producer's stock after purchasing an additional 2,836 shares during the quarter. Banque Transatlantique SA's holdings in Boeing were worth $486,000 at the end of the most recent reporting period.

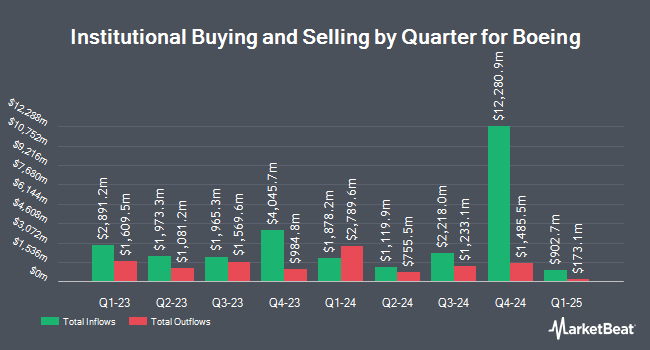

A number of other hedge funds also recently bought and sold shares of the business. Alliancebernstein L.P. boosted its position in Boeing by 29.5% during the first quarter. Alliancebernstein L.P. now owns 1,280,715 shares of the aircraft producer's stock worth $218,426,000 after purchasing an additional 291,639 shares in the last quarter. AQR Capital Management LLC raised its holdings in shares of Boeing by 522.5% during the first quarter. AQR Capital Management LLC now owns 69,170 shares of the aircraft producer's stock valued at $11,797,000 after acquiring an additional 58,059 shares during the last quarter. Advisors Asset Management Inc. raised its holdings in shares of Boeing by 0.7% during the first quarter. Advisors Asset Management Inc. now owns 14,275 shares of the aircraft producer's stock valued at $2,435,000 after acquiring an additional 101 shares during the last quarter. Aprio Wealth Management LLC acquired a new stake in shares of Boeing in the first quarter valued at approximately $219,000. Finally, Adage Capital Partners GP L.L.C. increased its holdings in shares of Boeing by 36.2% in the first quarter. Adage Capital Partners GP L.L.C. now owns 838,222 shares of the aircraft producer's stock valued at $142,959,000 after purchasing an additional 222,935 shares during the last quarter. Hedge funds and other institutional investors own 64.82% of the company's stock.

Insiders Place Their Bets

In related news, EVP David Christopher Raymond sold 3,771 shares of Boeing stock in a transaction on Friday, August 8th. The stock was sold at an average price of $229.94, for a total value of $867,103.74. Following the completion of the transaction, the executive vice president directly owned 35,873 shares in the company, valued at approximately $8,248,637.62. This trade represents a 9.51% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Mortimer J. Buckley bought 2,200 shares of the firm's stock in a transaction that occurred on Tuesday, August 19th. The stock was bought at an average price of $226.10 per share, with a total value of $497,420.00. Following the completion of the acquisition, the director owned 2,200 shares of the company's stock, valued at $497,420. This trade represents a ∞ increase in their position. The disclosure for this purchase can be found here. Company insiders own 0.09% of the company's stock.

Boeing Trading Up 0.6%

NYSE:BA traded up $1.28 during midday trading on Monday, reaching $230.89. The company had a trading volume of 5,950,006 shares, compared to its average volume of 8,237,565. The firm has a market capitalization of $174.59 billion, a price-to-earnings ratio of -13.99 and a beta of 1.48. The stock's fifty day simple moving average is $227.54 and its 200-day simple moving average is $197.88. The Boeing Company has a 12-month low of $128.88 and a 12-month high of $242.69.

Boeing (NYSE:BA - Get Free Report) last released its earnings results on Tuesday, July 29th. The aircraft producer reported ($1.24) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.92) by ($0.32). The company had revenue of $22.75 billion during the quarter, compared to analysts' expectations of $20.13 billion. The company's revenue for the quarter was up 34.9% compared to the same quarter last year. During the same period in the previous year, the business posted ($2.90) EPS. As a group, sell-side analysts expect that The Boeing Company will post -2.58 EPS for the current year.

Analysts Set New Price Targets

Several equities research analysts recently commented on the company. Vertical Research set a $270.00 price target on Boeing and gave the company a "buy" rating in a report on Monday. Barclays raised their target price on Boeing from $210.00 to $255.00 and gave the stock an "overweight" rating in a research note on Tuesday, July 29th. UBS Group set a $280.00 target price on Boeing and gave the stock a "buy" rating in a research note on Wednesday, July 30th. Jefferies Financial Group raised their target price on Boeing from $230.00 to $250.00 and gave the stock a "buy" rating in a research note on Wednesday, June 4th. Finally, Bank of America raised their target price on Boeing from $260.00 to $270.00 and gave the stock a "buy" rating in a research note on Friday, August 1st. Three research analysts have rated the stock with a Strong Buy rating, eighteen have given a Buy rating, three have assigned a Hold rating and two have given a Sell rating to the company. According to data from MarketBeat, Boeing has a consensus rating of "Moderate Buy" and a consensus target price of $230.77.

Get Our Latest Research Report on Boeing

Boeing Profile

(

Free Report)

The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide. The company operates through Commercial Airplanes; Defense, Space & Security; and Global Services segments.

Read More

Before you consider Boeing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boeing wasn't on the list.

While Boeing currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.