Banco Bilbao Vizcaya Argentaria S.A. raised its position in shares of The Charles Schwab Corporation (NYSE:SCHW - Free Report) by 15.2% in the first quarter, according to its most recent filing with the SEC. The firm owned 123,005 shares of the financial services provider's stock after purchasing an additional 16,194 shares during the quarter. Banco Bilbao Vizcaya Argentaria S.A.'s holdings in Charles Schwab were worth $9,622,000 at the end of the most recent quarter.

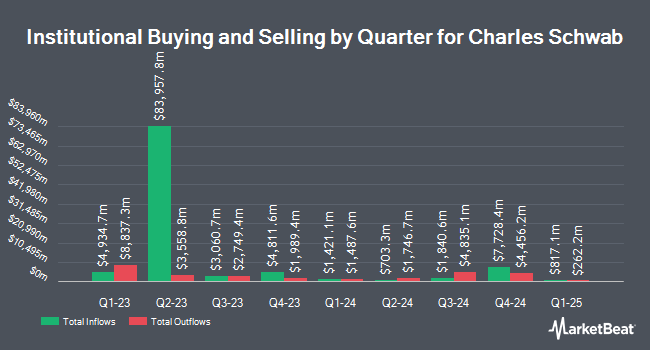

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. Atwood & Palmer Inc. acquired a new stake in Charles Schwab during the 1st quarter valued at approximately $25,000. Westside Investment Management Inc. increased its position in Charles Schwab by 75.0% during the 1st quarter. Westside Investment Management Inc. now owns 350 shares of the financial services provider's stock valued at $27,000 after purchasing an additional 150 shares during the period. Stone House Investment Management LLC acquired a new stake in Charles Schwab during the 1st quarter valued at approximately $31,000. WFA Asset Management Corp bought a new position in shares of Charles Schwab during the 1st quarter worth approximately $33,000. Finally, Cornerstone Planning Group LLC boosted its holdings in shares of Charles Schwab by 90.5% during the 1st quarter. Cornerstone Planning Group LLC now owns 463 shares of the financial services provider's stock worth $36,000 after buying an additional 220 shares in the last quarter. Institutional investors and hedge funds own 84.38% of the company's stock.

Charles Schwab Trading Down 0.2%

SCHW stock traded down $0.1690 during midday trading on Friday, hitting $95.6510. The company had a trading volume of 12,859,422 shares, compared to its average volume of 7,972,781. The company has a current ratio of 0.55, a quick ratio of 0.55 and a debt-to-equity ratio of 0.47. The Charles Schwab Corporation has a 52 week low of $61.16 and a 52 week high of $99.59. The stock has a market cap of $173.63 billion, a price-to-earnings ratio of 25.71, a PEG ratio of 0.94 and a beta of 0.96. The stock's 50 day moving average price is $93.85 and its 200 day moving average price is $85.34.

Charles Schwab (NYSE:SCHW - Get Free Report) last issued its quarterly earnings results on Friday, July 18th. The financial services provider reported $1.14 earnings per share for the quarter, topping the consensus estimate of $1.10 by $0.04. The company had revenue of $5.85 billion for the quarter, compared to analysts' expectations of $5.64 billion. Charles Schwab had a return on equity of 19.30% and a net margin of 33.68%.The firm's revenue for the quarter was up 24.8% on a year-over-year basis. During the same period in the prior year, the firm earned $0.73 earnings per share. As a group, equities research analysts expect that The Charles Schwab Corporation will post 4.22 earnings per share for the current fiscal year.

Charles Schwab announced that its board has initiated a share buyback program on Thursday, July 24th that permits the company to repurchase $20.00 billion in outstanding shares. This repurchase authorization permits the financial services provider to buy up to 11.6% of its shares through open market purchases. Shares repurchase programs are often an indication that the company's board of directors believes its stock is undervalued.

Charles Schwab Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, August 22nd. Investors of record on Friday, August 8th will be given a dividend of $0.27 per share. The ex-dividend date of this dividend is Friday, August 8th. This represents a $1.08 annualized dividend and a dividend yield of 1.1%. Charles Schwab's dividend payout ratio (DPR) is 29.03%.

Insider Activity at Charles Schwab

In other Charles Schwab news, Chairman Walter W. Bettinger sold 173,876 shares of the firm's stock in a transaction dated Tuesday, July 29th. The stock was sold at an average price of $98.84, for a total value of $17,185,903.84. Following the transaction, the chairman directly owned 590,734 shares of the company's stock, valued at approximately $58,388,148.56. This trade represents a 22.74% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Jonathan S. Beatty sold 2,850 shares of the firm's stock in a transaction dated Friday, May 30th. The stock was sold at an average price of $87.57, for a total value of $249,574.50. Following the completion of the transaction, the insider directly owned 15,219 shares in the company, valued at $1,332,727.83. The trade was a 15.77% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 250,340 shares of company stock valued at $24,250,303 over the last three months. 6.30% of the stock is owned by insiders.

Analysts Set New Price Targets

SCHW has been the topic of a number of recent research reports. The Goldman Sachs Group upgraded Charles Schwab from a "neutral" rating to a "buy" rating and set a $100.00 target price on the stock in a report on Friday, April 25th. Bank of America raised their target price on Charles Schwab from $83.00 to $84.00 and gave the company an "underperform" rating in a research report on Monday, July 21st. Citigroup raised their target price on Charles Schwab from $105.00 to $110.00 and gave the company a "buy" rating in a research report on Monday, July 21st. JMP Securities lifted their price objective on Charles Schwab from $106.00 to $110.00 and gave the stock a "market outperform" rating in a report on Monday, July 21st. Finally, Redburn Atlantic raised Charles Schwab from a "sell" rating to a "neutral" rating and lifted their price objective for the stock from $65.00 to $82.00 in a report on Monday, June 9th. Sixteen investment analysts have rated the stock with a Buy rating, three have given a Hold rating and two have assigned a Sell rating to the company's stock. Based on data from MarketBeat, Charles Schwab currently has a consensus rating of "Moderate Buy" and a consensus price target of $99.60.

Read Our Latest Research Report on Charles Schwab

Charles Schwab Profile

(

Free Report)

The Charles Schwab Corporation, together with its subsidiaries, operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally. The company operates in two segments, Investor Services and Advisor Services.

Featured Articles

Before you consider Charles Schwab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charles Schwab wasn't on the list.

While Charles Schwab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report