Mackenzie Financial Corp reduced its stake in shares of The Chemours Company (NYSE:CC - Free Report) by 98.2% in the first quarter, according to its most recent filing with the SEC. The fund owned 13,955 shares of the specialty chemicals company's stock after selling 775,922 shares during the period. Mackenzie Financial Corp's holdings in Chemours were worth $189,000 as of its most recent SEC filing.

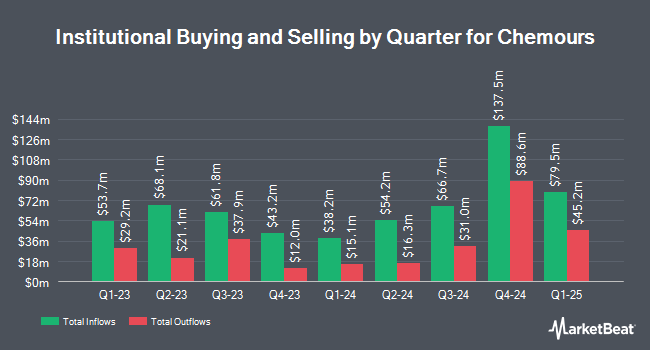

Other hedge funds also recently made changes to their positions in the company. UMB Bank n.a. boosted its stake in shares of Chemours by 73.9% during the 1st quarter. UMB Bank n.a. now owns 2,231 shares of the specialty chemicals company's stock valued at $30,000 after purchasing an additional 948 shares in the last quarter. Itau Unibanco Holding S.A. boosted its stake in shares of Chemours by 39.3% during the 4th quarter. Itau Unibanco Holding S.A. now owns 3,554 shares of the specialty chemicals company's stock valued at $60,000 after purchasing an additional 1,003 shares in the last quarter. Quadrant Capital Group LLC boosted its stake in shares of Chemours by 100.4% during the 4th quarter. Quadrant Capital Group LLC now owns 2,234 shares of the specialty chemicals company's stock valued at $38,000 after purchasing an additional 1,119 shares in the last quarter. Captrust Financial Advisors boosted its stake in shares of Chemours by 9.7% during the 4th quarter. Captrust Financial Advisors now owns 13,130 shares of the specialty chemicals company's stock valued at $222,000 after purchasing an additional 1,165 shares in the last quarter. Finally, Brown Advisory Inc. boosted its stake in shares of Chemours by 6.0% during the 1st quarter. Brown Advisory Inc. now owns 20,874 shares of the specialty chemicals company's stock valued at $282,000 after purchasing an additional 1,174 shares in the last quarter. 76.26% of the stock is owned by institutional investors.

Insiders Place Their Bets

In other news, insider Damian Gumpel acquired 7,822 shares of Chemours stock in a transaction dated Tuesday, June 3rd. The stock was purchased at an average cost of $9.95 per share, with a total value of $77,828.90. Following the completion of the purchase, the insider directly owned 131,701 shares in the company, valued at approximately $1,310,424.95. This trade represents a 6.31% increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Also, CFO Shane Hostetter bought 4,450 shares of the company's stock in a transaction that occurred on Monday, May 19th. The shares were bought at an average price of $11.28 per share, with a total value of $50,196.00. Following the transaction, the chief financial officer owned 59,694 shares of the company's stock, valued at $673,348.32. The trade was a 8.06% increase in their position. The disclosure for this purchase can be found here. Over the last three months, insiders bought 25,672 shares of company stock valued at $251,573. Corporate insiders own 0.34% of the company's stock.

Chemours Stock Performance

Shares of CC traded up $0.71 during mid-day trading on Tuesday, hitting $12.39. 2,768,111 shares of the company traded hands, compared to its average volume of 3,531,307. The company has a debt-to-equity ratio of 17.16, a quick ratio of 0.83 and a current ratio of 1.68. The stock has a 50-day moving average price of $12.27 and a two-hundred day moving average price of $13.15. The Chemours Company has a 1 year low of $9.13 and a 1 year high of $22.38. The stock has a market cap of $1.85 billion, a price-to-earnings ratio of -4.43 and a beta of 1.61.

Chemours (NYSE:CC - Get Free Report) last announced its earnings results on Tuesday, August 5th. The specialty chemicals company reported $0.58 EPS for the quarter, beating analysts' consensus estimates of $0.46 by $0.12. Chemours had a negative net margin of 7.19% and a positive return on equity of 35.14%. The business had revenue of $1.62 billion during the quarter, compared to analysts' expectations of $1.57 billion. During the same period in the prior year, the company earned $0.38 earnings per share. The firm's revenue was up 5.0% on a year-over-year basis. Equities analysts anticipate that The Chemours Company will post 2.03 earnings per share for the current year.

Chemours Cuts Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, September 12th. Stockholders of record on Friday, August 15th will be paid a $0.0875 dividend. The ex-dividend date of this dividend is Friday, August 15th. This represents a $0.35 dividend on an annualized basis and a dividend yield of 2.8%. Chemours's dividend payout ratio is -12.50%.

Analyst Upgrades and Downgrades

CC has been the topic of a number of research reports. Morgan Stanley cut their target price on shares of Chemours from $22.00 to $15.00 and set an "equal weight" rating on the stock in a research note on Monday, May 12th. UBS Group dropped their price objective on shares of Chemours from $18.00 to $17.00 and set a "buy" rating on the stock in a research note on Wednesday, May 7th. Wall Street Zen lowered shares of Chemours from a "hold" rating to a "sell" rating in a research note on Wednesday, May 21st. Royal Bank Of Canada boosted their price objective on shares of Chemours from $14.00 to $15.00 and gave the stock an "outperform" rating in a research note on Thursday, July 3rd. Finally, Barclays dropped their target price on shares of Chemours from $16.00 to $13.00 and set an "equal weight" rating on the stock in a research note on Wednesday, May 28th. One investment analyst has rated the stock with a sell rating, three have given a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat, Chemours currently has a consensus rating of "Hold" and a consensus price target of $17.38.

Get Our Latest Stock Analysis on CC

About Chemours

(

Free Report)

The Chemours Company provides performance chemicals in North America, the Asia Pacific, Europe, the Middle East, Africa, and Latin America. It operates through three segments: Titanium Technologies, Thermal & Specialized Solutions, and Advanced Performance Materials. The Titanium Technologies segment provides TiO2 pigment under the Ti-Pure brand for delivering whiteness, brightness, opacity, durability, efficiency, and protection in various of applications, such as architectural and industrial coatings, flexible and rigid plastic packaging, polyvinylchloride, laminate papers used for furniture and building materials, coated paper, and coated paperboard used for packaging.

Featured Articles

Before you consider Chemours, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chemours wasn't on the list.

While Chemours currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report