US Bancorp DE decreased its holdings in shares of The Ensign Group, Inc. (NASDAQ:ENSG - Free Report) by 25.7% in the 2nd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 4,380 shares of the company's stock after selling 1,513 shares during the period. US Bancorp DE's holdings in The Ensign Group were worth $676,000 as of its most recent filing with the Securities and Exchange Commission.

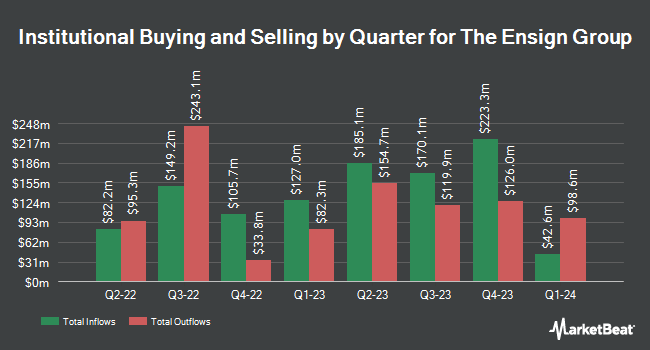

Several other large investors also recently made changes to their positions in the business. Northern Trust Corp boosted its position in shares of The Ensign Group by 0.4% during the 1st quarter. Northern Trust Corp now owns 941,274 shares of the company's stock valued at $121,801,000 after purchasing an additional 3,344 shares in the last quarter. Van Berkom & Associates Inc. boosted its position in shares of The Ensign Group by 14.1% during the 1st quarter. Van Berkom & Associates Inc. now owns 800,108 shares of the company's stock valued at $103,534,000 after purchasing an additional 99,147 shares in the last quarter. Wellington Management Group LLP boosted its position in shares of The Ensign Group by 17.6% during the 1st quarter. Wellington Management Group LLP now owns 683,650 shares of the company's stock valued at $88,464,000 after purchasing an additional 102,089 shares in the last quarter. American Century Companies Inc. boosted its position in shares of The Ensign Group by 1,235.5% during the 1st quarter. American Century Companies Inc. now owns 468,575 shares of the company's stock valued at $60,634,000 after purchasing an additional 433,489 shares in the last quarter. Finally, Crow s Nest Holdings LP bought a new position in shares of The Ensign Group during the 1st quarter valued at about $56,936,000. Institutional investors own 96.12% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts have recently weighed in on the stock. Weiss Ratings restated a "buy (b)" rating on shares of The Ensign Group in a research report on Wednesday, October 8th. UBS Group upped their price objective on shares of The Ensign Group from $195.00 to $205.00 and gave the company a "buy" rating in a research note on Tuesday, September 2nd. Stephens upped their price objective on shares of The Ensign Group from $165.00 to $170.00 and gave the company an "overweight" rating in a research note on Monday, July 28th. Finally, Truist Financial set a $190.00 price objective on shares of The Ensign Group in a research note on Tuesday, October 14th. Six equities research analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company. Based on data from MarketBeat, The Ensign Group currently has a consensus rating of "Moderate Buy" and an average price target of $176.83.

Read Our Latest Stock Analysis on ENSG

The Ensign Group Price Performance

NASDAQ ENSG opened at $182.04 on Monday. The company has a 50 day simple moving average of $171.01 and a 200-day simple moving average of $152.52. The company has a debt-to-equity ratio of 0.07, a current ratio of 1.41 and a quick ratio of 1.41. The firm has a market capitalization of $10.50 billion, a price-to-earnings ratio of 33.04, a price-to-earnings-growth ratio of 2.09 and a beta of 0.93. The Ensign Group, Inc. has a 52-week low of $118.73 and a 52-week high of $182.29.

The Ensign Group (NASDAQ:ENSG - Get Free Report) last posted its quarterly earnings results on Thursday, July 24th. The company reported $1.59 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.54 by $0.05. The business had revenue of $1.23 billion during the quarter, compared to analyst estimates of $1.22 billion. The Ensign Group had a net margin of 6.99% and a return on equity of 16.92%. The firm's revenue was up 18.5% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.32 earnings per share. The Ensign Group has set its FY 2025 guidance at 6.340-6.460 EPS. Equities research analysts predict that The Ensign Group, Inc. will post 5.59 earnings per share for the current fiscal year.

The Ensign Group Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, October 31st. Stockholders of record on Tuesday, September 30th will be given a $0.0625 dividend. This represents a $0.25 dividend on an annualized basis and a dividend yield of 0.1%. The ex-dividend date of this dividend is Tuesday, September 30th. The Ensign Group's dividend payout ratio is 4.54%.

Insider Activity

In other news, Director Barry M. Smith sold 700 shares of the stock in a transaction that occurred on Tuesday, September 2nd. The shares were sold at an average price of $172.06, for a total value of $120,442.00. Following the completion of the sale, the director directly owned 27,052 shares of the company's stock, valued at $4,654,567.12. This represents a 2.52% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. 3.90% of the stock is owned by company insiders.

About The Ensign Group

(

Free Report)

The Ensign Group, Inc provides skilled nursing, senior living, and rehabilitative services. It operates through two segments: Skilled Services and Standard Bearer. The company's Skilled Services segment engages in the operation of skilled nursing facilities and rehabilitation therapy services for patients with chronic conditions, prolonged illness, and the elderly; and offers nursing facilities including specialty care, such as on-site dialysis, ventilator care, cardiac, and pulmonary management, as well as standard services comprising room and board, special nutritional programs, social services, recreational activities, entertainment, and other services.

Further Reading

Want to see what other hedge funds are holding ENSG? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for The Ensign Group, Inc. (NASDAQ:ENSG - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider The Ensign Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Ensign Group wasn't on the list.

While The Ensign Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report