Invictus Private Wealth LLC decreased its holdings in shares of The Goldman Sachs Group, Inc. (NYSE:GS - Free Report) by 1.7% during the 2nd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 32,001 shares of the investment management company's stock after selling 556 shares during the quarter. The Goldman Sachs Group comprises about 1.6% of Invictus Private Wealth LLC's investment portfolio, making the stock its 17th biggest position. Invictus Private Wealth LLC's holdings in The Goldman Sachs Group were worth $22,649,000 as of its most recent SEC filing.

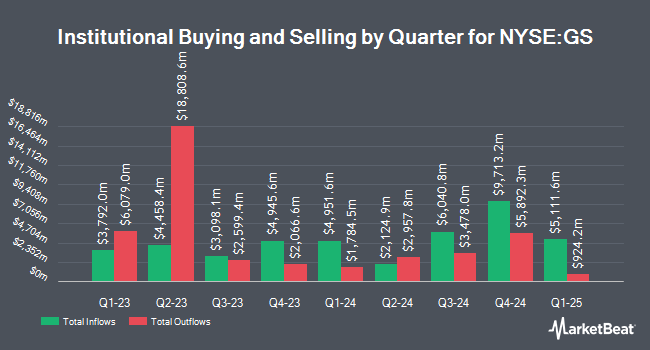

Several other hedge funds have also made changes to their positions in GS. Clal Insurance Enterprises Holdings Ltd acquired a new stake in shares of The Goldman Sachs Group during the first quarter worth $25,000. Dogwood Wealth Management LLC boosted its holdings in shares of The Goldman Sachs Group by 1,800.0% during the second quarter. Dogwood Wealth Management LLC now owns 38 shares of the investment management company's stock worth $26,000 after purchasing an additional 36 shares during the last quarter. American Capital Advisory LLC acquired a new position in The Goldman Sachs Group in the first quarter valued at $29,000. Cornerstone Planning Group LLC boosted its holdings in The Goldman Sachs Group by 46.9% in the first quarter. Cornerstone Planning Group LLC now owns 72 shares of the investment management company's stock valued at $38,000 after acquiring an additional 23 shares during the last quarter. Finally, Ridgewood Investments LLC boosted its holdings in The Goldman Sachs Group by 45.9% in the second quarter. Ridgewood Investments LLC now owns 54 shares of the investment management company's stock valued at $38,000 after acquiring an additional 17 shares during the last quarter. Institutional investors and hedge funds own 71.21% of the company's stock.

Insider Buying and Selling

In other The Goldman Sachs Group news, CEO David M. Solomon sold 6,608 shares of the business's stock in a transaction dated Wednesday, July 23rd. The stock was sold at an average price of $712.31, for a total transaction of $4,706,944.48. Following the transaction, the chief executive officer owned 126,176 shares in the company, valued at $89,876,426.56. The trade was a 4.98% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, COO John E. Waldron sold 9,244 shares of The Goldman Sachs Group stock in a transaction dated Wednesday, August 27th. The stock was sold at an average price of $750.11, for a total value of $6,934,016.84. Following the sale, the chief operating officer directly owned 115,268 shares in the company, valued at approximately $86,463,679.48. The trade was a 7.42% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 38,323 shares of company stock worth $28,111,828. Company insiders own 0.55% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts recently weighed in on GS shares. Wells Fargo & Company lifted their target price on The Goldman Sachs Group from $785.00 to $855.00 and gave the company an "overweight" rating in a report on Tuesday, September 16th. Wall Street Zen upgraded The Goldman Sachs Group from a "sell" rating to a "hold" rating in a report on Saturday, July 12th. UBS Group lifted their target price on The Goldman Sachs Group from $762.00 to $805.00 and gave the company a "neutral" rating in a report on Tuesday. HSBC lifted their target price on The Goldman Sachs Group from $652.00 to $677.00 in a report on Thursday, October 2nd. Finally, Deutsche Bank Aktiengesellschaft lifted their target price on The Goldman Sachs Group from $725.00 to $790.00 and gave the company a "hold" rating in a report on Tuesday, September 30th. Five analysts have rated the stock with a Buy rating, fourteen have given a Hold rating and one has given a Sell rating to the company. According to MarketBeat.com, The Goldman Sachs Group presently has an average rating of "Hold" and an average price target of $727.31.

Get Our Latest Research Report on GS

The Goldman Sachs Group Trading Down 1.9%

Shares of GS opened at $765.14 on Friday. The stock's 50-day moving average is $760.79 and its two-hundred day moving average is $662.32. The stock has a market cap of $231.62 billion, a PE ratio of 16.86, a P/E/G ratio of 1.47 and a beta of 1.42. The Goldman Sachs Group, Inc. has a 12 month low of $439.38 and a 12 month high of $825.25. The company has a debt-to-equity ratio of 2.57, a current ratio of 0.67 and a quick ratio of 0.67.

The Goldman Sachs Group (NYSE:GS - Get Free Report) last issued its quarterly earnings data on Wednesday, July 16th. The investment management company reported $10.91 EPS for the quarter, topping analysts' consensus estimates of $9.82 by $1.09. The company had revenue of $14.58 billion for the quarter, compared to analysts' expectations of $13.53 billion. The Goldman Sachs Group had a return on equity of 14.32% and a net margin of 12.37%.The firm's quarterly revenue was up 14.5% on a year-over-year basis. During the same quarter in the previous year, the firm posted $8.62 earnings per share. Equities analysts forecast that The Goldman Sachs Group, Inc. will post 47.12 earnings per share for the current fiscal year.

The Goldman Sachs Group Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, September 29th. Shareholders of record on Friday, August 29th were paid a dividend of $4.00 per share. This is a boost from The Goldman Sachs Group's previous quarterly dividend of $3.00. This represents a $16.00 dividend on an annualized basis and a dividend yield of 2.1%. The ex-dividend date was Friday, August 29th. The Goldman Sachs Group's payout ratio is presently 35.26%.

The Goldman Sachs Group Company Profile

(

Free Report)

The Goldman Sachs Group, Inc, a financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals worldwide. It operates through Global Banking & Markets, Asset & Wealth Management, and Platform Solutions segments. The Global Banking & Markets segment provides financial advisory services, including strategic advisory assignments related to mergers and acquisitions, divestitures, corporate defense activities, restructurings, and spin-offs; and relationship lending, and acquisition financing, as well as secured lending, through structured credit and asset-backed lending and involved in financing under securities to resale agreements.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider The Goldman Sachs Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Goldman Sachs Group wasn't on the list.

While The Goldman Sachs Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report