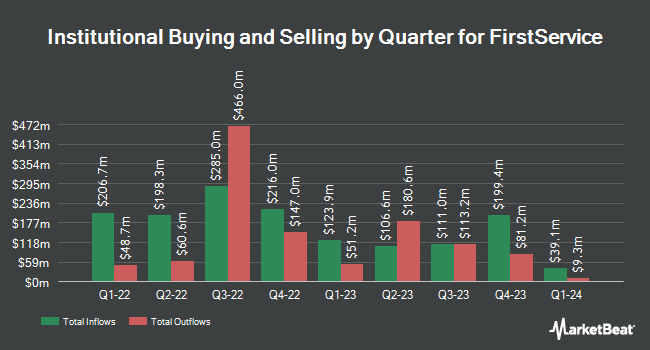

The Manufacturers Life Insurance Company lessened its holdings in FirstService Corporation (NASDAQ:FSV - Free Report) TSE: FSV by 39.7% during the first quarter, according to its most recent disclosure with the SEC. The institutional investor owned 814,635 shares of the financial services provider's stock after selling 535,577 shares during the period. The Manufacturers Life Insurance Company owned 1.79% of FirstService worth $135,819,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also bought and sold shares of the stock. Fiera Capital Corp increased its holdings in shares of FirstService by 3.9% in the first quarter. Fiera Capital Corp now owns 268,935 shares of the financial services provider's stock worth $44,639,000 after buying an additional 10,087 shares during the period. TD Asset Management Inc grew its stake in FirstService by 61.6% in the first quarter. TD Asset Management Inc now owns 335,542 shares of the financial services provider's stock worth $55,637,000 after purchasing an additional 127,846 shares during the period. Summit Creek Advisors LLC grew its holdings in FirstService by 8.4% in the first quarter. Summit Creek Advisors LLC now owns 115,245 shares of the financial services provider's stock worth $19,125,000 after purchasing an additional 8,961 shares during the period. Baskin Financial Services Inc. grew its stake in shares of FirstService by 0.6% in the 1st quarter. Baskin Financial Services Inc. now owns 251,850 shares of the financial services provider's stock worth $41,757,000 after buying an additional 1,588 shares during the last quarter. Finally, Spire Wealth Management increased its holdings in shares of FirstService by 52.1% during the first quarter. Spire Wealth Management now owns 543 shares of the financial services provider's stock valued at $90,000 after acquiring an additional 186 shares in the last quarter. 69.35% of the stock is owned by hedge funds and other institutional investors.

FirstService Price Performance

FirstService stock traded up $1.02 during mid-day trading on Wednesday, hitting $198.57. The stock had a trading volume of 55,869 shares, compared to its average volume of 135,568. The firm has a market capitalization of $9.05 billion, a P/E ratio of 63.64 and a beta of 0.96. The company has a current ratio of 1.76, a quick ratio of 1.76 and a debt-to-equity ratio of 0.99. The firm's 50 day moving average is $189.26 and its 200 day moving average is $178.26. FirstService Corporation has a one year low of $153.13 and a one year high of $202.55.

FirstService (NASDAQ:FSV - Get Free Report) TSE: FSV last released its quarterly earnings data on Thursday, July 24th. The financial services provider reported $1.71 earnings per share for the quarter, topping analysts' consensus estimates of $1.45 by $0.26. FirstService had a return on equity of 18.24% and a net margin of 2.61%.The firm had revenue of $1.42 billion during the quarter, compared to analyst estimates of $1.40 billion. During the same quarter in the prior year, the company posted $1.36 earnings per share. The business's quarterly revenue was up 9.1% compared to the same quarter last year. On average, sell-side analysts forecast that FirstService Corporation will post 5.27 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several research firms recently commented on FSV. Wall Street Zen downgraded FirstService from a "buy" rating to a "hold" rating in a report on Saturday. Scotiabank lifted their price objective on FirstService from $210.00 to $220.00 and gave the stock a "sector perform" rating in a report on Wednesday, July 30th. Finally, TD Securities boosted their price target on FirstService from $200.00 to $211.00 and gave the company a "hold" rating in a research note on Friday, July 25th. Two investment analysts have rated the stock with a Buy rating and two have issued a Hold rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $217.75.

Get Our Latest Stock Analysis on FirstService

About FirstService

(

Free Report)

FirstService Corporation, together with its subsidiaries, provides residential property management and other essential property services to residential and commercial customers in the United States and Canada. It operates through two segments: FirstService Residential and FirstService Brands. The FirstService Residential segment offers services for private residential communities, such as condominiums, co-operatives, homeowner associations, master-planned communities, active adult and lifestyle communities, and various other residential developments.

Featured Stories

Before you consider FirstService, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FirstService wasn't on the list.

While FirstService currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.