LFL Advisers LLC reduced its holdings in The Progressive Corporation (NYSE:PGR - Free Report) by 2.6% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 114,477 shares of the insurance provider's stock after selling 3,003 shares during the period. Progressive makes up 14.2% of LFL Advisers LLC's holdings, making the stock its 5th biggest position. LFL Advisers LLC's holdings in Progressive were worth $32,398,000 as of its most recent SEC filing.

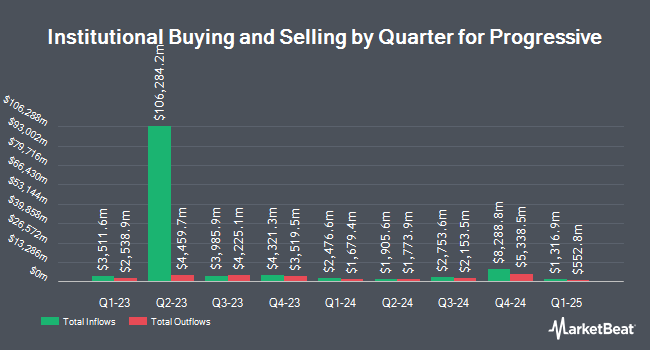

Several other hedge funds and other institutional investors have also recently modified their holdings of PGR. Integrated Advisors Network LLC lifted its stake in Progressive by 1.0% in the first quarter. Integrated Advisors Network LLC now owns 3,808 shares of the insurance provider's stock worth $1,078,000 after acquiring an additional 36 shares during the last quarter. Pines Wealth Management LLC lifted its position in shares of Progressive by 3.0% during the 1st quarter. Pines Wealth Management LLC now owns 1,287 shares of the insurance provider's stock worth $335,000 after buying an additional 37 shares during the last quarter. Contravisory Investment Management Inc. lifted its position in shares of Progressive by 2.0% during the 1st quarter. Contravisory Investment Management Inc. now owns 1,940 shares of the insurance provider's stock worth $549,000 after buying an additional 38 shares during the last quarter. Beacon Financial Group lifted its position in shares of Progressive by 1.1% during the 1st quarter. Beacon Financial Group now owns 3,659 shares of the insurance provider's stock worth $1,036,000 after buying an additional 39 shares during the last quarter. Finally, Pinnacle Wealth Management Advisory Group LLC lifted its position in shares of Progressive by 2.1% during the 1st quarter. Pinnacle Wealth Management Advisory Group LLC now owns 1,927 shares of the insurance provider's stock worth $545,000 after buying an additional 39 shares during the last quarter. 85.34% of the stock is owned by hedge funds and other institutional investors.

Insider Activity

In related news, CEO Susan Patricia Griffith sold 30,660 shares of Progressive stock in a transaction that occurred on Monday, July 28th. The stock was sold at an average price of $242.12, for a total transaction of $7,423,399.20. Following the completion of the transaction, the chief executive officer directly owned 506,945 shares in the company, valued at $122,741,523.40. The trade was a 5.70% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CFO John P. Sauerland sold 16,664 shares of the business's stock in a transaction on Monday, July 28th. The shares were sold at an average price of $249.24, for a total transaction of $4,153,335.36. Following the sale, the chief financial officer directly owned 228,024 shares of the company's stock, valued at $56,832,701.76. This represents a 6.81% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 112,313 shares of company stock worth $28,349,549. 0.33% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

Several analysts have recently weighed in on PGR shares. Keefe, Bruyette & Woods reduced their price objective on shares of Progressive from $290.00 to $268.00 and set a "market perform" rating for the company in a research report on Thursday, July 17th. UBS Group reduced their price objective on shares of Progressive from $280.00 to $268.00 and set a "neutral" rating for the company in a research report on Monday, July 21st. Bank of America reduced their price objective on shares of Progressive from $337.00 to $336.00 and set a "buy" rating for the company in a research report on Thursday, July 17th. Citigroup started coverage on shares of Progressive in a research report on Wednesday, August 13th. They set a "buy" rating and a $312.00 price objective for the company. Finally, Cantor Fitzgerald upgraded shares of Progressive to a "hold" rating in a research report on Wednesday, August 13th. Nine investment analysts have rated the stock with a Buy rating and nine have issued a Hold rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $284.53.

View Our Latest Stock Report on Progressive

Progressive Stock Performance

PGR traded up $1.6040 during trading on Wednesday, reaching $252.2440. The company's stock had a trading volume of 2,532,315 shares, compared to its average volume of 3,246,536. The Progressive Corporation has a 52-week low of $228.54 and a 52-week high of $292.99. The company's fifty day moving average price is $252.37 and its 200-day moving average price is $266.40. The company has a market capitalization of $147.87 billion, a price-to-earnings ratio of 14.21, a price-to-earnings-growth ratio of 1.46 and a beta of 0.33. The company has a debt-to-equity ratio of 0.21, a quick ratio of 0.31 and a current ratio of 0.31.

Progressive (NYSE:PGR - Get Free Report) last announced its quarterly earnings data on Wednesday, July 16th. The insurance provider reported $4.88 earnings per share for the quarter, beating analysts' consensus estimates of $4.43 by $0.45. Progressive had a return on equity of 35.37% and a net margin of 12.66%.The company had revenue of $20.08 billion for the quarter, compared to analyst estimates of $20.39 billion. During the same quarter in the previous year, the company earned $2.48 EPS. The firm's revenue for the quarter was up 12.1% compared to the same quarter last year. On average, equities analysts forecast that The Progressive Corporation will post 14.68 earnings per share for the current fiscal year.

Progressive Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, October 10th. Investors of record on Thursday, October 2nd will be given a dividend of $0.10 per share. This represents a $0.40 annualized dividend and a dividend yield of 0.2%. Progressive's dividend payout ratio is currently 2.25%.

About Progressive

(

Free Report)

The Progressive Corporation, an insurance holding company, provides personal and commercial auto, personal residential and commercial property, business related general liability, and other specialty property-casualty insurance products and related services in the United States. It operates in three segments: Personal Lines, Commercial Lines, and Property.

Featured Articles

Before you consider Progressive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progressive wasn't on the list.

While Progressive currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report