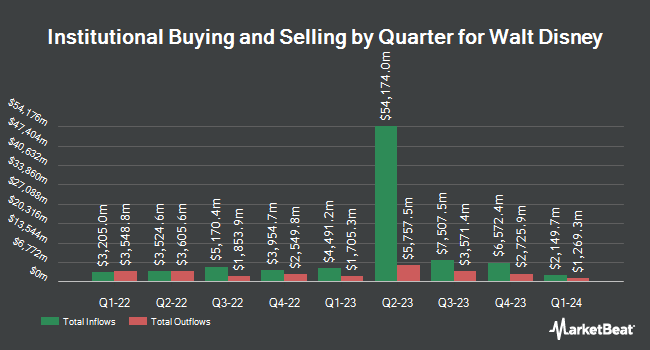

Legacy Trust decreased its position in shares of The Walt Disney Company (NYSE:DIS - Free Report) by 25.5% during the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 26,549 shares of the entertainment giant's stock after selling 9,093 shares during the quarter. Legacy Trust's holdings in Walt Disney were worth $3,292,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors have also made changes to their positions in the company. DiNuzzo Private Wealth Inc. grew its stake in shares of Walt Disney by 82.5% during the 2nd quarter. DiNuzzo Private Wealth Inc. now owns 208 shares of the entertainment giant's stock worth $26,000 after purchasing an additional 94 shares during the period. MJT & Associates Financial Advisory Group Inc. acquired a new stake in shares of Walt Disney during the 1st quarter worth approximately $26,000. Kessler Investment Group LLC grew its stake in shares of Walt Disney by 274.0% during the 1st quarter. Kessler Investment Group LLC now owns 273 shares of the entertainment giant's stock worth $27,000 after purchasing an additional 200 shares during the period. Wolff Wiese Magana LLC grew its stake in shares of Walt Disney by 41.5% during the 2nd quarter. Wolff Wiese Magana LLC now owns 460 shares of the entertainment giant's stock worth $57,000 after purchasing an additional 135 shares during the period. Finally, First PREMIER Bank grew its stake in shares of Walt Disney by 72.2% during the 1st quarter. First PREMIER Bank now owns 489 shares of the entertainment giant's stock worth $48,000 after purchasing an additional 205 shares during the period. Institutional investors and hedge funds own 65.71% of the company's stock.

Walt Disney Trading Up 0.3%

Shares of DIS stock opened at $112.49 on Friday. The stock's fifty day moving average is $116.12 and its two-hundred day moving average is $110.02. The company has a debt-to-equity ratio of 0.32, a quick ratio of 0.66 and a current ratio of 0.72. The firm has a market capitalization of $202.25 billion, a P/E ratio of 17.63, a PEG ratio of 1.48 and a beta of 1.54. The Walt Disney Company has a fifty-two week low of $80.10 and a fifty-two week high of $124.69.

Walt Disney (NYSE:DIS - Get Free Report) last announced its quarterly earnings data on Wednesday, August 6th. The entertainment giant reported $1.61 earnings per share for the quarter, beating analysts' consensus estimates of $1.45 by $0.16. The company had revenue of $23.65 billion for the quarter, compared to analyst estimates of $23.69 billion. Walt Disney had a return on equity of 9.67% and a net margin of 12.22%.The firm's revenue for the quarter was up 2.1% on a year-over-year basis. During the same quarter last year, the firm posted $1.39 EPS. Research analysts expect that The Walt Disney Company will post 5.47 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of equities research analysts recently issued reports on DIS shares. Jefferies Financial Group cut shares of Walt Disney from a "strong-buy" rating to a "hold" rating in a research note on Monday, August 11th. Loop Capital lifted their price target on shares of Walt Disney from $125.00 to $130.00 and gave the company a "buy" rating in a research note on Tuesday, June 10th. JPMorgan Chase & Co. lifted their price target on shares of Walt Disney from $130.00 to $138.00 and gave the company an "overweight" rating in a research note on Tuesday, July 29th. Susquehanna reissued a "neutral" rating on shares of Walt Disney in a research note on Monday, August 11th. Finally, Raymond James Financial reissued a "neutral" rating on shares of Walt Disney in a research note on Monday, August 11th. Nineteen investment analysts have rated the stock with a Buy rating and nine have assigned a Hold rating to the stock. According to data from MarketBeat.com, Walt Disney currently has an average rating of "Moderate Buy" and a consensus price target of $131.18.

Get Our Latest Research Report on Walt Disney

About Walt Disney

(

Free Report)

The Walt Disney Company operates as an entertainment company worldwide. It operates through three segments: Entertainment, Sports, and Experiences. The company produces and distributes film and television video streaming content under the ABC Television Network, Disney, Freeform, FX, Fox, National Geographic, and Star brand television channels, as well as ABC television stations and A+E television networks; and produces original content under the ABC Signature, Disney Branded Television, FX Productions, Lucasfilm, Marvel, National Geographic Studios, Pixar, Searchlight Pictures, Twentieth Century Studios, 20th Television, and Walt Disney Pictures banners.

See Also

Want to see what other hedge funds are holding DIS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for The Walt Disney Company (NYSE:DIS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Walt Disney, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walt Disney wasn't on the list.

While Walt Disney currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.