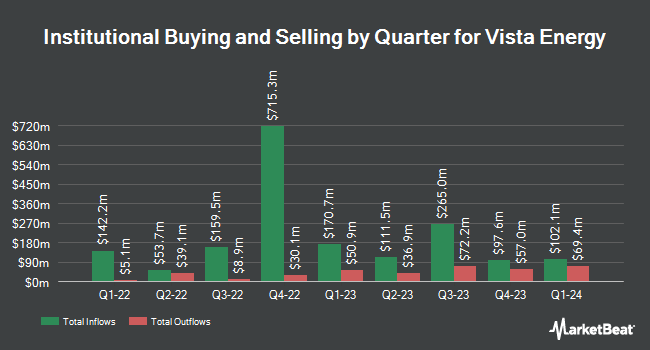

Thornburg Investment Management Inc. reduced its stake in Vista Energy, S.A.B. de C.V. - Sponsored ADR (NYSE:VIST - Free Report) by 27.5% in the 1st quarter, according to the company in its most recent filing with the SEC. The fund owned 110,312 shares of the company's stock after selling 41,840 shares during the quarter. Thornburg Investment Management Inc. owned approximately 0.12% of Vista Energy worth $5,136,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in VIST. Geode Capital Management LLC lifted its holdings in shares of Vista Energy by 2.9% during the fourth quarter. Geode Capital Management LLC now owns 14,413 shares of the company's stock worth $780,000 after buying an additional 410 shares during the last quarter. Legal & General Group Plc lifted its holdings in shares of Vista Energy by 32.9% during the fourth quarter. Legal & General Group Plc now owns 2,269 shares of the company's stock worth $123,000 after buying an additional 562 shares during the last quarter. Oppenheimer & Co. Inc. lifted its holdings in shares of Vista Energy by 14.6% during the first quarter. Oppenheimer & Co. Inc. now owns 4,950 shares of the company's stock worth $230,000 after buying an additional 632 shares during the last quarter. Money Concepts Capital Corp lifted its holdings in shares of Vista Energy by 5.1% during the first quarter. Money Concepts Capital Corp now owns 16,896 shares of the company's stock worth $787,000 after buying an additional 813 shares during the last quarter. Finally, Commonwealth Equity Services LLC lifted its holdings in shares of Vista Energy by 10.5% during the fourth quarter. Commonwealth Equity Services LLC now owns 9,434 shares of the company's stock worth $510,000 after buying an additional 897 shares during the last quarter. 63.81% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of brokerages have recently commented on VIST. UBS Group upgraded Vista Energy from a "hold" rating to a "strong-buy" rating in a report on Tuesday, June 17th. Pickering Energy Partners assumed coverage on Vista Energy in a research report on Monday, April 7th. They set an "outperform" rating on the stock. Finally, Wall Street Zen upgraded Vista Energy from a "sell" rating to a "hold" rating in a research report on Sunday, July 20th. One research analyst has rated the stock with a hold rating, four have given a buy rating and two have issued a strong buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Buy" and an average target price of $65.68.

Read Our Latest Report on VIST

Vista Energy Stock Performance

Shares of VIST traded down $1.15 on Friday, reaching $43.55. 2,002,365 shares of the stock traded hands, compared to its average volume of 1,083,227. The stock's 50-day moving average price is $48.04 and its 200-day moving average price is $48.34. Vista Energy, S.A.B. de C.V. - Sponsored ADR has a 12 month low of $32.11 and a 12 month high of $61.67. The firm has a market cap of $4.15 billion, a price-to-earnings ratio of 7.85 and a beta of 0.97. The company has a debt-to-equity ratio of 0.89, a current ratio of 0.41 and a quick ratio of 0.41.

Vista Energy (NYSE:VIST - Get Free Report) last announced its quarterly earnings results on Thursday, July 10th. The company reported $0.55 earnings per share for the quarter, missing analysts' consensus estimates of $2.15 by ($1.60). Vista Energy had a net margin of 29.12% and a return on equity of 12.02%. The company had revenue of $610.54 million during the quarter, compared to the consensus estimate of $572.37 million. Equities analysts forecast that Vista Energy, S.A.B. de C.V. - Sponsored ADR will post 5.74 EPS for the current fiscal year.

Vista Energy Company Profile

(

Free Report)

Vista Energy, SAB. de C.V., through its subsidiaries, engages in the exploration and production of oil and gas in Latin America. The company's principal assets located in Neuquina basin, Argentina and Vaca Muerta. It owns producing assets in Argentina and Mexico. In addition, the company involved in drilling and workover activities located in Argentina.

Featured Articles

Before you consider Vista Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vista Energy wasn't on the list.

While Vista Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.