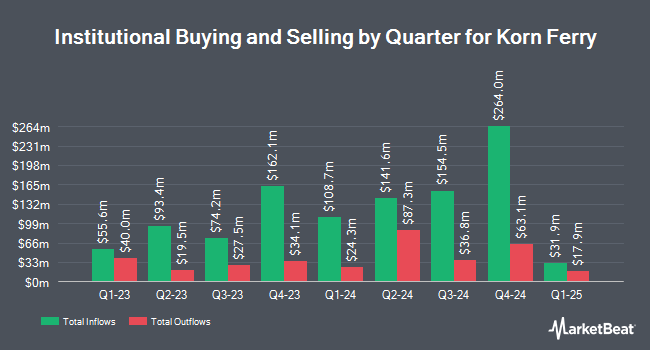

Tidal Investments LLC boosted its holdings in Korn Ferry (NYSE:KFY - Free Report) by 5,931.0% during the 4th quarter, according to the company in its most recent disclosure with the SEC. The fund owned 352,030 shares of the business services provider's stock after buying an additional 346,193 shares during the quarter. Tidal Investments LLC owned 0.68% of Korn Ferry worth $23,744,000 as of its most recent SEC filing.

Several other institutional investors also recently modified their holdings of KFY. Wealthfront Advisers LLC acquired a new position in shares of Korn Ferry in the 4th quarter worth $76,000. Smartleaf Asset Management LLC boosted its position in shares of Korn Ferry by 230.4% in the 4th quarter. Smartleaf Asset Management LLC now owns 1,381 shares of the business services provider's stock valued at $93,000 after purchasing an additional 963 shares during the period. Sterling Capital Management LLC increased its stake in Korn Ferry by 828.3% in the 4th quarter. Sterling Capital Management LLC now owns 1,671 shares of the business services provider's stock worth $113,000 after purchasing an additional 1,491 shares in the last quarter. Venturi Wealth Management LLC acquired a new stake in Korn Ferry during the 4th quarter worth about $122,000. Finally, New Age Alpha Advisors LLC purchased a new stake in Korn Ferry during the fourth quarter valued at about $162,000. Institutional investors own 98.82% of the company's stock.

Wall Street Analyst Weigh In

Separately, Truist Financial dropped their target price on shares of Korn Ferry from $84.00 to $80.00 and set a "buy" rating on the stock in a research report on Tuesday, April 15th.

Read Our Latest Research Report on KFY

Korn Ferry Stock Down 0.7%

Shares of Korn Ferry stock traded down $0.50 during midday trading on Friday, hitting $67.65. The company's stock had a trading volume of 61,293 shares, compared to its average volume of 375,633. Korn Ferry has a 1-year low of $59.23 and a 1-year high of $80.64. The company has a quick ratio of 2.07, a current ratio of 2.07 and a debt-to-equity ratio of 0.22. The firm has a market capitalization of $3.49 billion, a P/E ratio of 14.45 and a beta of 1.41. The stock has a 50-day simple moving average of $64.90 and a 200-day simple moving average of $68.34.

Korn Ferry (NYSE:KFY - Get Free Report) last released its earnings results on Tuesday, March 11th. The business services provider reported $1.19 earnings per share for the quarter, beating the consensus estimate of $1.13 by $0.06. The company had revenue of $676.50 million for the quarter, compared to analysts' expectations of $650.45 million. Korn Ferry had a return on equity of 14.27% and a net margin of 9.03%. The business's revenue for the quarter was down .1% on a year-over-year basis. During the same quarter in the previous year, the business posted $1.07 EPS. As a group, sell-side analysts expect that Korn Ferry will post 4.75 earnings per share for the current year.

Korn Ferry Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, April 15th. Shareholders of record on Thursday, March 27th were paid a $0.48 dividend. This represents a $1.92 annualized dividend and a yield of 2.84%. The ex-dividend date of this dividend was Thursday, March 27th. This is a positive change from Korn Ferry's previous quarterly dividend of $0.37. Korn Ferry's dividend payout ratio is currently 41.29%.

About Korn Ferry

(

Free Report)

Korn Ferry, together with its subsidiaries, provides organizational consulting services worldwide. It operates through four segments: Consulting, Digital, Executive Search, and Recruitment Process Outsourcing (RPO) & Professional Search. The company provides executive search services to recruit board level, chief executive, other senior executive, and general management talent of organizations.

Featured Articles

Before you consider Korn Ferry, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Korn Ferry wasn't on the list.

While Korn Ferry currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.