Titan Global Capital Management USA LLC trimmed its holdings in shares of T-Mobile US, Inc. (NASDAQ:TMUS - Free Report) by 3.4% in the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 74,425 shares of the Wireless communications provider's stock after selling 2,600 shares during the period. T-Mobile US comprises approximately 4.0% of Titan Global Capital Management USA LLC's portfolio, making the stock its 9th largest position. Titan Global Capital Management USA LLC's holdings in T-Mobile US were worth $19,850,000 as of its most recent SEC filing.

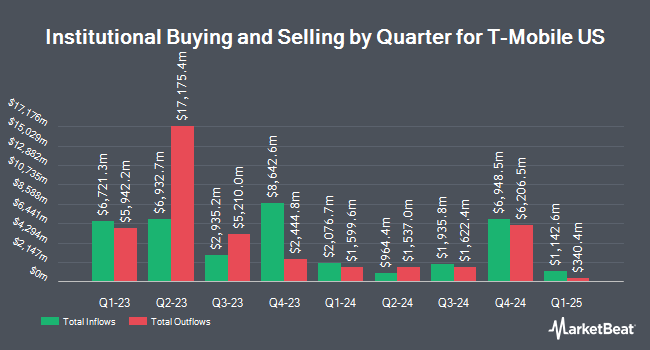

Several other hedge funds and other institutional investors have also recently modified their holdings of TMUS. GAMMA Investing LLC raised its stake in shares of T-Mobile US by 29,289.4% during the first quarter. GAMMA Investing LLC now owns 3,053,563 shares of the Wireless communications provider's stock valued at $814,416,000 after acquiring an additional 3,043,173 shares during the last quarter. Nuveen LLC bought a new position in shares of T-Mobile US during the first quarter valued at about $618,248,000. Deutsche Bank AG raised its stake in shares of T-Mobile US by 38.8% during the fourth quarter. Deutsche Bank AG now owns 3,465,534 shares of the Wireless communications provider's stock valued at $764,947,000 after acquiring an additional 968,444 shares during the last quarter. Goldman Sachs Group Inc. raised its stake in shares of T-Mobile US by 25.4% during the first quarter. Goldman Sachs Group Inc. now owns 4,172,644 shares of the Wireless communications provider's stock valued at $1,112,886,000 after acquiring an additional 844,932 shares during the last quarter. Finally, Northern Trust Corp raised its stake in shares of T-Mobile US by 13.8% during the fourth quarter. Northern Trust Corp now owns 5,325,541 shares of the Wireless communications provider's stock valued at $1,175,507,000 after acquiring an additional 645,892 shares during the last quarter. 42.49% of the stock is owned by institutional investors.

T-Mobile US Stock Down 2.4%

NASDAQ:TMUS traded down $6.21 during mid-day trading on Friday, hitting $251.95. 3,984,708 shares of the company's stock were exchanged, compared to its average volume of 3,841,946. T-Mobile US, Inc. has a one year low of $192.61 and a one year high of $276.49. The company has a debt-to-equity ratio of 1.33, a current ratio of 1.21 and a quick ratio of 1.13. The business has a fifty day moving average price of $237.98 and a 200 day moving average price of $248.02. The company has a market cap of $283.55 billion, a PE ratio of 23.77, a P/E/G ratio of 1.38 and a beta of 0.62.

T-Mobile US (NASDAQ:TMUS - Get Free Report) last posted its quarterly earnings data on Wednesday, July 23rd. The Wireless communications provider reported $2.84 EPS for the quarter, topping the consensus estimate of $2.69 by $0.15. T-Mobile US had a net margin of 14.53% and a return on equity of 19.68%. The business had revenue of $21.13 billion for the quarter, compared to analyst estimates of $20.99 billion. During the same quarter in the previous year, the firm posted $2.49 earnings per share. T-Mobile US's quarterly revenue was up 6.9% on a year-over-year basis. Equities analysts predict that T-Mobile US, Inc. will post 10.37 EPS for the current year.

T-Mobile US Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, September 11th. Investors of record on Friday, August 29th will be paid a dividend of $0.88 per share. The ex-dividend date of this dividend is Friday, August 29th. This represents a $3.52 annualized dividend and a yield of 1.4%. T-Mobile US's payout ratio is presently 33.21%.

Wall Street Analysts Forecast Growth

TMUS has been the subject of several recent analyst reports. Rothschild & Co Redburn raised shares of T-Mobile US from a "sell" rating to a "neutral" rating and set a $228.00 price objective for the company in a research note on Monday, July 7th. Royal Bank Of Canada upped their price objective on shares of T-Mobile US from $265.00 to $270.00 and gave the company a "sector perform" rating in a research note on Friday, July 25th. Morgan Stanley upped their price objective on shares of T-Mobile US from $265.00 to $285.00 and gave the company an "overweight" rating in a research note on Thursday, July 24th. JPMorgan Chase & Co. boosted their price target on shares of T-Mobile US from $270.00 to $280.00 and gave the company an "overweight" rating in a research report on Thursday, July 24th. Finally, KeyCorp reiterated an "underweight" rating and set a $200.00 price target on shares of T-Mobile US in a research report on Wednesday, July 9th. Three analysts have rated the stock with a Strong Buy rating, nine have given a Buy rating, twelve have assigned a Hold rating and one has issued a Sell rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $256.31.

View Our Latest Stock Analysis on T-Mobile US

Insider Buying and Selling

In related news, Director Telekom Ag Deutsche sold 69,840 shares of the business's stock in a transaction dated Wednesday, August 20th. The shares were sold at an average price of $259.87, for a total transaction of $18,149,320.80. Following the sale, the director owned 635,992,364 shares of the company's stock, valued at $165,275,335,632.68. The trade was a 0.01% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, CEO G Michael Sievert sold 22,500 shares of the business's stock in a transaction dated Monday, August 18th. The stock was sold at an average price of $255.58, for a total transaction of $5,750,550.00. Following the sale, the chief executive officer directly owned 358,722 shares in the company, valued at $91,682,168.76. The trade was a 5.90% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 2,139,050 shares of company stock valued at $504,895,827 over the last quarter. Corporate insiders own 0.37% of the company's stock.

About T-Mobile US

(

Free Report)

T-Mobile US, Inc, together with its subsidiaries, provides mobile communications services in the United States, Puerto Rico, and the United States Virgin Islands. The company offers voice, messaging, and data services to customers in the postpaid, prepaid, and wholesale and other services. It also provides wireless devices, including smartphones, wearables, tablets, home broadband routers, and other mobile communication devices, as well as wireless devices and accessories; financing through equipment installment plans; reinsurance for device insurance policies and extended warranty contracts; leasing through JUMP! On Demand; and High Speed Internet services.

Recommended Stories

Before you consider T-Mobile US, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and T-Mobile US wasn't on the list.

While T-Mobile US currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report