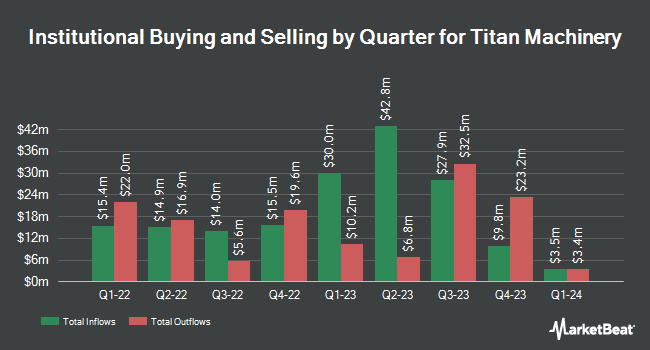

Assenagon Asset Management S.A. trimmed its stake in Titan Machinery Inc. (NASDAQ:TITN - Free Report) by 81.1% in the second quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 23,177 shares of the company's stock after selling 99,579 shares during the quarter. Assenagon Asset Management S.A. owned 0.10% of Titan Machinery worth $459,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds have also made changes to their positions in TITN. Bank of America Corp DE lifted its position in shares of Titan Machinery by 76.9% in the fourth quarter. Bank of America Corp DE now owns 153,787 shares of the company's stock worth $2,173,000 after purchasing an additional 66,853 shares in the last quarter. Millennium Management LLC raised its position in Titan Machinery by 12.4% during the fourth quarter. Millennium Management LLC now owns 38,689 shares of the company's stock valued at $547,000 after acquiring an additional 4,266 shares in the last quarter. Squarepoint Ops LLC raised its position in Titan Machinery by 28.9% during the fourth quarter. Squarepoint Ops LLC now owns 38,697 shares of the company's stock valued at $547,000 after acquiring an additional 8,678 shares in the last quarter. GAMMA Investing LLC raised its position in Titan Machinery by 6,432.3% during the first quarter. GAMMA Investing LLC now owns 12,150 shares of the company's stock valued at $207,000 after acquiring an additional 11,964 shares in the last quarter. Finally, SummerHaven Investment Management LLC raised its position in Titan Machinery by 1.5% during the first quarter. SummerHaven Investment Management LLC now owns 51,255 shares of the company's stock valued at $873,000 after acquiring an additional 768 shares in the last quarter. 78.38% of the stock is owned by hedge funds and other institutional investors.

Titan Machinery Trading Down 0.1%

Shares of TITN stock opened at $17.07 on Monday. Titan Machinery Inc. has a 12 month low of $12.50 and a 12 month high of $23.41. The company has a quick ratio of 0.18, a current ratio of 1.31 and a debt-to-equity ratio of 0.32. The business's 50 day moving average is $19.53 and its two-hundred day moving average is $18.75. The company has a market cap of $398.93 million, a PE ratio of -6.32 and a beta of 1.30.

Titan Machinery (NASDAQ:TITN - Get Free Report) last announced its quarterly earnings results on Thursday, August 28th. The company reported ($0.26) EPS for the quarter, beating the consensus estimate of ($0.56) by $0.30. Titan Machinery had a negative return on equity of 9.99% and a negative net margin of 2.37%.The company had revenue of $546.43 million for the quarter, compared to the consensus estimate of $503.80 million. Titan Machinery has set its FY 2026 guidance at -2.000--1.500 EPS.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen raised shares of Titan Machinery from a "sell" rating to a "hold" rating in a research report on Friday. Two investment analysts have rated the stock with a Strong Buy rating, two have issued a Buy rating and two have assigned a Hold rating to the company. Based on data from MarketBeat, Titan Machinery has a consensus rating of "Buy" and a consensus target price of $22.25.

Check Out Our Latest Research Report on Titan Machinery

About Titan Machinery

(

Free Report)

Titan Machinery Inc owns and operates a network of full service agricultural and construction equipment stores in the United States, Europe, and Australia. It operates through four segments: Agriculture, Construction, Europe, and Australia. The company sells new and used equipment, including agricultural and construction equipment manufactured under the CNH Industrial family of brands, as well as equipment from various other manufacturers.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Titan Machinery, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Titan Machinery wasn't on the list.

While Titan Machinery currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.