Tocqueville Asset Management L.P. reduced its position in shares of Fortive Corporation (NYSE:FTV - Free Report) by 10.1% in the first quarter, according to its most recent filing with the SEC. The fund owned 49,471 shares of the technology company's stock after selling 5,566 shares during the quarter. Tocqueville Asset Management L.P.'s holdings in Fortive were worth $3,620,000 at the end of the most recent reporting period.

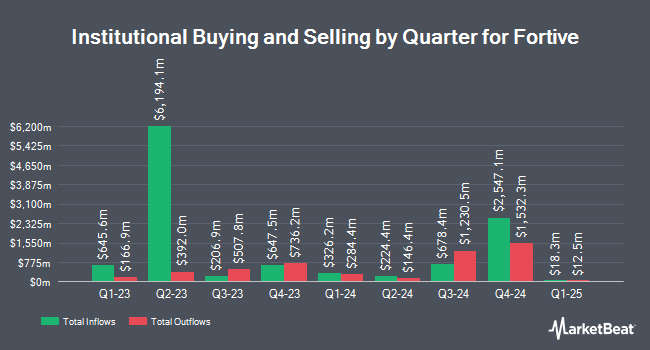

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Parvin Asset Management LLC purchased a new stake in Fortive during the 4th quarter valued at $26,000. American National Bank & Trust purchased a new position in shares of Fortive during the first quarter valued at $26,000. Accent Capital Management LLC purchased a new position in shares of Fortive during the first quarter valued at $26,000. Global X Japan Co. Ltd. boosted its position in Fortive by 114.2% during the first quarter. Global X Japan Co. Ltd. now owns 377 shares of the technology company's stock valued at $28,000 after purchasing an additional 201 shares in the last quarter. Finally, Park Square Financial Group LLC bought a new stake in Fortive during the fourth quarter valued at about $30,000. 94.94% of the stock is currently owned by institutional investors.

Fortive Price Performance

Shares of NYSE:FTV traded down $0.3650 during trading on Thursday, reaching $47.6750. The stock had a trading volume of 4,113,131 shares, compared to its average volume of 3,357,506. The company has a debt-to-equity ratio of 0.28, a quick ratio of 0.82 and a current ratio of 0.98. The business has a fifty day moving average price of $55.00 and a 200-day moving average price of $66.67. The stock has a market cap of $16.13 billion, a PE ratio of 21.48, a PEG ratio of 3.05 and a beta of 1.08. Fortive Corporation has a 1-year low of $46.34 and a 1-year high of $83.32.

Fortive (NYSE:FTV - Get Free Report) last issued its quarterly earnings results on Wednesday, July 30th. The technology company reported $0.58 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.60 by ($0.02). The firm had revenue of $1.52 billion during the quarter, compared to analyst estimates of $1.54 billion. Fortive had a return on equity of 11.96% and a net margin of 13.62%.The business's revenue was down .4% on a year-over-year basis. During the same period in the prior year, the firm earned $0.93 earnings per share. Fortive has set its FY 2025 guidance at 2.500-2.600 EPS. On average, equities analysts forecast that Fortive Corporation will post 4.05 earnings per share for the current fiscal year.

Fortive announced that its board has initiated a stock buyback plan on Tuesday, May 27th that permits the company to repurchase 15,630,000 outstanding shares. This repurchase authorization permits the technology company to reacquire shares of its stock through open market purchases. Stock repurchase plans are often a sign that the company's management believes its shares are undervalued.

Analyst Upgrades and Downgrades

A number of brokerages recently weighed in on FTV. BNP Paribas reaffirmed a "neutral" rating on shares of Fortive in a research report on Thursday, June 12th. Robert W. Baird dropped their price objective on Fortive from $88.00 to $82.00 and set an "outperform" rating on the stock in a research report on Wednesday, May 7th. Mizuho dropped their price objective on Fortive from $85.00 to $65.00 and set an "outperform" rating on the stock in a research report on Wednesday, July 16th. Cowen downgraded Fortive from a "buy" rating to a "hold" rating in a research report on Tuesday, July 15th. Finally, JPMorgan Chase & Co. reduced their price objective on Fortive from $87.00 to $65.00 and set an "overweight" rating for the company in a research note on Wednesday, July 2nd. Five equities research analysts have rated the stock with a Buy rating and thirteen have assigned a Hold rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $65.57.

Read Our Latest Stock Report on FTV

Fortive Company Profile

(

Free Report)

Fortive Corporation designs, develops, manufactures, and services professional and engineered products, software, and services in the United States, China, and internationally. It operates in three segments: Intelligent Operating Solutions, Precision Technologies, and Advanced Healthcare Solutions. The Intelligent Operating Solutions segment provides advanced instrumentation, software, and services, including electrical test and measurement, facility and asset lifecycle software applications, and connected worker safety and compliance solutions for manufacturing, process industries, healthcare, utilities and power, communications and electronics, and other industries.

See Also

Before you consider Fortive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortive wasn't on the list.

While Fortive currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.