Topline Capital Management LLC reduced its position in Intellicheck, Inc. (NYSE:IDN - Free Report) by 12.5% in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,014,507 shares of the company's stock after selling 145,371 shares during the quarter. Intellicheck makes up about 0.7% of Topline Capital Management LLC's investment portfolio, making the stock its 25th largest holding. Topline Capital Management LLC owned approximately 5.12% of Intellicheck worth $3,074,000 at the end of the most recent reporting period.

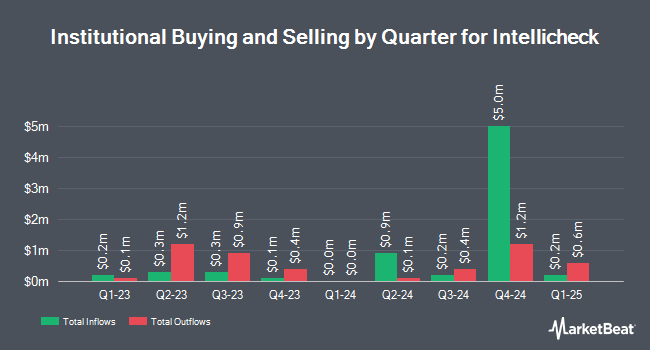

A number of other hedge funds have also modified their holdings of the company. Northern Trust Corp boosted its position in shares of Intellicheck by 20.7% in the fourth quarter. Northern Trust Corp now owns 33,925 shares of the company's stock worth $95,000 after purchasing an additional 5,827 shares during the period. Geode Capital Management LLC boosted its position in shares of Intellicheck by 4.8% in the fourth quarter. Geode Capital Management LLC now owns 199,835 shares of the company's stock worth $560,000 after purchasing an additional 9,166 shares during the period. Renaissance Technologies LLC boosted its position in shares of Intellicheck by 9.5% in the fourth quarter. Renaissance Technologies LLC now owns 114,000 shares of the company's stock worth $319,000 after purchasing an additional 9,900 shares during the period. Wilkinson Global Asset Management LLC boosted its position in shares of Intellicheck by 5.2% in the first quarter. Wilkinson Global Asset Management LLC now owns 216,116 shares of the company's stock worth $655,000 after purchasing an additional 10,714 shares during the period. Finally, Virtu Financial LLC bought a new position in shares of Intellicheck in the first quarter worth approximately $45,000. 42.79% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

IDN has been the subject of a number of research reports. Craig Hallum upgraded shares of Intellicheck from a "hold" rating to a "buy" rating and set a $6.00 target price for the company in a research report on Wednesday, May 21st. Wall Street Zen upgraded shares of Intellicheck from a "hold" rating to a "buy" rating in a research report on Wednesday, June 18th. HC Wainwright restated a "buy" rating and set a $6.00 target price on shares of Intellicheck in a research report on Wednesday, August 13th. Finally, DA Davidson upped their target price on shares of Intellicheck from $5.50 to $6.50 and gave the stock a "buy" rating in a research report on Wednesday, August 13th. Three equities research analysts have rated the stock with a Buy rating, According to MarketBeat, Intellicheck currently has an average rating of "Buy" and a consensus price target of $6.17.

View Our Latest Stock Analysis on Intellicheck

Intellicheck Stock Down 1.5%

Intellicheck stock traded down $0.08 during mid-day trading on Tuesday, reaching $5.37. 57,347 shares of the company's stock traded hands, compared to its average volume of 208,568. The company has a market cap of $107.52 million, a price-to-earnings ratio of -180.00 and a beta of 1.21. The stock has a 50 day moving average of $5.21 and a two-hundred day moving average of $3.96. Intellicheck, Inc. has a 12-month low of $1.92 and a 12-month high of $6.49.

Intellicheck Profile

(

Free Report)

Intellicheck, Inc, a technology company, provides on-demand digital identity validation solutions for KYC, fraud, and age verification needs in North America. The company offers solutions for digital and physical identities for financial services, fintech companies, BNPL providers, e-commerce and retail commerce businesses, law enforcement, and government agencies.

See Also

Before you consider Intellicheck, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intellicheck wasn't on the list.

While Intellicheck currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.