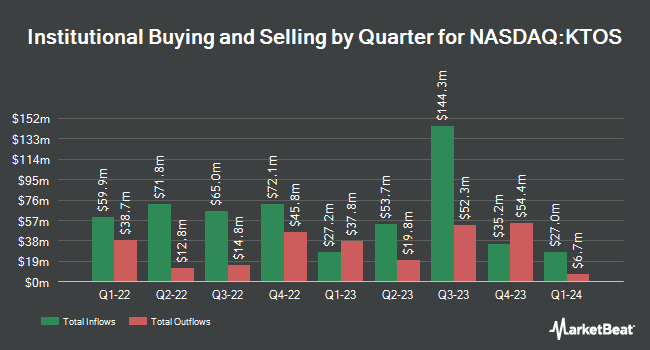

Toth Financial Advisory Corp lessened its holdings in Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS - Free Report) by 17.8% in the second quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 29,350 shares of the aerospace company's stock after selling 6,370 shares during the quarter. Toth Financial Advisory Corp's holdings in Kratos Defense & Security Solutions were worth $1,363,000 as of its most recent SEC filing.

Other institutional investors and hedge funds have also bought and sold shares of the company. Wealth Enhancement Advisory Services LLC bought a new stake in Kratos Defense & Security Solutions during the first quarter worth about $594,000. Corebridge Financial Inc. lifted its position in Kratos Defense & Security Solutions by 5.2% during the first quarter. Corebridge Financial Inc. now owns 77,422 shares of the aerospace company's stock worth $2,299,000 after purchasing an additional 3,860 shares during the period. New York State Teachers Retirement System bought a new stake in Kratos Defense & Security Solutions during the first quarter worth about $1,407,000. Oregon Public Employees Retirement Fund bought a new position in shares of Kratos Defense & Security Solutions in the first quarter worth about $1,039,000. Finally, Bank of New York Mellon Corp lifted its holdings in shares of Kratos Defense & Security Solutions by 2.0% in the first quarter. Bank of New York Mellon Corp now owns 1,221,860 shares of the aerospace company's stock worth $36,277,000 after acquiring an additional 24,455 shares during the last quarter. Institutional investors own 75.92% of the company's stock.

Analyst Upgrades and Downgrades

KTOS has been the subject of a number of research reports. BTIG Research raised shares of Kratos Defense & Security Solutions from a "neutral" rating to a "buy" rating and set a $80.00 target price for the company in a report on Thursday, August 14th. B. Riley reissued a "buy" rating and issued a $72.00 target price (up previously from $55.00) on shares of Kratos Defense & Security Solutions in a report on Monday, August 11th. Royal Bank Of Canada increased their target price on shares of Kratos Defense & Security Solutions from $50.00 to $65.00 and gave the stock an "outperform" rating in a report on Friday, August 8th. Raymond James Financial reissued a "strong-buy" rating on shares of Kratos Defense & Security Solutions in a report on Friday, August 8th. Finally, Cantor Fitzgerald reissued an "overweight" rating on shares of Kratos Defense & Security Solutions in a report on Friday, July 18th. One analyst has rated the stock with a Strong Buy rating, thirteen have issued a Buy rating and two have assigned a Hold rating to the company's stock. According to MarketBeat.com, Kratos Defense & Security Solutions presently has a consensus rating of "Moderate Buy" and an average target price of $57.64.

Get Our Latest Report on KTOS

Kratos Defense & Security Solutions Trading Up 3.2%

Shares of Kratos Defense & Security Solutions stock traded up $2.62 on Tuesday, hitting $83.34. The stock had a trading volume of 3,626,707 shares, compared to its average volume of 3,511,985. The stock has a 50 day moving average of $64.66 and a 200 day moving average of $46.19. Kratos Defense & Security Solutions, Inc. has a twelve month low of $22.69 and a twelve month high of $85.48. The company has a debt-to-equity ratio of 0.12, a quick ratio of 3.88 and a current ratio of 4.43. The firm has a market capitalization of $14.07 billion, a P/E ratio of 839.70 and a beta of 1.05.

Kratos Defense & Security Solutions (NASDAQ:KTOS - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The aerospace company reported $0.11 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.09 by $0.02. Kratos Defense & Security Solutions had a return on equity of 3.10% and a net margin of 1.20%.The company had revenue of $351.50 million during the quarter, compared to the consensus estimate of $305.67 million. During the same quarter in the prior year, the firm posted $0.14 earnings per share. The firm's revenue was up 17.1% compared to the same quarter last year. Kratos Defense & Security Solutions has set its FY 2025 guidance at EPS. Q3 2025 guidance at EPS. Sell-side analysts expect that Kratos Defense & Security Solutions, Inc. will post 0.31 earnings per share for the current fiscal year.

Insider Buying and Selling at Kratos Defense & Security Solutions

In other Kratos Defense & Security Solutions news, insider Phillip D. Carrai sold 6,000 shares of the stock in a transaction that occurred on Monday, September 15th. The shares were sold at an average price of $68.82, for a total transaction of $412,920.00. Following the completion of the sale, the insider owned 258,073 shares of the company's stock, valued at approximately $17,760,583.86. This represents a 2.27% decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, insider David M. Carter sold 4,000 shares of the stock in a transaction that occurred on Friday, September 12th. The shares were sold at an average price of $68.70, for a total transaction of $274,800.00. Following the sale, the insider directly owned 97,809 shares of the company's stock, valued at $6,719,478.30. This represents a 3.93% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 77,430 shares of company stock worth $4,745,162. Company insiders own 2.37% of the company's stock.

Kratos Defense & Security Solutions Company Profile

(

Free Report)

Kratos Defense & Security Solutions, Inc engages in the provision of mission critical products, services and solutions for United States national security priorities. It operates through the Kratos Government Solutions (KGS) and Unmanned Systems (US) segments. The KGS segment consists of an aggregation of KGS operating segments, including microwave electronic products, space, satellite and cyber, training solutions.

See Also

Before you consider Kratos Defense & Security Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kratos Defense & Security Solutions wasn't on the list.

While Kratos Defense & Security Solutions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.