The Manufacturers Life Insurance Company trimmed its holdings in Tractor Supply Company (NASDAQ:TSCO - Free Report) by 21.4% in the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 314,999 shares of the specialty retailer's stock after selling 85,963 shares during the period. The Manufacturers Life Insurance Company owned 0.06% of Tractor Supply worth $17,356,000 as of its most recent filing with the Securities & Exchange Commission.

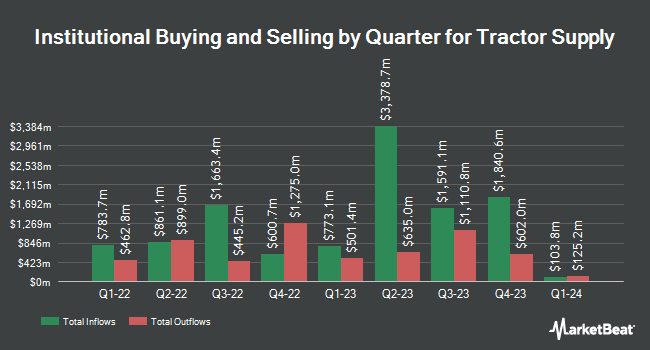

A number of other hedge funds have also recently modified their holdings of TSCO. AQR Capital Management LLC grew its holdings in shares of Tractor Supply by 421.0% in the fourth quarter. AQR Capital Management LLC now owns 140,974 shares of the specialty retailer's stock valued at $7,480,000 after purchasing an additional 113,914 shares during the period. Schonfeld Strategic Advisors LLC grew its holdings in shares of Tractor Supply by 40.3% in the fourth quarter. Schonfeld Strategic Advisors LLC now owns 10,810 shares of the specialty retailer's stock valued at $574,000 after purchasing an additional 3,106 shares during the period. Bison Wealth LLC grew its holdings in shares of Tractor Supply by 356.1% in the fourth quarter. Bison Wealth LLC now owns 6,426 shares of the specialty retailer's stock valued at $341,000 after purchasing an additional 5,017 shares during the period. Mercer Global Advisors Inc. ADV grew its holdings in shares of Tractor Supply by 420.9% in the fourth quarter. Mercer Global Advisors Inc. ADV now owns 78,539 shares of the specialty retailer's stock valued at $4,167,000 after purchasing an additional 63,460 shares during the period. Finally, Ancora Advisors LLC grew its holdings in shares of Tractor Supply by 556.1% in the fourth quarter. Ancora Advisors LLC now owns 1,345 shares of the specialty retailer's stock valued at $71,000 after purchasing an additional 1,140 shares during the period. Hedge funds and other institutional investors own 98.72% of the company's stock.

Analysts Set New Price Targets

A number of equities research analysts recently issued reports on TSCO shares. Telsey Advisory Group set a $70.00 price objective on shares of Tractor Supply in a report on Friday, July 25th. JPMorgan Chase & Co. upped their price objective on shares of Tractor Supply from $56.00 to $65.00 and gave the company a "neutral" rating in a report on Monday, July 21st. Wells Fargo & Company upped their price objective on shares of Tractor Supply from $63.00 to $65.00 and gave the company an "overweight" rating in a report on Friday, July 25th. Evercore ISI increased their target price on shares of Tractor Supply from $60.00 to $65.00 and gave the stock an "in-line" rating in a research note on Friday, July 25th. Finally, UBS Group increased their target price on shares of Tractor Supply from $54.00 to $61.00 and gave the stock a "neutral" rating in a research note on Friday, July 25th. Thirteen research analysts have rated the stock with a Buy rating and eight have given a Hold rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $61.80.

Get Our Latest Research Report on TSCO

Insiders Place Their Bets

In other news, EVP Colin Yankee sold 6,680 shares of the firm's stock in a transaction that occurred on Monday, July 28th. The shares were sold at an average price of $58.40, for a total value of $390,112.00. Following the completion of the transaction, the executive vice president owned 40,142 shares of the company's stock, valued at approximately $2,344,292.80. This trade represents a 14.27% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, EVP Jonathan S. Estep sold 56,630 shares of the firm's stock in a transaction that occurred on Monday, June 23rd. The shares were sold at an average price of $53.00, for a total transaction of $3,001,390.00. Following the completion of the transaction, the executive vice president directly owned 74,605 shares of the company's stock, valued at approximately $3,954,065. The trade was a 43.15% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 204,680 shares of company stock valued at $12,071,552. 0.65% of the stock is owned by company insiders.

Tractor Supply Trading Down 0.4%

NASDAQ TSCO opened at $61.52 on Wednesday. The firm has a 50 day simple moving average of $58.37 and a 200-day simple moving average of $54.34. The company has a debt-to-equity ratio of 0.68, a quick ratio of 0.16 and a current ratio of 1.28. Tractor Supply Company has a one year low of $46.85 and a one year high of $63.99. The firm has a market cap of $32.60 billion, a price-to-earnings ratio of 30.19, a PEG ratio of 3.17 and a beta of 0.76.

Tractor Supply (NASDAQ:TSCO - Get Free Report) last posted its quarterly earnings data on Thursday, July 24th. The specialty retailer reported $0.81 EPS for the quarter, beating the consensus estimate of $0.80 by $0.01. Tractor Supply had a net margin of 7.18% and a return on equity of 46.83%. The business had revenue of $4.44 billion during the quarter, compared to analyst estimates of $4.40 billion. During the same quarter last year, the firm posted $3.93 earnings per share. The business's revenue for the quarter was up 4.5% compared to the same quarter last year. Tractor Supply has set its Q3 2025 guidance at 2.000-2.180 EPS. Equities research analysts anticipate that Tractor Supply Company will post 2.17 EPS for the current fiscal year.

Tractor Supply Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 9th. Stockholders of record on Monday, August 25th will be paid a $0.23 dividend. The ex-dividend date of this dividend is Monday, August 25th. This represents a $0.92 annualized dividend and a dividend yield of 1.5%. Tractor Supply's dividend payout ratio (DPR) is presently 45.10%.

Tractor Supply Company Profile

(

Free Report)

Tractor Supply Company operates as a rural lifestyle retailer in the United States. The company offers various merchandise, including livestock and equine feed and equipment, poultry, fencing, and sprayers and chemicals; food, treats, and equipment for dogs, cats, and other small animals, as well as dog wellness products; seasonal and recreation products comprising tractors and riders, lawn and garden, bird feeding, power equipment, and other recreational products; truck, tool, and hardware products, such as truck accessories, trailers, generators, lubricants, batteries, and hardware and tools; and clothing, gift, and décor products consist of clothing, footwear, toys, snacks, and decorative merchandise.

Read More

Want to see what other hedge funds are holding TSCO? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Tractor Supply Company (NASDAQ:TSCO - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tractor Supply, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tractor Supply wasn't on the list.

While Tractor Supply currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report