Tradition Wealth Management LLC bought a new position in CME Group Inc. (NASDAQ:CME - Free Report) during the first quarter, according to its most recent 13F filing with the SEC. The institutional investor bought 980 shares of the financial services provider's stock, valued at approximately $260,000.

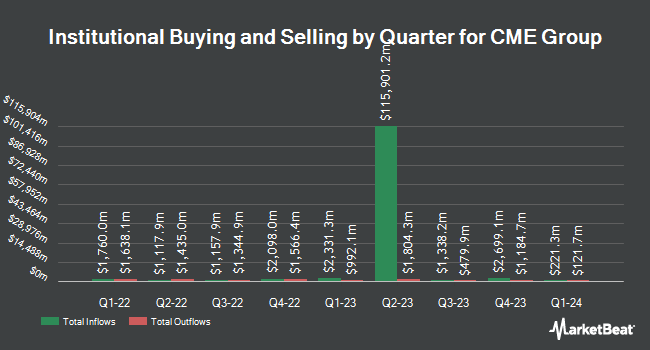

Several other institutional investors also recently bought and sold shares of CME. Erste Asset Management GmbH bought a new position in shares of CME Group during the first quarter valued at approximately $8,679,000. Vertex Planning Partners LLC increased its holdings in shares of CME Group by 0.9% in the 1st quarter. Vertex Planning Partners LLC now owns 6,941 shares of the financial services provider's stock worth $1,841,000 after purchasing an additional 63 shares in the last quarter. Decatur Capital Management Inc. bought a new stake in shares of CME Group in the first quarter worth $3,256,000. Groupama Asset Managment grew its holdings in shares of CME Group by 5.7% in the first quarter. Groupama Asset Managment now owns 143,119 shares of the financial services provider's stock worth $37,529,000 after acquiring an additional 7,658 shares during the period. Finally, Berkshire Asset Management LLC PA bought a new stake in shares of CME Group in the first quarter worth $329,000. 87.75% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several equities analysts have recently commented on the company. Piper Sandler boosted their price objective on CME Group from $283.00 to $296.00 and gave the company an "overweight" rating in a research report on Tuesday, July 15th. Wall Street Zen lowered CME Group from a "hold" rating to a "sell" rating in a report on Sunday, July 13th. Barclays set a $298.00 price objective on CME Group and gave the company an "equal weight" rating in a report on Thursday, July 24th. Citigroup upped their target price on CME Group from $265.00 to $275.00 and gave the company a "neutral" rating in a research report on Thursday, July 3rd. Finally, Oppenheimer upped their target price on CME Group from $300.00 to $303.00 and gave the company an "outperform" rating in a research report on Thursday, July 24th. Four analysts have rated the stock with a Buy rating, nine have issued a Hold rating and three have assigned a Sell rating to the stock. According to MarketBeat.com, CME Group currently has an average rating of "Hold" and an average target price of $261.93.

View Our Latest Research Report on CME Group

CME Group Stock Performance

CME traded up $1.87 during midday trading on Monday, hitting $271.39. 1,701,847 shares of the company were exchanged, compared to its average volume of 2,322,310. CME Group Inc. has a 1-year low of $207.10 and a 1-year high of $290.79. The company has a current ratio of 1.02, a quick ratio of 1.02 and a debt-to-equity ratio of 0.12. The firm has a market capitalization of $97.80 billion, a price-to-earnings ratio of 26.27, a price-to-earnings-growth ratio of 4.88 and a beta of 0.44. The company's 50 day simple moving average is $275.82 and its 200 day simple moving average is $268.67.

CME Group (NASDAQ:CME - Get Free Report) last posted its earnings results on Wednesday, July 23rd. The financial services provider reported $2.96 EPS for the quarter, beating analysts' consensus estimates of $2.91 by $0.05. The firm had revenue of $1.69 billion for the quarter, compared to analysts' expectations of $1.68 billion. CME Group had a return on equity of 14.60% and a net margin of 58.48%.The company's quarterly revenue was up 10.4% on a year-over-year basis. During the same period last year, the firm earned $2.56 EPS. As a group, sell-side analysts predict that CME Group Inc. will post 10.49 earnings per share for the current year.

CME Group Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Thursday, September 25th. Investors of record on Tuesday, September 9th will be paid a $1.25 dividend. The ex-dividend date of this dividend is Tuesday, September 9th. This represents a $5.00 dividend on an annualized basis and a yield of 1.8%. CME Group's dividend payout ratio (DPR) is currently 48.40%.

Insider Buying and Selling

In other CME Group news, Director Charles P. Carey sold 500 shares of the firm's stock in a transaction that occurred on Tuesday, June 10th. The shares were sold at an average price of $265.35, for a total value of $132,675.00. Following the transaction, the director directly owned 4,900 shares of the company's stock, valued at $1,300,215. This trade represents a 9.26% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director William R. Shepard purchased 256 shares of the business's stock in a transaction dated Wednesday, June 25th. The shares were purchased at an average price of $270.53 per share, with a total value of $69,255.68. Following the acquisition, the director directly owned 258,196 shares in the company, valued at approximately $69,849,763.88. The trade was a 0.10% increase in their ownership of the stock. The disclosure for this purchase can be found here. Company insiders own 0.30% of the company's stock.

About CME Group

(

Free Report)

CME Group Inc, together with its subsidiaries, operates contract markets for the trading of futures and options on futures contracts worldwide. It offers futures and options products based on interest rates, equity indexes, foreign exchange, agricultural commodities, energy, and metals, as well as fixed income and foreign currency trading services.

See Also

Before you consider CME Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CME Group wasn't on the list.

While CME Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.