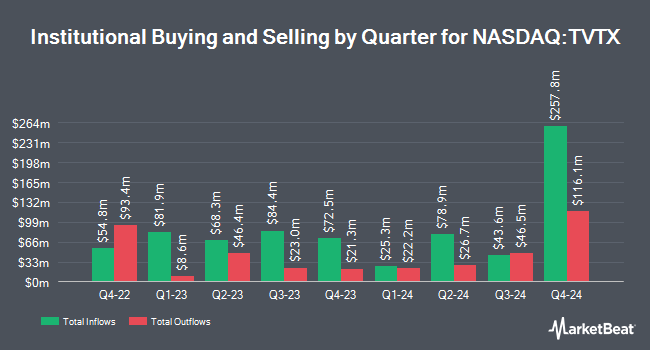

Northern Trust Corp lifted its holdings in shares of Travere Therapeutics, Inc. (NASDAQ:TVTX - Free Report) by 7.2% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 808,687 shares of the company's stock after acquiring an additional 54,292 shares during the quarter. Northern Trust Corp owned about 0.91% of Travere Therapeutics worth $14,492,000 as of its most recent filing with the Securities and Exchange Commission.

Several other hedge funds and other institutional investors have also made changes to their positions in TVTX. Tudor Investment Corp ET AL lifted its holdings in shares of Travere Therapeutics by 13.3% during the 4th quarter. Tudor Investment Corp ET AL now owns 43,213 shares of the company's stock valued at $753,000 after acquiring an additional 5,069 shares in the last quarter. AQR Capital Management LLC lifted its holdings in Travere Therapeutics by 117.8% in the 4th quarter. AQR Capital Management LLC now owns 424,024 shares of the company's stock worth $7,386,000 after buying an additional 229,361 shares in the last quarter. Algert Global LLC acquired a new position in Travere Therapeutics in the 4th quarter worth $282,000. Ameriprise Financial Inc. lifted its holdings in Travere Therapeutics by 132.6% in the 4th quarter. Ameriprise Financial Inc. now owns 285,350 shares of the company's stock worth $4,971,000 after buying an additional 162,649 shares in the last quarter. Finally, BNP Paribas Financial Markets acquired a new position in Travere Therapeutics in the 4th quarter worth $21,075,000.

Travere Therapeutics Stock Performance

Shares of NASDAQ:TVTX traded down $0.17 during trading on Tuesday, reaching $21.03. 391,689 shares of the company's stock traded hands, compared to its average volume of 1,679,657. The company has a debt-to-equity ratio of 9.50, a current ratio of 2.00 and a quick ratio of 1.98. Travere Therapeutics, Inc. has a 12 month low of $11.89 and a 12 month high of $25.29. The company has a 50 day moving average of $16.96 and a 200-day moving average of $17.26. The stock has a market capitalization of $1.87 billion, a P/E ratio of -10.30 and a beta of 0.78.

Travere Therapeutics (NASDAQ:TVTX - Get Free Report) last announced its quarterly earnings data on Wednesday, August 6th. The company reported ($0.14) earnings per share for the quarter, beating analysts' consensus estimates of ($0.28) by $0.14. Travere Therapeutics had a negative net margin of 50.64% and a negative return on equity of 717.68%. The business had revenue of $94.84 million during the quarter, compared to the consensus estimate of $100.18 million. During the same quarter in the prior year, the firm earned ($0.65) EPS. The company's revenue for the quarter was up 111.5% compared to the same quarter last year. On average, equities analysts expect that Travere Therapeutics, Inc. will post -1.4 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of equities analysts have commented on the stock. Wall Street Zen upgraded shares of Travere Therapeutics from a "hold" rating to a "buy" rating in a report on Monday, September 1st. Wedbush boosted their price objective on shares of Travere Therapeutics from $30.00 to $32.00 and gave the stock an "outperform" rating in a report on Thursday, August 7th. Citigroup reiterated a "buy" rating on shares of Travere Therapeutics in a report on Sunday, August 10th. HC Wainwright reiterated a "buy" rating and issued a $47.00 price objective on shares of Travere Therapeutics in a report on Wednesday, September 3rd. Finally, Scotiabank restated an "outperform" rating on shares of Travere Therapeutics in a research note on Thursday, August 7th. Thirteen analysts have rated the stock with a Buy rating and two have issued a Hold rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $33.43.

View Our Latest Stock Report on TVTX

Travere Therapeutics Profile

(

Free Report)

Travere Therapeutics, Inc, a biopharmaceutical company, identifies, develops, and delivers therapies to people living with rare kidney and metabolic diseases. Its products include FILSPARI (sparsentan), a once-daily, oral medication designed to target two critical pathways in the disease progression of IgA Nephropathy (endothelin 1 and angiotensin-II); and Thiola and Thiola EC (tiopronin tablets) for the treatment of cystinuria, a rare genetic cystine transport disorder that causes high cystine levels in the urine and the formation of recurring kidney stones.

Read More

Before you consider Travere Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Travere Therapeutics wasn't on the list.

While Travere Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.