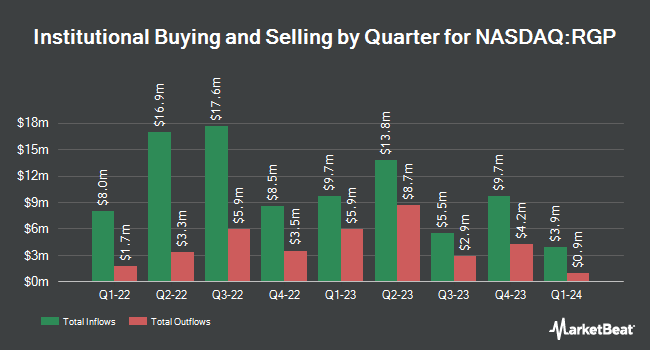

Trexquant Investment LP boosted its position in Resources Connection, Inc. (NASDAQ:RGP - Free Report) by 189.6% in the first quarter, according to its most recent filing with the SEC. The institutional investor owned 213,494 shares of the company's stock after purchasing an additional 139,761 shares during the period. Trexquant Investment LP owned about 0.65% of Resources Connection worth $1,396,000 as of its most recent SEC filing.

Other institutional investors have also added to or reduced their stakes in the company. MetLife Investment Management LLC boosted its stake in Resources Connection by 19.4% in the first quarter. MetLife Investment Management LLC now owns 18,249 shares of the company's stock valued at $119,000 after acquiring an additional 2,969 shares during the last quarter. Walleye Capital LLC lifted its stake in shares of Resources Connection by 5.7% during the 1st quarter. Walleye Capital LLC now owns 253,356 shares of the company's stock valued at $1,657,000 after buying an additional 13,663 shares in the last quarter. Hotchkis & Wiley Capital Management LLC lifted its stake in shares of Resources Connection by 3.6% during the 1st quarter. Hotchkis & Wiley Capital Management LLC now owns 1,187,901 shares of the company's stock valued at $7,769,000 after buying an additional 41,800 shares in the last quarter. AlphaQuest LLC lifted its stake in shares of Resources Connection by 429.1% during the 1st quarter. AlphaQuest LLC now owns 60,195 shares of the company's stock valued at $394,000 after buying an additional 48,819 shares in the last quarter. Finally, Hsbc Holdings PLC purchased a new stake in shares of Resources Connection during the 1st quarter valued at approximately $120,000. 93.23% of the stock is owned by institutional investors.

Resources Connection Price Performance

NASDAQ RGP traded up $0.10 during trading hours on Thursday, reaching $5.09. 263,478 shares of the company's stock traded hands, compared to its average volume of 246,209. Resources Connection, Inc. has a 52-week low of $4.44 and a 52-week high of $10.27. The firm has a market cap of $169.85 million, a PE ratio of -0.87, a PEG ratio of 2.77 and a beta of 0.63. The firm has a 50-day simple moving average of $5.09 and a 200 day simple moving average of $5.58.

Resources Connection Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, September 26th. Stockholders of record on Friday, August 29th will be paid a $0.07 dividend. The ex-dividend date is Friday, August 29th. This represents a $0.28 dividend on an annualized basis and a dividend yield of 5.5%. Resources Connection's payout ratio is currently -4.81%.

Analysts Set New Price Targets

Separately, Wall Street Zen upgraded shares of Resources Connection from a "strong sell" rating to a "hold" rating in a research note on Saturday, July 26th. One research analyst has rated the stock with a Sell rating, According to MarketBeat.com, Resources Connection has a consensus rating of "Sell" and a consensus target price of $5.00.

Get Our Latest Analysis on Resources Connection

Resources Connection Profile

(

Free Report)

Resources Connection, Inc provides consulting services to business customers under the Resources Global Professionals name in North America, Europe, and the Asia Pacific. The company offers services in the areas of transactions, including integration and divestitures, bankruptcy/restructuring, going public readiness and support, financial process optimization, and system implementation; and regulations, such as accounting regulations, internal audit and compliance, data privacy and security, healthcare compliance, and regulatory compliance.

Featured Articles

Before you consider Resources Connection, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Resources Connection wasn't on the list.

While Resources Connection currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.